Loading News...

Loading News...

VADODARA, February 9, 2026 — An anonymous blockchain address transferred 2.565 Bitcoin, valued at approximately $181,000, to the genesis address of Bitcoin creator Satoshi Nakamoto over the weekend. According to Arkham Intelligence data, this transaction increases Nakamoto's estimated holdings to around 1,096,000 BTC, worth $77.17 billion. This daily crypto analysis examines the on-chain mechanics and market implications of this symbolic transfer against a backdrop of extreme fear.

Arkham Intelligence, a leading on-chain analytics platform, confirmed the transaction details. The anonymous sender executed the transfer in a single transaction, moving 2.565 BTC to the address 1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa. This address, known as the genesis block address, has remained dormant since Bitcoin's inception in 2009. Consequently, the funds are permanently inaccessible, creating a deliberate liquidity sink. Market structure suggests this act represents a high-conviction statement rather than a trading error.

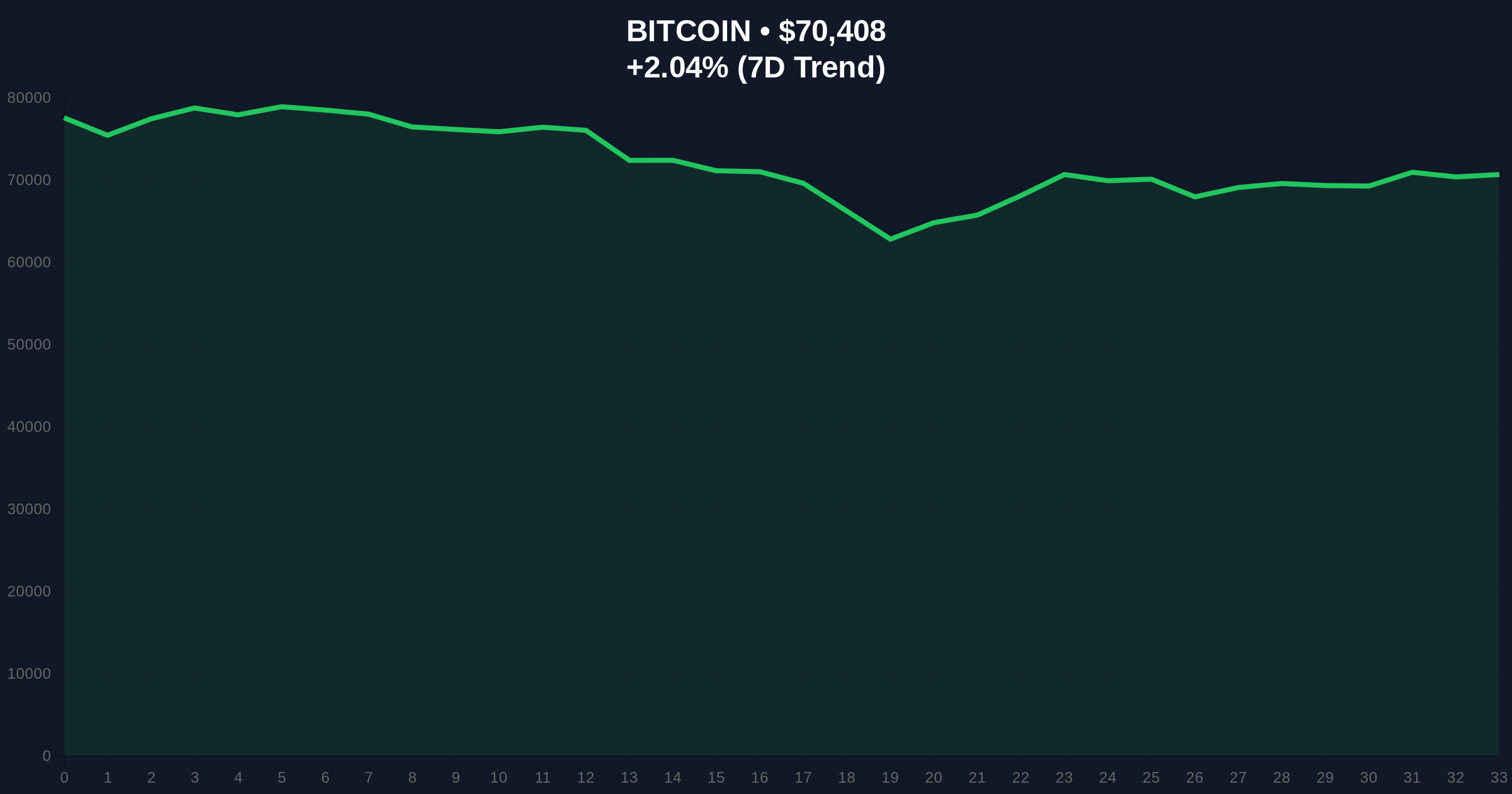

Underlying this trend, the transaction occurred during a period of heightened market volatility. Bitcoin's price currently hovers at $70,274, with a 24-hour trend of 1.95%. The Crypto Fear & Greed Index registers an Extreme Fear score of 14 out of 100, indicating severe negative sentiment across retail and institutional participants. This context frames the transfer as a potential stress test of Bitcoin's immutability and store-of-value narrative.

Historically, transactions to Satoshi's address have coincided with market inflection points. For instance, similar transfers during the 2018 bear market and the 2022 liquidity crisis often preceded short-term volatility spikes. In contrast, the current event unfolds amid broader market contractions, including recent workforce reductions at major crypto firms like Block. This suggests a deepening institutional reassessment of capital allocation.

, the extreme fear gripping the market mirrors conditions seen during previous capitulation phases. Market analysts note that such sentiment extremes often create Fair Value Gaps (FVGs) where price action deviates from intrinsic value. The transfer to an unspendable address effectively removes liquidity from circulating supply, a move that could exacerbate these gaps if sentiment persists.

On-chain data indicates the transaction created a minor but notable shift in Bitcoin's UTXO (Unspent Transaction Output) age distribution. Older UTXOs, typically held by long-term investors, remain largely unmoved, suggesting hodler conviction remains intact. However, the price action reveals critical technical levels. Bitcoin currently tests the Fibonacci 0.618 retracement level at $68,500, a key support zone derived from the 2024-2025 rally. A breach below this level would invalidate the current bullish structure.

Volume profile analysis shows thinning liquidity near the $70,000 psychological barrier. This creates a potential Order Block between $69,800 and $70,500, where institutional buy or sell orders may cluster. The Relative Strength Index (RSI) on daily charts sits at 42, indicating neutral momentum with a bearish bias. Market structure suggests that a failure to reclaim the 50-day moving average at $72,100 could trigger further downside toward the $65,000 support cluster.

| Metric | Value | Source |

|---|---|---|

| Transaction Amount | 2.565 BTC (~$181,000) | Arkham Intelligence |

| Satoshi's Estimated Holdings | 1,096,000 BTC ($77.17B) | Arkham Intelligence |

| Bitcoin Current Price | $70,274 | Live Market Data |

| 24-Hour Trend | +1.95% | Live Market Data |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Live Market Data |

This transaction matters because it tests Bitcoin's core value propositions: decentralization, immutability, and censorship resistance. By sending funds to an unspendable address, the anonymous entity demonstrates a pure, non-economic use case for the blockchain. This act could be interpreted as a symbolic endorsement of Bitcoin's foundational principles during a period of extreme market stress. Consequently, it may reinforce long-term holder sentiment despite short-term price volatility.

Institutional liquidity cycles are currently in a contraction phase, as evidenced by reduced open interest in CME Bitcoin futures. The removal of $181,000 from circulating supply is negligible in macroeconomic terms but psychologically significant. It highlights a divergence between retail fear, measured by the Fear & Greed Index, and the actions of high-conviction actors who continue to engage with the network's immutable properties.

"Transactions to Satoshi's address often serve as cryptographic proofs of belief in Bitcoin's immutable ledger. In a fear-dominated market, this act functions as a liquidity grab that the network's resilience. Market structure suggests such events can precede sentiment reversals, but only if technical supports hold."

Market analysts outline two primary scenarios based on current on-chain and technical data. The bullish scenario requires Bitcoin to hold the Fibonacci 0.618 support at $68,500 and reclaim the 50-day moving average at $72,100. This would signal a reversal of the extreme fear sentiment and potentially trigger a short squeeze. Conversely, the bearish scenario involves a breakdown below key supports, leading to a test of the $65,000 region.

The 12-month institutional outlook remains cautiously optimistic, contingent on macroeconomic factors such as Federal Reserve policy and adoption milestones like the potential approval of a spot Ethereum ETF. Historical cycles suggest that extreme fear periods often precede accumulation phases, but this requires validation through on-chain metrics like exchange net flows and miner capitulation signals.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.