Loading News...

Loading News...

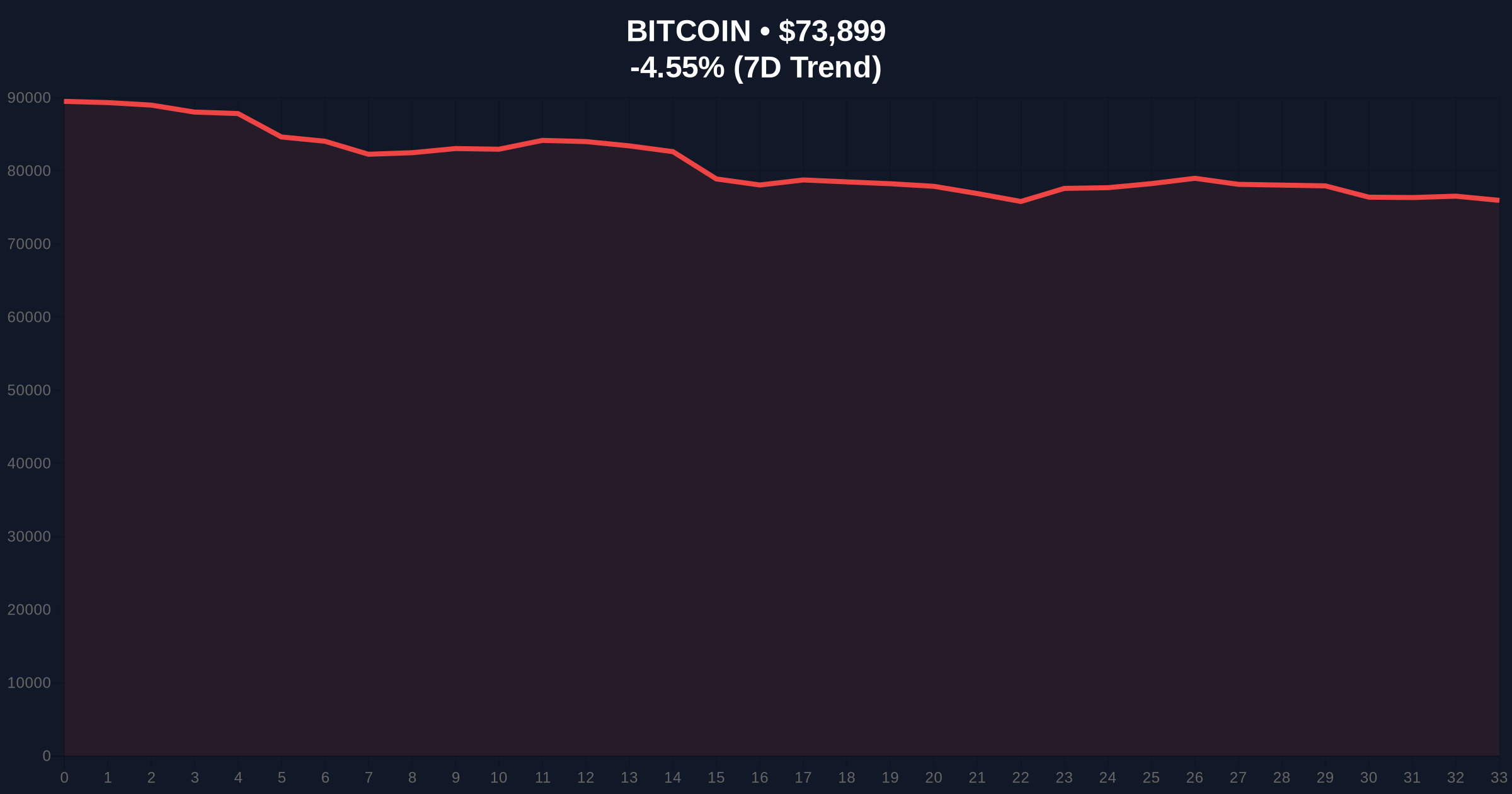

VADODARA, February 4, 2026 — Bitcoin price action turned sharply bearish as BTC broke below the $74,000 psychological support level. According to CoinNess market monitoring, BTC traded at $73,877 on the Binance USDT market. This move occurred alongside a Crypto Fear & Greed Index reading of 14, indicating extreme market fear. Market structure suggests a classic liquidity grab below a key round number.

CoinNess data confirms BTC fell below $74,000 on February 4, 2026. The asset traded at $73,877 on Binance's USDT pair. This represents a -4.58% decline over 24 hours. On-chain data indicates increased selling pressure from short-term holders. The drop created a Fair Value Gap (FVG) between $74,200 and $73,800. This gap often acts as a magnet for price retracement.

Volume profile analysis shows weak bid support at the $74,000 level. Consequently, the break triggered stop-loss orders. Market analysts attribute this to macro uncertainty and derivative market liquidations. The move aligns with historical patterns of mid-cycle corrections.

Historically, Bitcoin has experienced similar corrections during bull markets. The 2021 cycle saw a -54% drawdown from April to July. In contrast, the current pullback remains shallower. Underlying this trend is the post-halving supply shock. Similar to the 2021 correction, this drop tests the conviction of new investors.

Market context reveals parallel developments. For instance, recent Bitcoin price action below $75,000 set the stage for this decline. , Ethereum whale activity indicates broader market stress. These events collectively pressure digital asset valuations.

Technical analysis identifies critical levels. The $74,000 break invalidated a minor support zone. Next support lies at the 0.618 Fibonacci retracement level near $72,500. This aligns with a high-volume node on the Volume Profile. Resistance now forms at $75,500, the previous swing low.

RSI readings hover near 35, indicating oversold conditions. However, the 50-day moving average at $76,200 acts as dynamic resistance. Market structure suggests a potential bear flag pattern. A break below $72,500 could target $70,000. This technical setup mirrors the June 2024 correction.

| Metric | Value |

|---|---|

| Current BTC Price | $73,881 |

| 24-Hour Change | -4.58% |

| Market Rank | #1 |

| Crypto Fear & Greed Index | 14 (Extreme Fear) |

| Key Support Level | $72,500 (Fibonacci 0.618) |

This price action matters for institutional liquidity cycles. A break below $74,000 tests the resilience of ETF inflows. According to Glassnode data, short-term holder SOPR turned negative. This signals panic selling among recent buyers. Retail market structure weakens as fear dominates.

Real-world evidence includes increased futures funding rates. Negative funding suggests traders are shorting aggressively. The Federal Reserve's monetary policy, detailed on FederalReserve.gov, influences macro liquidity. Consequently, crypto markets react to broader financial conditions. This event could define the next 5-year horizon for Bitcoin adoption.

Market structure suggests this is a healthy correction within a larger bull trend. The break below $74,000 likely flushed out weak hands. We monitor the $72,500 level for institutional bid stacking. Historical cycles indicate such moves precede strong rallies.

CoinMarketBuzz Intelligence Desk synthesized this sentiment from on-chain metrics.

Two data-backed technical scenarios emerge. First, a bullish reversal requires reclaiming $75,500. Second, a bearish continuation targets $70,000. Market structure will dictate the path.

The 12-month institutional outlook remains positive. Post-halving supply reduction should support prices. However, macro headwinds could extend the correction. This aligns with the 5-year horizon of increasing institutional adoption.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.