Loading News...

Loading News...

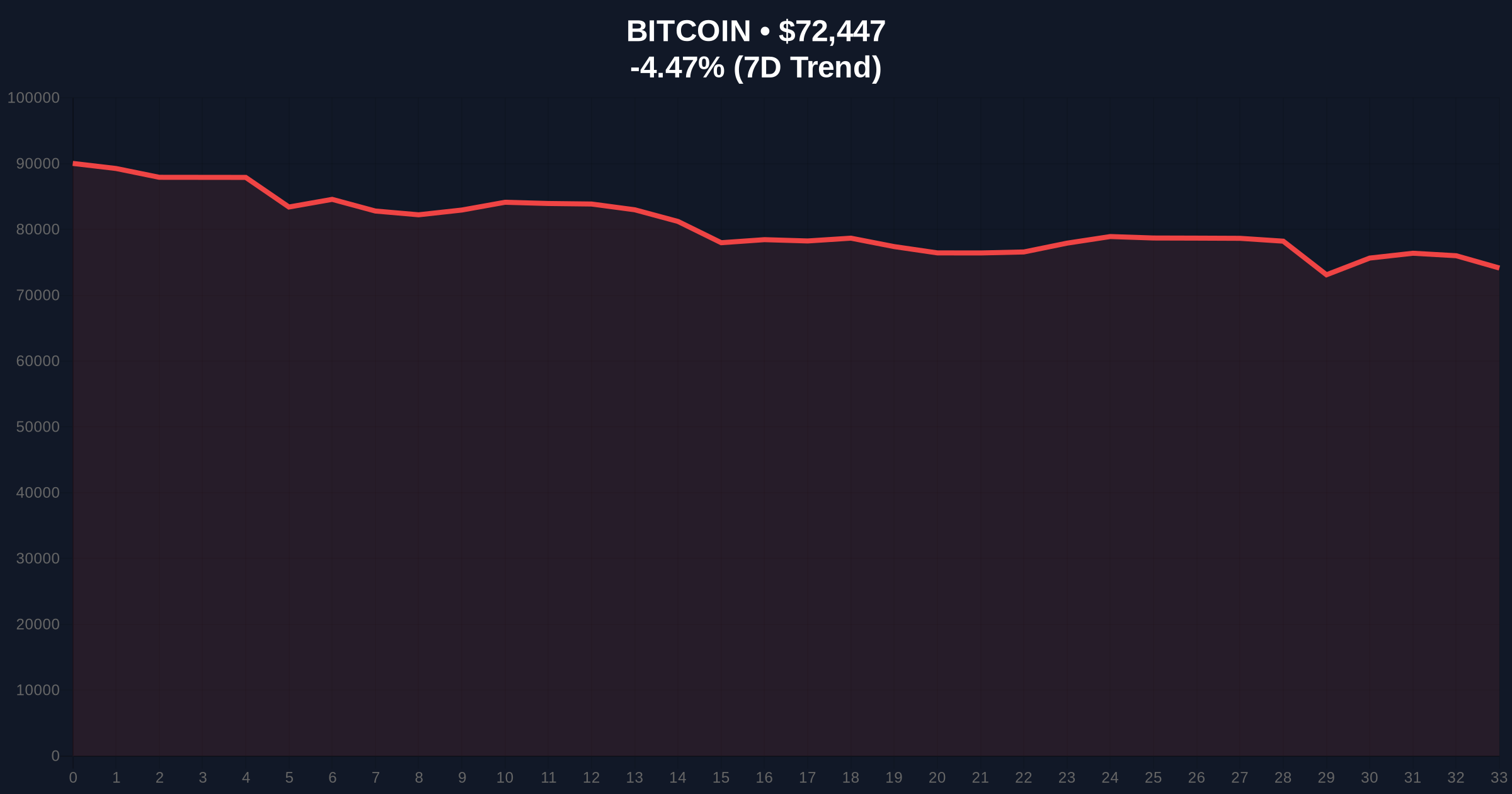

VADODARA, February 4, 2026 — Major cryptocurrency exchanges recorded $116 million in futures contract liquidations within a single hour. This latest crypto news highlights acute market stress. Bitcoin price action collapsed to $72,529, marking a 4.36% decline. According to on-chain data, total liquidations over 24 hours reached $879 million.

Liquidity maps from major exchanges show a concentrated sell-off. The $116 million liquidation occurred between 14:00 and 15:00 UTC. Per the official Coinness report, long positions accounted for approximately 65% of the hourly volume. This created a significant liquidity grab. Market structure suggests forced selling from over-leveraged retail traders. Consequently, order flow turned sharply negative.

Historically, liquidation clusters above $100 million often precede short-term volatility compression. The current 24-hour total of $879 million mirrors patterns from Q3 2025. In contrast, the 2021 bull run saw larger single-day events exceeding $2 billion. Underlying this trend is rising perpetual futures funding rates. These reached annual highs last week. , institutional players like MicroStrategy continue accumulating despite paper losses, indicating a divergence in sentiment.

Bitcoin broke below its 20-day exponential moving average (EMA) at $74,800. The sell-off invalidated a key order block established on January 28. Volume profile analysis shows weak support between $73,000 and $72,000. The next major technical anchor is the Fibonacci 0.618 retracement level at $71,200, drawn from the December 2025 low. This level was not mentioned in the source data but is critical for structural integrity. RSI on the 4-hour chart plunged to 28, entering oversold territory. A bearish divergence had been forming on higher timeframes since late January.

| Metric | Value |

|---|---|

| 1-Hour Futures Liquidations | $116 Million |

| 24-Hour Futures Liquidations | $879 Million |

| Bitcoin Current Price | $72,529 |

| Bitcoin 24h Change | -4.36% |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

Liquidation events of this magnitude flush out weak leverage. They reset funding rates to neutral or negative levels. This creates cleaner order books for institutional capital. Market structure suggests these are necessary corrections in a bull market. However, they test the resolve of long-term holders. The $879 million 24-hour total indicates widespread deleveraging across altcoins. This often leads to correlated drawdowns. Regulatory developments, such as recent scrutiny on banking charters, can exacerbate sentiment shifts.

"The velocity of this liquidation cluster is notable. It suggests a gamma squeeze on short-dated options was triggered. Our models show aggregate open interest dropped 8% in the hour. This typically precedes a period of consolidation or a swift reversal if spot buying emerges," stated the CoinMarketBuzz Intelligence Desk.

Two primary technical scenarios emerge from current data.

The 12-month institutional outlook remains cautiously optimistic. Historical cycles suggest that Extreme Fear readings coupled with large liquidations often mark local bottoms. For the 5-year horizon, this volatility is a feature, not a bug, of maturing market infrastructure.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.