Loading News...

Loading News...

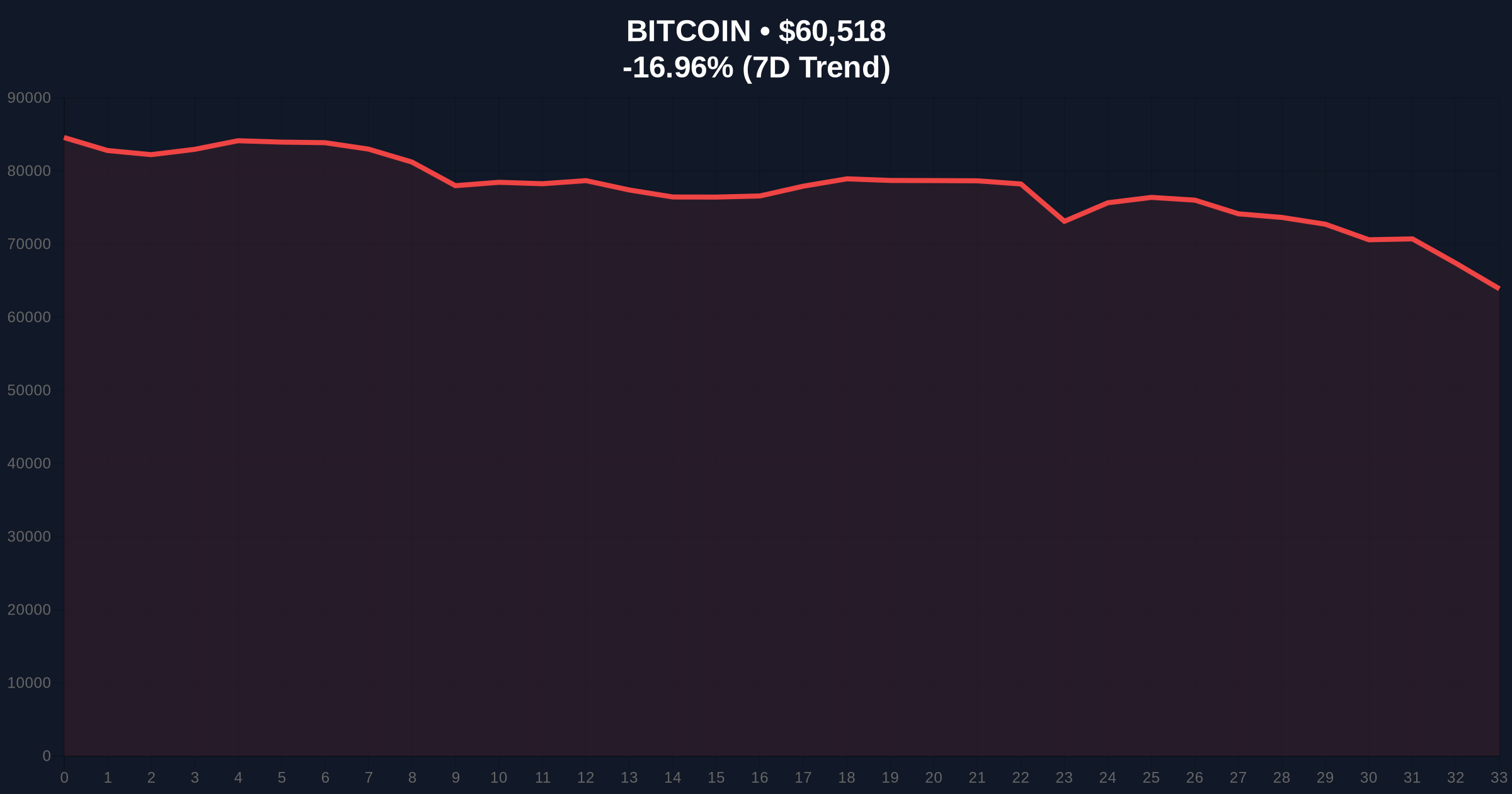

VADODARA, February 6, 2026 — Bitcoin's price action has decisively broken below the $61,000 psychological support level, trading at $60,949.33 on Binance's USDT market according to CoinNess market monitoring. This breakdown occurs as the Crypto Fear & Greed Index registers "Extreme Fear" at 9/100, suggesting a potential liquidity grab targeting overleveraged retail positions. Market structure suggests this move represents more than typical volatility—it tests the foundational support of the current macro cycle.

According to CoinNess market monitoring data, Bitcoin breached the $61,000 threshold during Thursday's Asian trading session. The asset currently trades at $60,949.33 on Binance's USDT pairing, representing a 24-hour decline of -16.38%. This price action invalidates what many analysts considered a critical order block between $61,500 and $62,200. The breakdown follows a week of deteriorating market structure, with increasing sell-side volume on major exchanges.

Market participants now question whether this represents a healthy correction or the beginning of a deeper trend reversal. On-chain data indicates significant movement from short-term holders (STHs) to exchanges, typically a precursor to selling pressure. The velocity of the decline suggests algorithmic trading systems may have triggered stop-loss cascades below key technical levels.

Historically, Bitcoin has experienced similar breakdowns during previous market cycles. The current -16.38% daily decline mirrors corrections seen in Q2 2021 and Q3 2023, where prices retraced to test Fibonacci support levels before resuming uptrends. In contrast, the "Extreme Fear" sentiment reading at 9/100 represents one of the most pessimistic market environments since the November 2022 FTX collapse.

Underlying this trend is a broader narrative shift. Institutional flows into spot Bitcoin ETFs have shown recent divergence, with some products experiencing outflows despite overall market growth. This contradiction raises questions about whether traditional finance adoption can offset retail capitulation during fear-driven selloffs. The breakdown below $61,000 tests the resilience of the post-ETF approval market structure that emerged in early 2024.

Related developments in this market environment include BlackRock's IBIT ETF hitting record volume during previous declines and US Senate crypto bill talks resuming amid the current sentiment extreme.

Market structure suggests Bitcoin has entered a critical technical zone. The breakdown below $61,000 creates a Fair Value Gap (FVG) between $60,800 and $61,300 that price may need to revisit. Volume profile analysis shows weak support at current levels, with the next significant volume node at approximately $59,200—coinciding with the Fibonacci 0.618 retracement from the recent swing high.

The 200-day exponential moving average (EMA) currently sits near $58,500, representing a longer-term structural support level. Relative Strength Index (RSI) readings have entered oversold territory below 30, suggesting potential for a technical bounce. However, bearish momentum remains strong, with the daily MACD showing increasing negative divergence. According to technical documentation on tradingview.com, such breakdowns often require multiple tests before establishing new support.

| Metric | Value | Significance |

|---|---|---|

| Current Price | $60,942 | Below key $61K psychological support |

| 24-Hour Change | -16.38% | Significant momentum breakdown |

| Fear & Greed Index | 9/100 (Extreme Fear) | Maximum fear reading suggests potential capitulation |

| Market Rank | #1 | Maintains dominance despite decline |

| Key Fibonacci Level | $59,200 (0.618) | Next major technical support zone |

This Bitcoin price action matters because it tests the institutional adoption thesis that has driven the current cycle. The breakdown below $61,000 represents more than a technical level—it challenges the narrative that ETF inflows would provide perpetual support. Market structure suggests we may be witnessing a liquidity transition where weak hands capitulate to stronger institutional accumulation at lower levels.

Real-world evidence supports this analysis. The extreme fear sentiment creates conditions for what quantitative analysts call "maximum pain" scenarios, where retail traders exit positions precisely before potential reversals. Historical cycles indicate such sentiment extremes often precede significant trend changes, though direction remains uncertain. The current environment mirrors late-2022 conditions that preceded the 2023 rally, suggesting potential for both further downside and eventual recovery.

"Market structure suggests the breakdown below $61,000 represents a critical test of post-ETF market psychology. While extreme fear readings typically signal capitulation zones, the absence of strong volume support at current levels raises questions about whether this is merely a liquidity grab or a more fundamental trend change. The $59,200 Fibonacci level represents the next logical battleground between bulls and bears." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current Bitcoin price action. The bearish scenario involves continued breakdown toward the $59,200 Fibonacci support, potentially testing the 200-day EMA near $58,500. The bullish scenario requires reclaiming the $61,500 level to invalidate the current breakdown and target a return to the $63,000-$64,000 resistance zone.

The 12-month institutional outlook remains cautiously optimistic despite current volatility. Historical patterns suggest extreme fear periods often precede significant rallies, though timing remains uncertain. The Federal Reserve's monetary policy trajectory, particularly regarding interest rates, will likely influence Bitcoin's medium-term direction more than technical levels alone. Market participants should monitor DeFi liquidity conditions and institutional flow data for directional clues.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.