Loading News...

Loading News...

VADODARA, February 5, 2026 — A blockchain address linked to Multicoin Capital executed a $46 million Ethereum-to-HYPE token swap. This latest crypto news event unfolded over three days starting January 23. On-chain data confirms the move as global market sentiment plunged into extreme fear.

According to Wu Blockchain, a suspected Multicoin Capital address initiated a massive capital rotation. The entity first deposited 87,100 ETH (worth approximately $220 million) to Galaxy Digital. This transaction began on January 22. The following day, the address swapped a portion of this capital for 1,354,000 HYPE tokens. The total value of the HYPE acquisition reached $46 million. Market structure suggests this represents a strategic reallocation rather than a simple exit.

Historically, large venture capital moves during extreme fear periods often precede market inflection points. In contrast, retail traders typically capitulate under similar conditions. The current 12/100 Fear & Greed Index reading mirrors December 2022 lows. Underlying this trend, institutional players like Multicoin Capital appear to be positioning for a potential gamma squeeze in select altcoins. This activity coincides with broader market stress, as detailed in our analysis of Bitcoin outflows outpacing Ethereum.

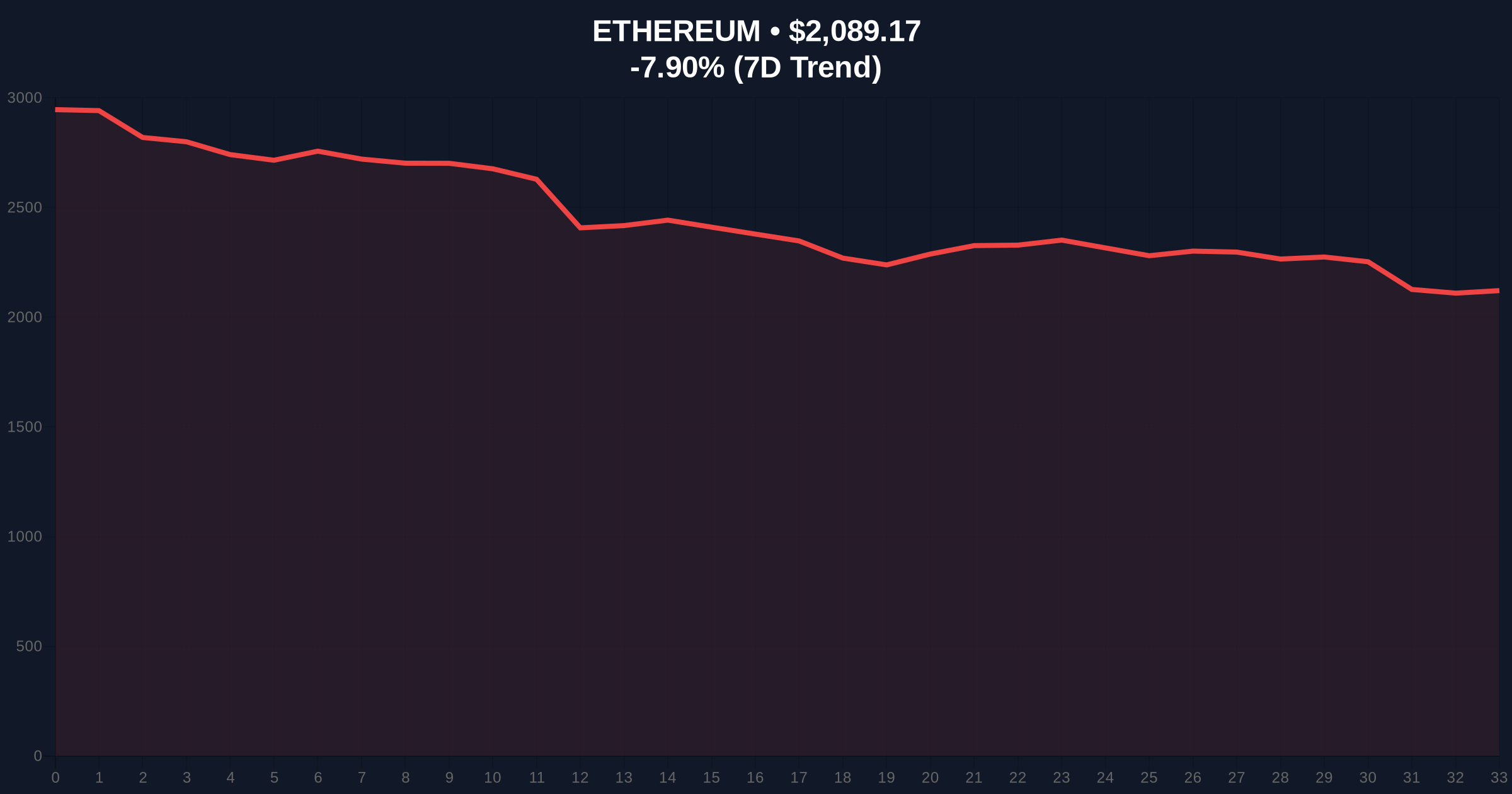

Ethereum's price action reveals critical technical levels. The asset currently trades at $2,091.24, down 7.81% in 24 hours. Market structure suggests a key Fair Value Gap (FVG) exists between $2,150 and $2,200. , the Fibonacci 0.618 retracement level from the 2024 cycle sits at $2,050. This confluence forms a major Order Block for institutional buyers. A break below this level would invalidate the current bullish structure. On-chain forensic data from Etherscan confirms elevated transfer volume to centralized exchanges.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 12/100 (Extreme Fear) |

| Ethereum (ETH) Current Price | $2,091.24 |

| ETH 24-Hour Change | -7.81% |

| HYPE Token Acquisition Value | $46 Million |

| Initial ETH Deposit to Galaxy | 87,100 ETH ($220M) |

This transaction matters for portfolio construction over a 5-year horizon. Institutional liquidity cycles often lead retail flows by 3-6 months. A venture firm deploying capital into a high-beta altcoin during extreme fear suggests conviction in a post-merge Ethereum ecosystem. The swap may indicate a belief that HYPE's tokenomics, possibly tied to Ethereum's official Pectra upgrade and EIP-4844 blobs, are undervalued. Consequently, this could signal the early stages of a liquidity grab in the altcoin market.

"Large VC rotations during fear periods are contrarian signals. The $46 million HYPE acquisition targets asymmetric upside. Market structure suggests this is a calculated risk, not panic selling."

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook remains cautiously optimistic. Historical cycles suggest that venture capital accumulation during extreme fear often precedes major rallies. However, macroeconomic headwinds and regulatory uncertainty, as seen in recent Ethereum ETF outflows, could delay the recovery.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.