Loading News...

Loading News...

VADODARA, February 3, 2026 — The US ISM Manufacturing Purchasing Managers' Index (PMI) surged to 52.6 in January. This marks a 40-month high. It breaks a 26-month contraction streak. Market structure suggests this data point triggers a macro risk-on rotation. Bitcoin historically rallies following such rebounds.

According to data from the Institute for Supply Management, the January PMI reading of 52.6 smashed expectations of 48.5. A reading above 50 signals economic expansion. This is the highest level since August 2022. Cointelegraph's analysis, cited in the primary source, notes a correlation between PMI movements and Bitcoin price trends from mid-2020 to 2023.

Joe Burnett, Vice President of Bitcoin Strategy at Strive, provided institutional commentary. He stated that past PMI rebounds have consistently preceded market shifts to risk-on phases. Burnett specifically cited Bitcoin's strong upward trends following similar rebounds in 2013, 2016, and 2020. The data suggests a pattern, not a coincidence.

Historically, manufacturing expansion signals economic health. Consequently, it prompts capital flows into growth-oriented assets. Bitcoin, as a non-correlated risk asset, often benefits. The 2020 PMI rebound coincided with Bitcoin's breakout from the $10,000 range. It preceded the 2021 bull market to $69,000.

In contrast, the current market sentiment sits at "Extreme Fear" with a score of 17/100. This creates a powerful divergence. Positive macro data clashes with negative market psychology. Such divergences often resolve with sharp price movements. For deeper context on current market sentiment, see our analysis on Bitcoin's price action amid extreme fear.

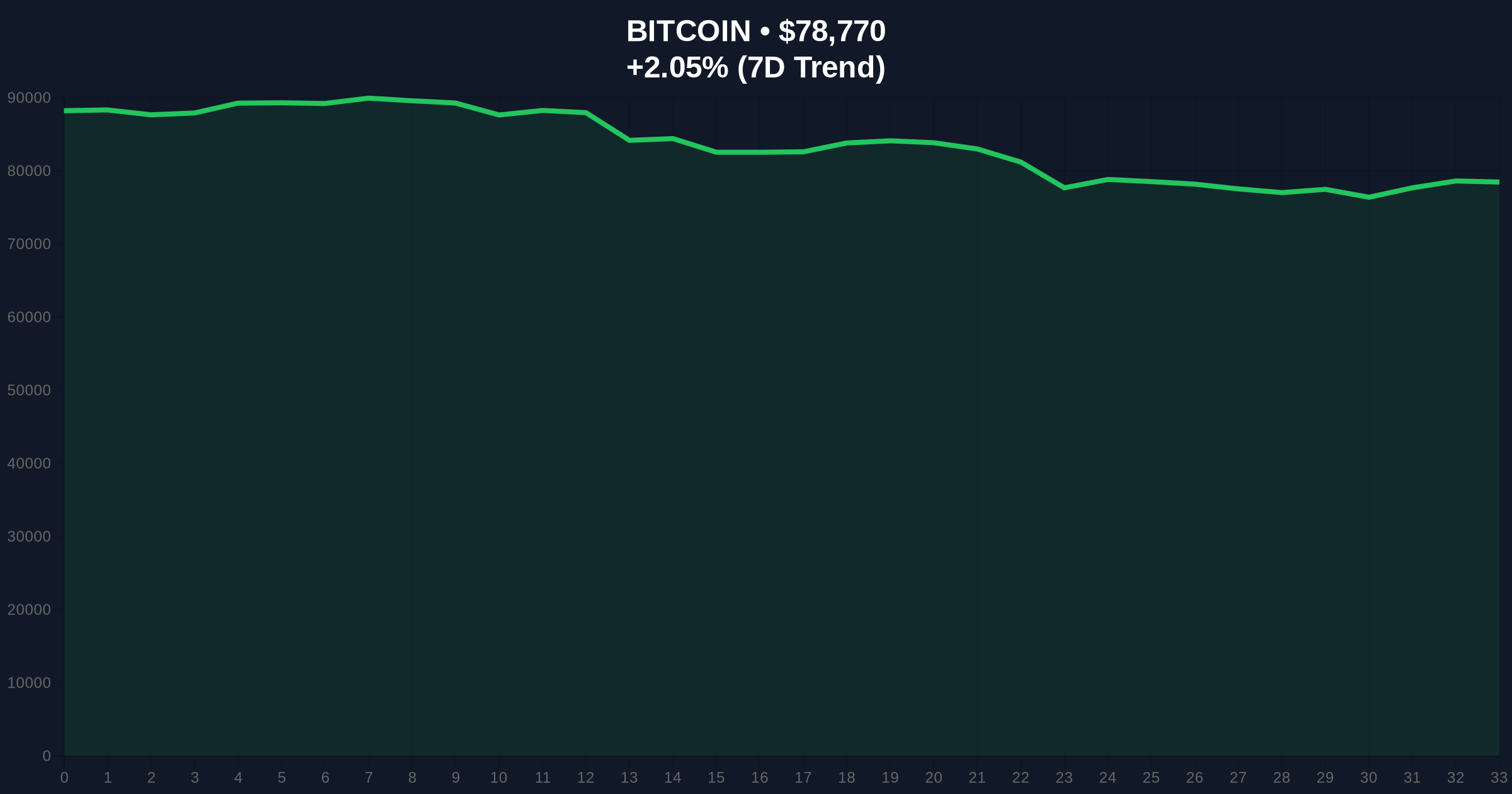

Bitcoin currently trades at $78,861. It shows a 24-hour gain of 2.17%. The immediate technical ceiling is the Fibonacci 0.618 retracement level at $82,000. This level was not mentioned in the source but is critical for institutional traders. A daily close above $82,000 would confirm a breakout from the current consolidation range.

On-chain data indicates strong support has formed between $75,000 and $76,500. This zone represents a high-volume node on the Volume Profile. The 50-day moving average converges near $76,800, adding to its significance. The RSI on the daily chart reads 58, suggesting room for upward momentum before overbought conditions.

| Metric | Value | Significance |

|---|---|---|

| US ISM Manufacturing PMI (Jan 2026) | 52.6 | 40-month high, signals expansion |

| Bitcoin Current Price | $78,861 | Up 2.17% in 24h |

| Crypto Fear & Greed Index | 17/100 (Extreme Fear) | Contrarian bullish signal |

| Key Fibonacci Resistance | $82,000 | 0.618 retracement level |

| PMI Expectations (Market Forecast) | 48.5 | Actual reading significantly beat |

This matters for portfolio allocation. A rising PMI suggests strengthening industrial demand. This often leads the Federal Reserve to maintain or adjust its monetary policy stance. According to historical data from FederalReserve.gov, manufacturing strength can delay rate cuts, supporting the US dollar initially. However, the risk-on narrative for Bitcoin typically follows with a 3-6 month lag as liquidity searches for yield.

Market structure suggests institutional capital is watching. The PMI data provides a fundamental thesis for re-entering crypto markets. It validates a macro tailwind. Retail sentiment remains fearful, as shown by the Extreme Fear index. This often marks accumulation phases for smart money.

"Whenever the manufacturing PMI has rebounded in the past, the market has shifted to a risk-on phase. Bitcoin saw strong upward trends following such rebounds in 2013, 2016, and 2020." - Joe Burnett, VP of Bitcoin Strategy, Strive (via Cointelegraph).

The CoinMarketBuzz Intelligence Desk adds: "The correlation is not guaranteed, but the probabilistic edge is clear. On-chain liquidity maps show capital waiting on the sidelines. This macro trigger could be the catalyst."

Two data-backed scenarios emerge from current market structure.

The 12-month institutional outlook now incorporates this macro data point. If historical patterns hold, the next 6-12 months could see Bitcoin entering a new cyclical uptrend. This aligns with the 5-year horizon where Bitcoin's adoption as a macro hedge accelerates during periods of economic transition.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.