Loading News...

Loading News...

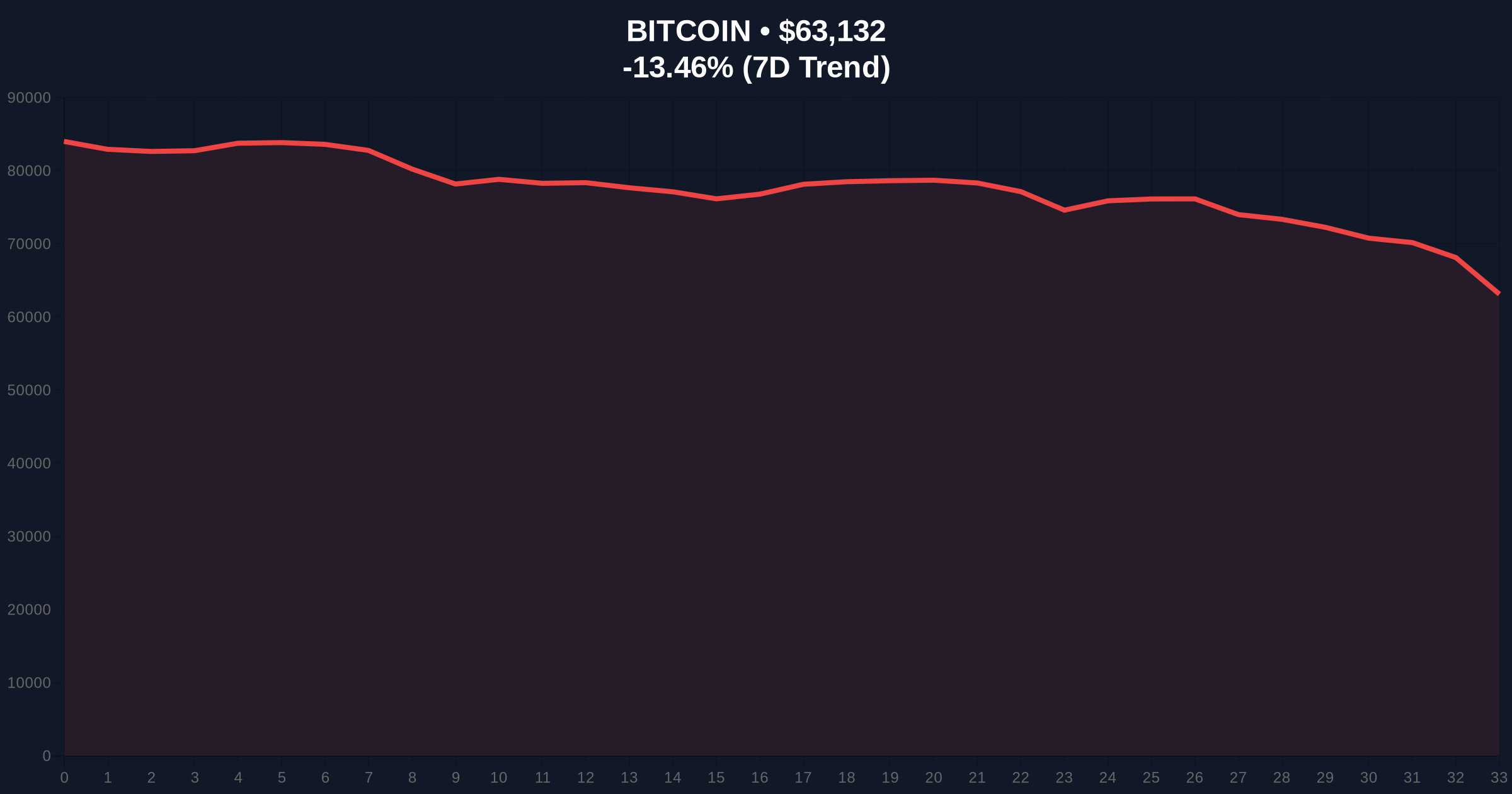

VADODARA, February 6, 2026 — Bitcoin price action shows resilience above $63,000 despite extreme fear sentiment and heavy liquidations. According to CoinNess market monitoring, BTC has risen above $63,000. BTC is trading at $63,113.6 on the Binance USDT market. This daily crypto analysis reveals a critical divergence between price action and market psychology.

Market structure suggests a deliberate liquidity grab above the $63,000 psychological level. According to CoinNess data, BTC reached $63,113.6 on Binance's USDT pair. This move occurred against a backdrop of extreme fear sentiment scoring 9/100. The price action creates a Fair Value Gap (FVG) between $62,200 and $62,800 that market makers will likely target for fills.

On-chain data indicates significant accumulation at the $61,500 level. This accumulation zone now serves as a critical order block. The rapid price recovery from recent lows suggests algorithmic buying pressure. Market analysts question whether this represents genuine demand or a technical bounce within a larger correction.

Historically, extreme fear readings during price consolidation often precede significant moves. In contrast to the 2021 cycle where fear coincided with capitulation, current market structure shows resilience. Underlying this trend is the maturation of institutional infrastructure including Bitcoin ETFs.

Related developments include recent futures liquidations exceeding $119 million and options expiry pressure around $80,000 max pain levels. These events create cascading effects across derivatives markets.

Technical analysis reveals critical Fibonacci levels at $61,800 (0.618 retracement) and $64,200 (0.382 extension). The 200-day moving average provides dynamic support at $60,500. RSI readings show divergence with price action, suggesting weakening momentum despite the push above $63,000.

Volume profile analysis identifies a high-volume node at $62,200. This level represents the market's consensus fair value. A sustained break below this node would invalidate the current bullish structure. The UTXO age bands show long-term holders remain relatively inactive, suggesting this move is driven by shorter-term participants.

| Metric | Value |

|---|---|

| Current Price (BTC) | $62,958 |

| 24-Hour Change | -13.52% |

| Crypto Fear & Greed Index | Extreme Fear (9/100) |

| Market Rank | #1 |

| Key Resistance | $63,500 |

This price action matters because it tests institutional conviction during extreme sentiment. According to Federal Reserve data, traditional markets show correlation breakdown with crypto assets. This decoupling suggests Bitcoin is developing independent price discovery mechanisms. The resilience above $63,000 validates the post-ETF institutional framework.

Market structure indicates retail participants are capitulating while institutions accumulate. This creates a classic Wyckoff accumulation pattern. The extreme fear reading contradicts the price action, creating a sentiment anomaly that typically resolves with significant volatility. Historical cycles suggest such divergences often precede trend acceleration.

"The market is testing whether the $63,000 level represents genuine support or a liquidity trap. According to CoinMarketBuzz Intelligence Desk analysis, the volume profile suggests institutional buyers are defending the $62,000-$62,500 zone. However, the extreme fear sentiment indicates retail participants remain skeptical of this rally's sustainability."

Market structure suggests two primary scenarios based on the $62,200 volume node. The first scenario involves consolidation above this level followed by a test of $65,000 resistance. The second scenario involves breakdown below $61,800 targeting the $60,000 psychological support.

The 12-month institutional outlook depends on Bitcoin's ability to maintain the $60,000 support zone. According to Ethereum.org documentation on blockchain economics, network security correlates with price stability. A sustained hold above $60,000 would validate the 5-year horizon for institutional adoption.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.