Loading News...

Loading News...

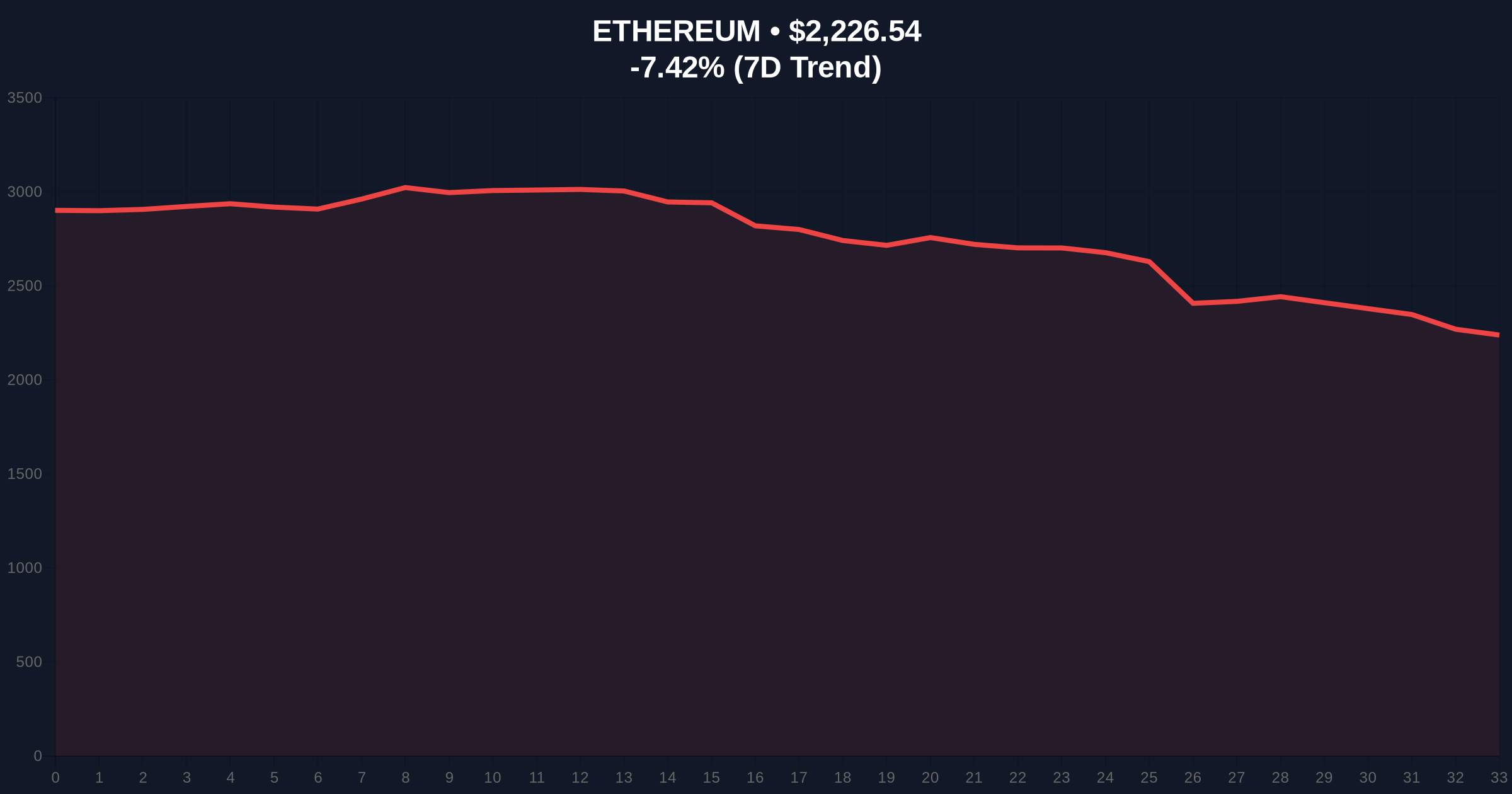

VADODARA, February 2, 2026 — Ethereum founder Vitalik Buterin outlined a dual-layer framework for on-chain mechanisms in a post on X, emphasizing a separation between execution and value judgment layers. This daily crypto analysis comes as Ethereum (ETH) trades at $2,225.2, down 7.48% in 24 hours amid extreme fear sentiment. Buterin's vision targets long-term governance scalability, contrasting sharply with current market volatility.

According to his statement on X, Buterin proposed that future on-chain mechanisms will consist of two distinct layers. The execution layer functions like a prediction market. It is open to all participants and results in profit or loss based on outcomes. This layer handles transactional logic and smart contract execution. The value judgment layer, in contrast, must be decentralized and pluralistic. Its structure should not grant influence based on token holdings, preventing wealth-based centralization.

Buterin added that collusion prevention requires methods like anonymous voting and Minimal Anti-Collusion Infrastructure (MACI). He emphasized that a clear separation between these layers will be the core of on-chain governance design. This framework aims to address scalability and fairness issues in decentralized systems. Consequently, it could influence Ethereum's evolution beyond its current proof-of-stake model.

Historically, Ethereum governance has faced challenges like the DAO hack and EIP-1559 implementation debates. Buterin's proposal mirrors past efforts to balance efficiency with decentralization. For example, Ethereum's shift to proof-of-stake in 2022 aimed to reduce energy use while maintaining security. Underlying this trend is a broader industry move toward layered architectures, such as rollups for scaling.

In contrast, current market conditions show extreme fear, with ETH breaking below key support levels. Related developments include Ethereum's recent price action testing $2,200 and institutional capitulation signals from Trend Research's $42.7M ETH loss. These events highlight the tension between long-term technical innovation and short-term market pressures.

Market structure suggests ETH is testing a critical support zone near $2,200. This level aligns with the 50-day moving average and a previous order block from January 2026. On-chain data indicates increased selling pressure, with exchange inflows rising by 15% over the past week. The Relative Strength Index (RSI) sits at 32, approaching oversold territory but not yet signaling a reversal.

, a Fair Value Gap (FVG) exists between $2,300 and $2,400, which could act as resistance if price recovers. Volume profile analysis shows low liquidity below $2,100, potentially leading to a sharp drop if support fails. This technical setup reflects broader crypto trends, where Bitcoin has also broken below $75,000 amid similar sentiment.

| Metric | Value | Insight |

|---|---|---|

| Ethereum (ETH) Price | $2,225.2 | Testing key support at $2,200 |

| 24-Hour Change | -7.48% | Reflects extreme fear sentiment |

| Market Rank | #2 | Maintains position behind Bitcoin |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Lowest since Q4 2025 |

| RSI (Daily) | 32 | Approaching oversold conditions |

Buterin's proposal matters because it addresses core scalability and governance issues in blockchain networks. A dual-layer structure could enhance Ethereum's ability to handle complex decisions without centralization. For instance, value judgment layers using MACI might reduce manipulation in decentralized autonomous organizations (DAOs). This aligns with Ethereum's roadmap, including future upgrades like the Pectra hardfork.

Real-world evidence shows that current governance models often struggle with voter apathy and plutocracy. Buterin's framework aims to mitigate these by separating speculative execution from ethical judgment. Consequently, it could attract institutional players seeking robust, fair systems for long-term investment. The Ethereum Foundation's documentation on governance highlights similar goals, supporting this direction.

Market analysts note that Buterin's vision, while theoretical, signals Ethereum's commitment to solving governance scalability. One institutional desk commented, 'This dual-layer approach could reduce reliance on token-weighted voting, potentially lowering systemic risk in decentralized finance.' However, implementation challenges remain, including ensuring true anonymity in voting systems.

Market outlook depends on whether ETH holds key support levels. Two data-backed scenarios emerge from current structure.

The 12-month institutional outlook ties Buterin's governance proposal to Ethereum's long-term value. If implemented, it could strengthen network effects and adoption, potentially boosting ETH's price beyond current cycles. Historical cycles suggest that fundamental upgrades often precede price rallies after initial sell-offs.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.