Loading News...

Loading News...

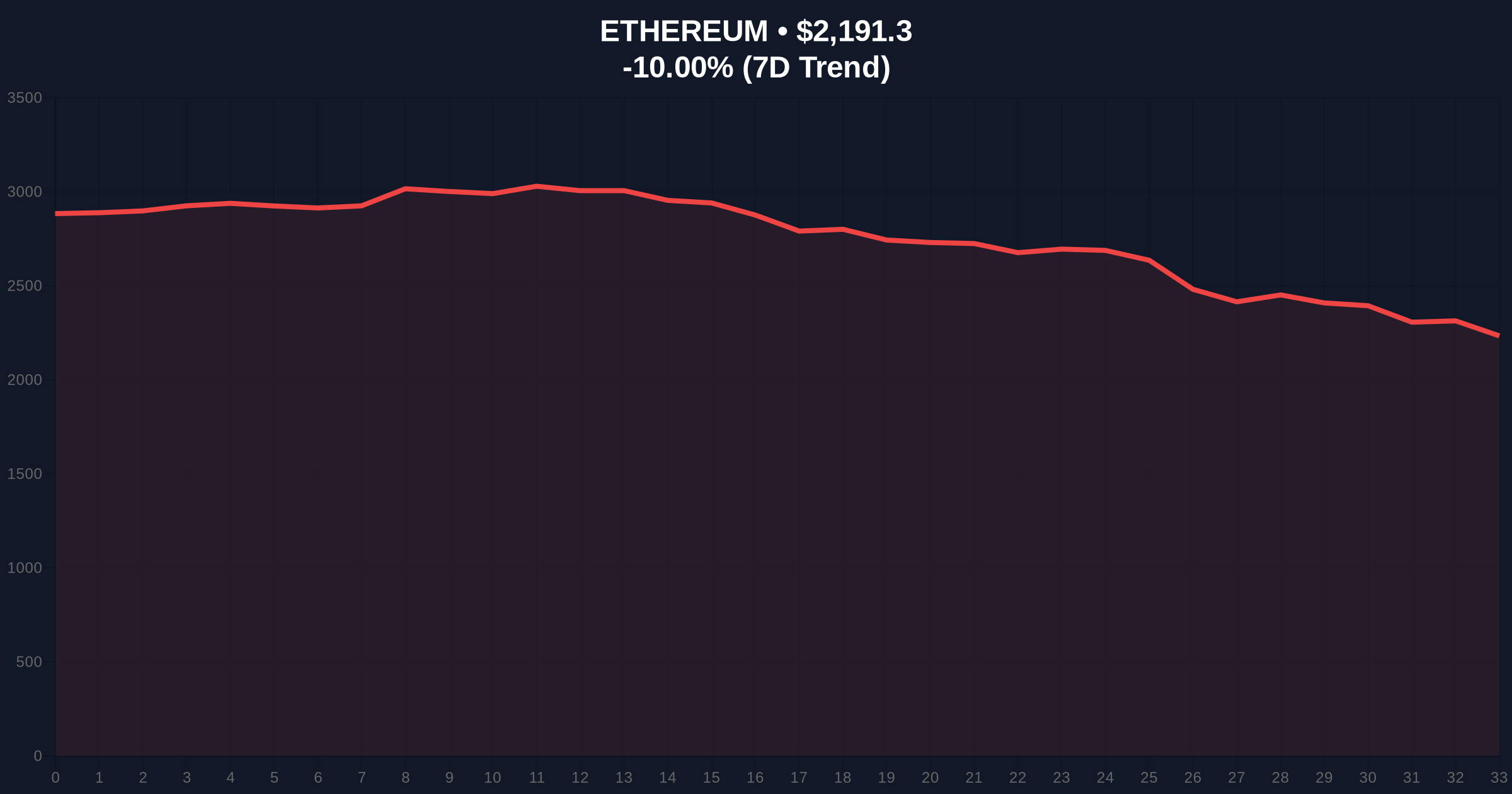

VADODARA, February 2, 2026 — On-chain data reveals Trend Research, a subsidiary of LD Capital, deposited 20,000 ETH to Binance, crystallizing a potential realized loss of $42.67 million. This latest crypto news event, tracked by analyst ai_9684xtpa, exposes a critical fracture in institutional accumulation strategies as Ethereum trades at $2,191.23, down 10% in 24 hours. Market structure suggests this move represents a forced liquidity grab, not strategic rebalancing.

According to on-chain analyst ai_9684xtpa, Trend Research moved 20,000 ETH to the Binance exchange. A sale at current prices locks in a $42.67 million loss. The firm began accumulating ETH in November 2025 with an average cost basis of $3,180. Its holdings peaked at approximately 650,000 ETH on January 21. They have since dwindled to 608,251 ETH. This deposit follows a period of sustained price decline. The transaction volume profile indicates a single, large block transfer. This suggests a deliberate exit rather than gradual distribution.

Historically, large realized losses from committed accumulators often precede local bottoms. The 2022 cycle saw similar capitulation from entities like Three Arrows Capital. In contrast, Trend Research's actions occur amid a broader Extreme Fear sentiment reading of 14/100. This mirrors the liquidity crises of Q2 2022. Underlying this trend is a global macro squeeze on risk assets. The firm's average cost basis of $3,180 now sits far above spot price. This creates a massive Fair Value Gap (FVG) on their balance sheet.

Related developments in this regulatory and market climate include India's maintained 30% crypto tax adding to sell-side pressure, and Bitcoin breaking below $76,000 amid the same fear sentiment, indicating a correlated market downturn.

Ethereum's price action shows a clear breakdown below the 200-day moving average. The deposit coincides with a test of the $2,150 level. This level represents a critical Fibonacci 0.618 retracement from the 2025 cycle low. A break below this invalidation point could trigger a cascade of stop-loss orders. The Relative Strength Index (RSI) sits at 28, nearing oversold territory. However, capitulation events can push RSI into the teens. On-chain data from Etherscan confirms rising exchange inflows. This typically precedes further selling pressure. The UTXO age band for large holders shows increased movement of 6-12 month old coins. This confirms the loss realization narrative.

| Metric | Value |

|---|---|

| ETH Deposited to Binance | 20,000 |

| Potential Realized Loss | $42.67 Million |

| Trend Research's Average Cost Basis | $3,180 |

| Current ETH Holdings | 608,251 ETH |

| Crypto Fear & Greed Index | 14 (Extreme Fear) |

| Current ETH Price | $2,191.23 |

| 24-Hour Price Change | -10.00% |

This event matters because it signals institutional distress. Trend Research was a net accumulator. Their shift to realizing losses suggests portfolio rebalancing under duress. This creates a liquidity vacuum in the market. Other institutions may follow suit, creating a negative feedback loop. Retail sentiment, already in Extreme Fear, could amplify the sell-off. The realized loss of $42.67 million is not trivial. It impacts LD Capital's overall fund performance. This could trigger redemption requests from limited partners. Consequently, forced selling may spread to other assets in their portfolio.

"The data shows a classic capitulation signature. A large holder moving coins to an exchange at a significant loss often marks a peak in panic selling. However, the critical question is whether this is an isolated liquidity need or a strategic shift. The decrease from 650,000 to 608,251 ETH holdings suggests this may be part of a larger unwind. The market must now watch for follow-through selling from other large wallets." – CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on this liquidity event.

The 12-month institutional outlook hinges on whether this event represents a localized fund issue or a sector-wide trend. If it's the former, Ethereum's long-term value proposition tied to its roadmap, including future upgrades like the Pectra hardfork, remains intact. If it's the latter, further deleveraging across crypto-native funds could prolong the bear market phase. The 5-year horizon still favors blockchain infrastructure, but short-term capital preservation is now the dominant theme.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.