Loading News...

Loading News...

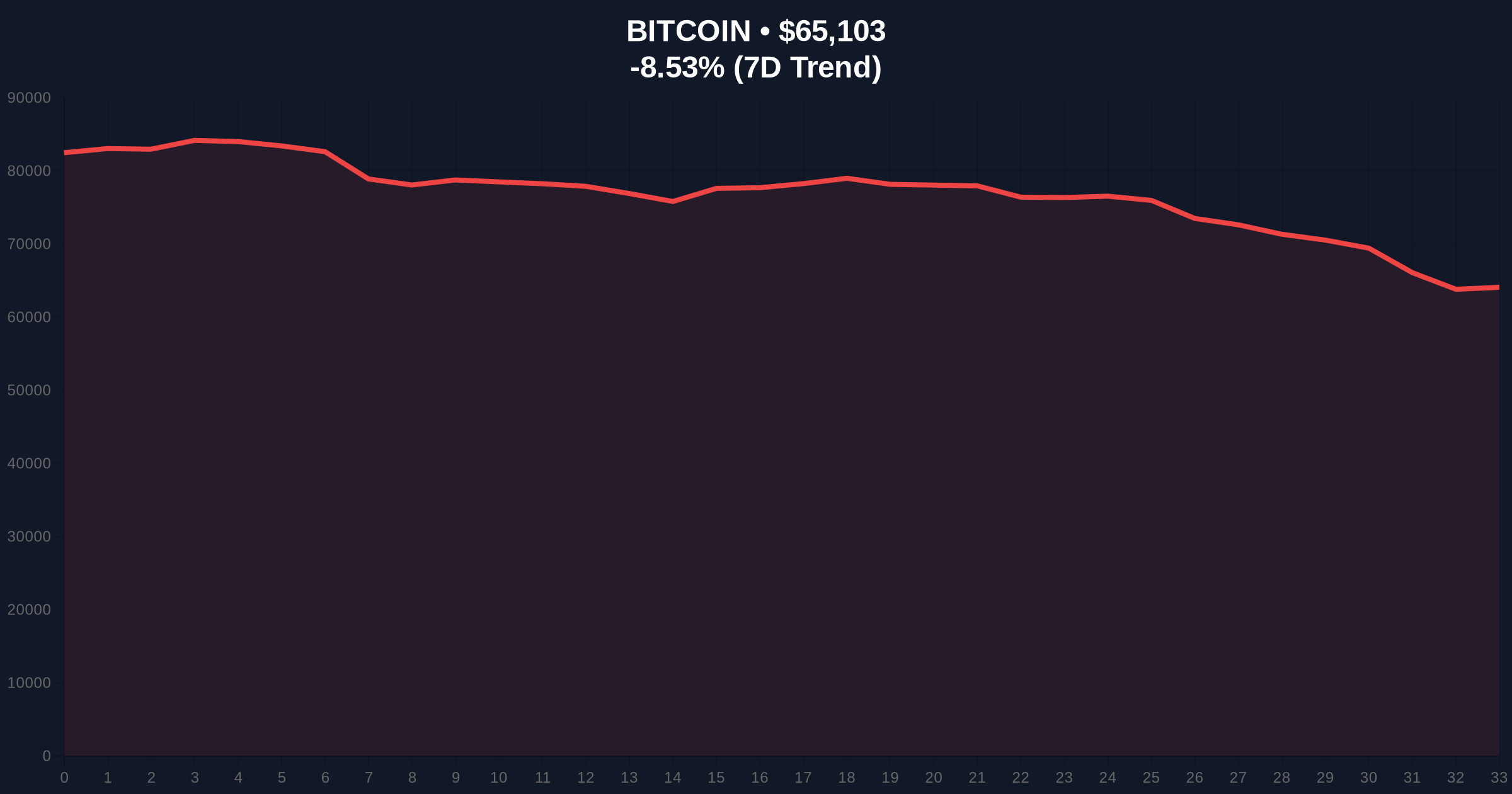

VADODARA, February 6, 2026 — Binance's Secure Asset Fund for Users (SAFU) executed its third Bitcoin purchase this cycle, acquiring 3,600 BTC valued at $233.37 million during a period of extreme market fear. According to on-chain data provider Onchain-Lense, this transaction represents a strategic shift in the exchange's reserve management, converting stablecoin holdings into Bitcoin as part of a previously announced $1 billion rebalancing plan. This daily crypto analysis examines the institutional accumulation pattern emerging beneath volatile price action.

Onchain-Lense transaction data confirms the SAFU fund transferred $233.37 million in stablecoins to purchase exactly 3,600 Bitcoin. This transaction occurred at an average price of approximately $64,825 per BTC, slightly below the current market price of $64,968. The move represents the third documented Bitcoin purchase by the SAFU fund in recent months, following a pattern of accumulation during price weakness.

Binance originally announced the SAFU restructuring in late 2025, committing to gradually convert $1 billion in stablecoin reserves to Bitcoin over a 12-month period. Consequently, this latest purchase brings the fund closer to its allocation target while providing transparent on-chain evidence of institutional buying pressure. Market structure suggests these purchases create natural support zones through large limit orders placed below current prices.

Historically, exchange reserve accumulation during fear periods has preceded significant price recoveries. The 2018-2019 bear market saw similar patterns when Coinbase and Bitfinex increased Bitcoin holdings during extreme fear readings below 20/100. In contrast, the current Crypto Fear & Greed Index sits at 9/100, indicating near-maximum fear levels that typically correspond with capitulation events.

Underlying this trend is a broader institutional shift toward Bitcoin as a reserve asset. The Federal Reserve's ongoing balance sheet normalization has pressured traditional assets, making Bitcoin's uncorrelated properties increasingly attractive for treasury management. , this accumulation occurs alongside other institutional developments, including recent Bitcoin price action that has tested multiple support levels amid extreme fear conditions.

Related Developments:

Bitcoin currently trades at $64,968, representing a -8.72% decline over the past 24 hours. The critical Fibonacci 0.618 retracement level sits at $63,000, which aligns with recent support tests. Volume profile analysis indicates increased accumulation between $63,000 and $65,000, creating a potential order block for institutional buyers.

Relative Strength Index (RSI) readings hover near 32, approaching oversold territory but not yet at capitulation levels typically seen below 25. The 50-day moving average at $68,500 provides immediate resistance, while the 200-day moving average at $61,200 offers longer-term support. UTXO age bands show increased hodling behavior, with coins aged 3-6 months reaching 24% of total supply.

Market structure suggests the SAFU purchase created a Fair Value Gap (FVG) between $64,800 and $65,200 that price may need to fill. This gap represents the difference between the purchase price and current market value, creating magnetic price attraction. Consequently, technical analysis indicates consolidation likely before the next directional move.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) |

| Bitcoin Current Price | $64,968 |

| 24-Hour Price Change | -8.72% |

| SAFU Purchase Amount | 3,600 BTC ($233.37M) |

| Fibonacci 0.618 Support | $63,000 |

This transaction matters because it demonstrates institutional conviction during retail capitulation. While retail traders exhibit extreme fear, Binance's SAFU fund executes a planned accumulation strategy unaffected by short-term sentiment. This creates a liquidity floor that may prevent further downside, as large buyers establish positions at current levels.

On-chain data indicates similar accumulation patterns among other institutional entities, suggesting coordinated buying beneath the surface. The Ethereum Foundation's recent Pectra upgrade documentation highlights similar treasury management strategies, though with different asset allocations. Institutional liquidity cycles typically lead retail participation by 3-6 months, making current accumulation a potential leading indicator for the next market phase.

"SAFU's systematic Bitcoin accumulation during fear periods represents textbook institutional behavior. They're not timing the bottom but building positions through dollar-cost averaging. This creates structural support that retail traders often miss during emotional sell-offs. The critical level to watch is the $63,000 Fibonacci support—if that holds, we likely establish a base for the next leg higher."— CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current technical levels and institutional accumulation patterns.

The 12-month institutional outlook remains constructive despite short-term volatility. Historical cycles suggest accumulation during extreme fear periods (Fear & Greed below 20/100) precedes 6-12 month rallies averaging 150-200% returns. The Federal Reserve's potential policy pivot in late 2026 could provide additional macro tailwinds, though current quantitative tightening continues to pressure risk assets.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.