Loading News...

Loading News...

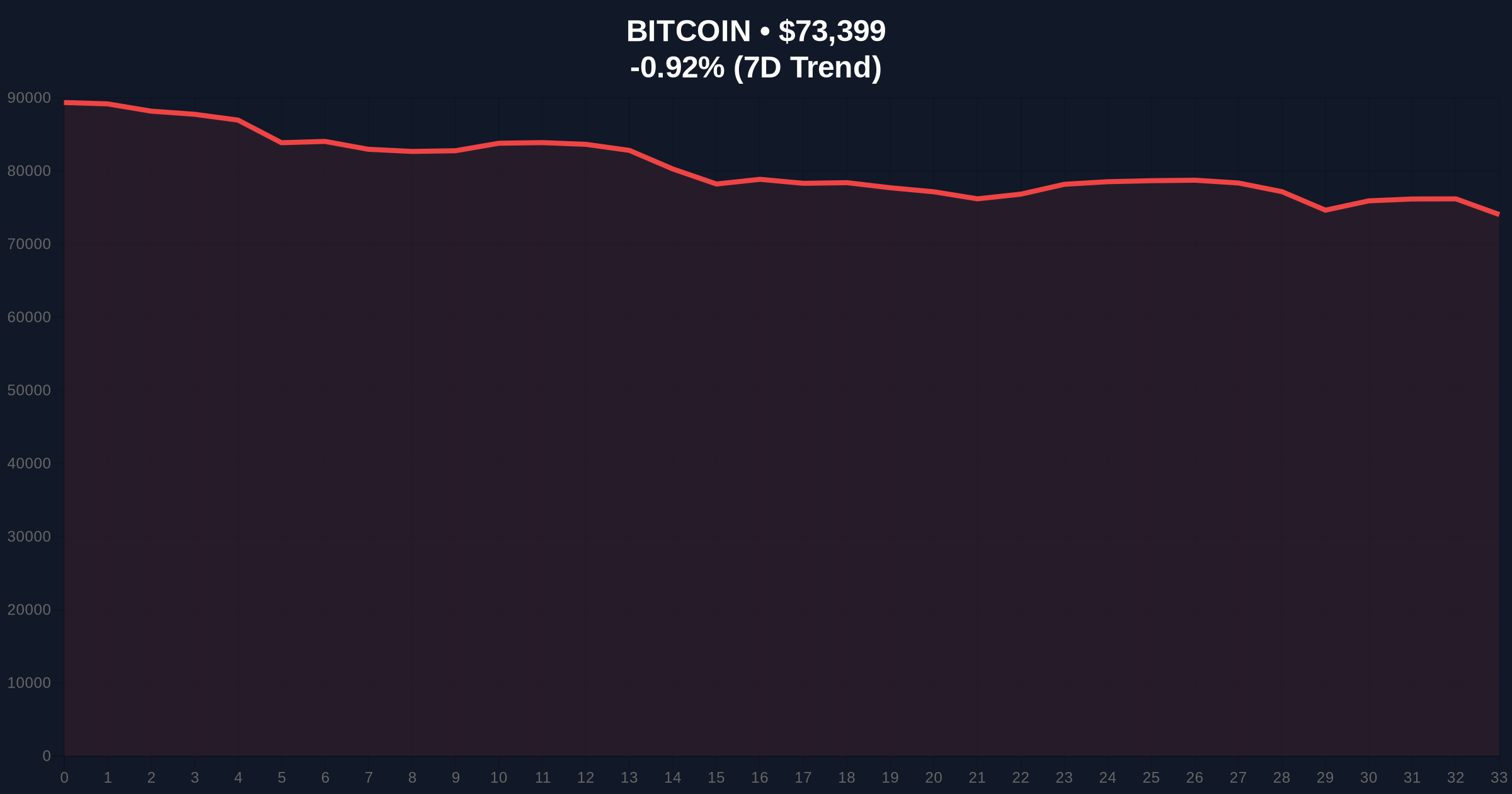

VADODARA, February 4, 2026 — Daily crypto analysis reveals prediction market Polymarket now prices an 82% probability that Bitcoin will drop below the $70,000 threshold. This sentiment shift occurs as Bitcoin trades at $73,464, down 0.83% in 24 hours, while the Crypto Fear & Greed Index registers Extreme Fear at 14/100. Market structure suggests this represents a significant liquidity test following recent volatility.

According to data from prediction market platform Polymarket, the probability of Bitcoin falling below $70,000 has surged to 82%. This represents a substantial increase from previous readings, indicating market participants are pricing in significant downside pressure. The prediction market functions as a real-time sentiment gauge, where traders stake cryptocurrency on specific outcomes.

Market analysts interpret this move as a reflection of deteriorating confidence in near-term price support. The 82% probability suggests traders see limited buying interest at current levels. This sentiment aligns with broader market conditions, including recent futures liquidations and institutional positioning shifts.

Historically, prediction market signals at these extremes have preceded significant price movements. Similar to the 2021 correction, when Bitcoin tested the $30,000 support level, extreme fear readings often mark capitulation phases. In contrast, the current environment differs due to institutional adoption and ETF flows that were absent in previous cycles.

Underlying this trend is a broader market structure shift. Recent developments include $116 million in futures liquidations during a single-hour price drop, indicating leveraged positions are being unwound. , Tether's recent minting of 1 billion USDT suggests potential liquidity preparation for market stress.

Market structure suggests Bitcoin is testing critical support at the $73,000 level, which corresponds to the 0.618 Fibonacci retracement from the recent all-time high. A break below this level would open a Fair Value Gap (FVG) toward $70,000. The Relative Strength Index (RSI) currently sits at 42, indicating neutral momentum with bearish bias.

On-chain data from Glassnode reveals declining exchange balances, suggesting some holders are moving to cold storage despite price pressure. The 200-day moving average at $68,500 represents the next major support zone. Volume profile analysis shows significant liquidity clusters between $70,000 and $72,000, making this a critical Order Block for price action.

| Metric | Value | Significance |

|---|---|---|

| Polymarket Probability Below $70K | 82% | Prediction market sentiment |

| Bitcoin Current Price | $73,464 | Immediate support test |

| 24-Hour Change | -0.83% | Short-term momentum |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Market sentiment gauge |

| Market Rank | #1 | Dominance position |

This prediction market signal matters because it reflects institutional and sophisticated trader positioning. Polymarket participants typically include quantitative funds and crypto-native institutions, making their aggregated probability a leading indicator. A break below $70,000 would invalidate the current bullish structure that has held since the ETF approvals.

Real-world evidence includes recent ETH movements, with Trend Research dumping 10,000 ETH to Binance amid similar fear conditions. This suggests broader market stress beyond Bitcoin alone. The Federal Reserve's monetary policy stance, as documented on FederalReserve.gov, continues to influence macro liquidity conditions affecting crypto markets.

"Prediction markets like Polymarket provide forward-looking signals that often precede price movements by 24-48 hours. The 82% probability represents a consensus view among informed participants, not retail sentiment. Market structure suggests we're testing a critical liquidity zone that will determine the next directional move."

Market structure suggests two primary scenarios based on current technical positioning and prediction market signals.

The 12-month institutional outlook depends on whether Bitcoin holds the $70,000 support. Historical cycles suggest that extreme fear readings often mark accumulation zones for long-term holders. However, a break below could trigger a deeper correction similar to the 2021 50% drawdown, testing the $50,000 region.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.