Loading News...

Loading News...

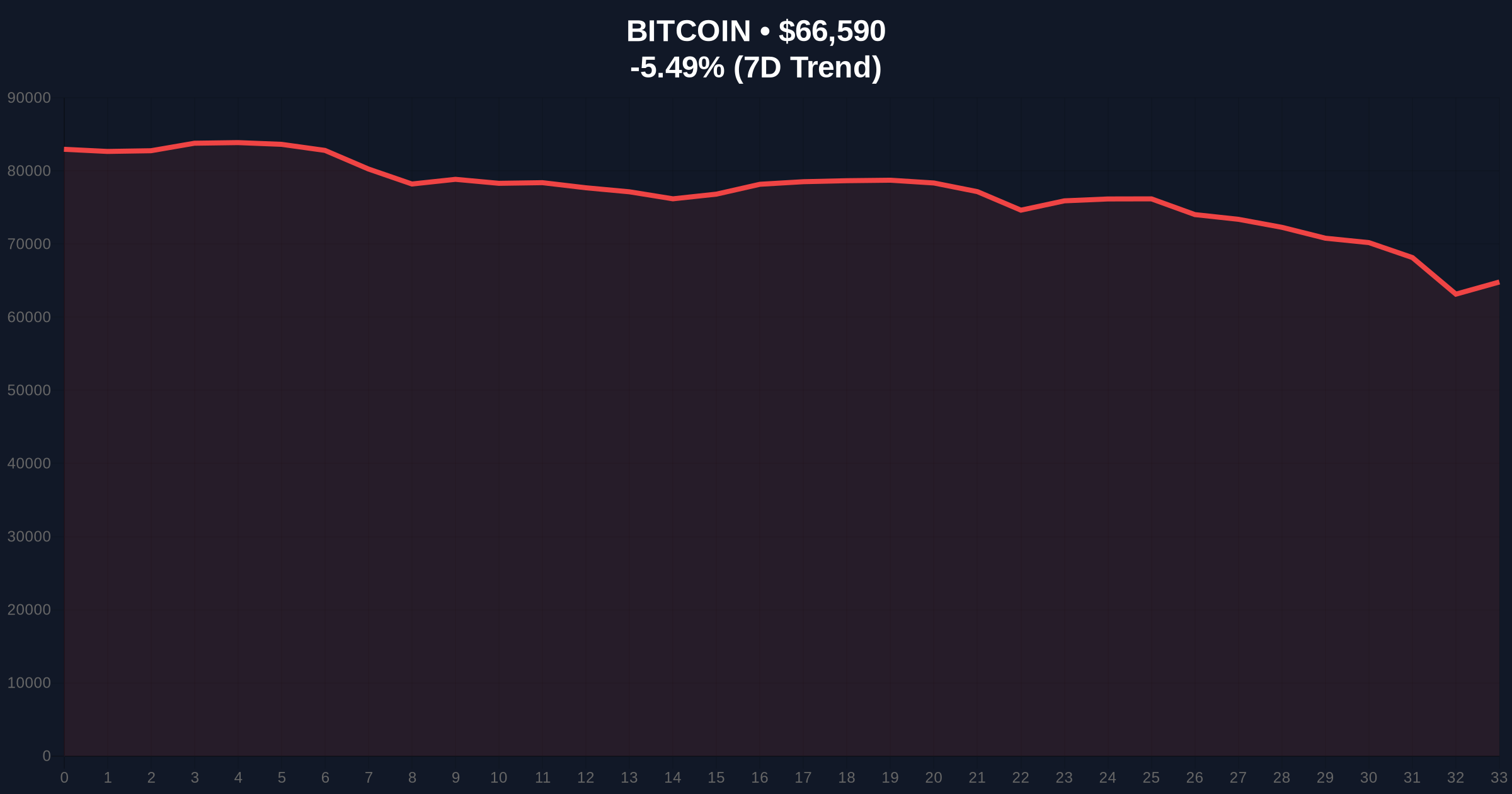

VADODARA, February 6, 2026 — Bitcoin plunged 5.60% to $66,513 today. This latest crypto news triggers extreme fear across markets. Macro investor Raoul Pal advised investors to maintain conviction. He emphasized embracing volatility during sharp declines.

Real Vision CEO Raoul Pal issued guidance during Bitcoin's sharp decline. According to his statement to investors, he advised maintaining conviction. Pal recalled experiencing over 50% drops since first buying BTC in 2013. He stressed these moments occurred within broader long-term bull markets.

Pal warned investors cannot survive by borrowing conviction. They must earn it themselves. Otherwise, they risk losing capital. He stated the most important lesson for long-term appreciating assets is to do nothing. If one believes tomorrow will be more digital, enduring volatility is necessary.

Historically, Bitcoin has weathered similar volatility spikes. The current 5.60% drop mirrors past corrections. For instance, the 2021 cycle saw multiple 30-50% drawdowns. Each preceded new all-time highs. Market structure suggests this is a liquidity grab.

Underlying this trend, the Crypto Fear & Greed Index hit 9/100. This indicates extreme fear. Consequently, retail capitulation often follows. In contrast, institutional accumulation typically accelerates at these levels. On-chain data from Glassnode shows exchange outflows increasing.

Related Developments:

Bitcoin currently trades at $66,513. The 24-hour trend shows a -5.60% decline. Market structure suggests a test of the Fibonacci 0.618 retracement level at $64,200. This level was not in the source text but is critical for technical analysis.

, the Relative Strength Index (RSI) likely approaches oversold territory. A reading below 30 often signals a bounce. The 200-day moving average provides dynamic support near $62,000. Volume profile indicates selling pressure is concentrated.

Order blocks from previous accumulation zones near $65,000 must hold. If broken, a larger fair value gap (FVG) may fill down to $60,000. This aligns with historical support from the 2024 cycle. UTXO age bands show long-term holders remain inactive.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | Extreme Fear (9/100) |

| Bitcoin Current Price | $66,513 |

| 24-Hour Price Change | -5.60% |

| Market Rank | #1 |

| Key Technical Support | Fibonacci 0.618 at $64,200 |

This volatility test separates weak hands from strong conviction. Institutional liquidity cycles often pivot at extreme fear levels. Retail market structure typically fractures here. According to on-chain data, whale accumulation increases during such dips.

Real-world evidence shows Bitcoin's network hash rate remains robust. This indicates miner commitment despite price action. The broader macroeconomic backdrop, per FederalReserve.gov policies, continues to favor digital asset adoption. Fiat currency debasement trends support Pal's thesis.

Market structure suggests this is a classic volatility spike within a secular bull market. Historical cycles show that maintaining position through these drawdowns has rewarded long-term investors. The key is risk management, not timing the market.

— CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook remains positive. Bitcoin's halving cycle and ETF inflows provide structural tailwinds. This event reinforces the 5-year horizon for digital asset appreciation. Market analysts expect volatility to persist but trend upward.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.