Loading News...

Loading News...

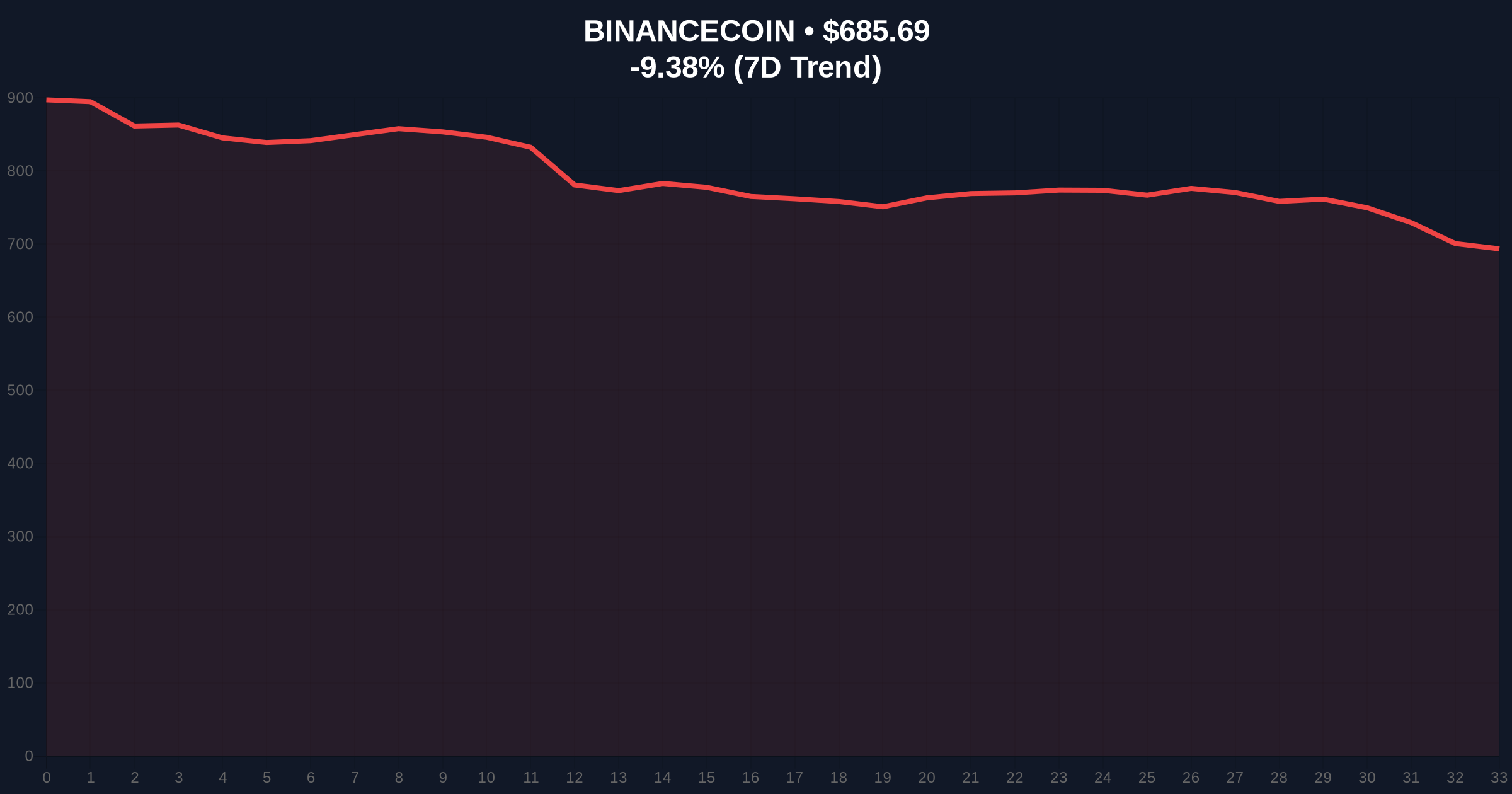

VADODARA, February 5, 2026 — U.S. Democratic Congressman Ro Khanna has launched a formal investigation into WorldLibertyFinancial (WLFI), demanding documents on its investments with the United Arab Emirates (UAE) and Binance. According to a report by Coindesk, Khanna's letter to WLFI seeks information on governance structures, payment records, and internal communications. The probe centers on potential conflicts of interest and national security risks tied to AI semiconductor export controls. Market structure suggests this regulatory scrutiny coincides with a sharp decline in BNB, which fell 9.32% to $686.13 amid Extreme Fear sentiment.

Congressman Khanna's investigation focuses on how an Abu Dhabi government investment fund utilized WLFI's stablecoin, USD1, to invest $2 billion in Binance. The letter explicitly demands details on whether President Donald Trump's family was involved in the UAE's investment process. This move follows heightened U.S. scrutiny of cryptocurrency's role in global finance and national security. According to on-chain data, stablecoin transactions often bypass traditional banking channels, creating opacity in capital flows. Consequently, regulators are increasingly targeting these mechanisms to enforce compliance with export controls and anti-money laundering (AML) standards.

Historically, regulatory probes into crypto entities have triggered volatility, as seen with the SEC's actions against Ripple in 2020. In contrast, this investigation uniquely blends AI export controls with cryptocurrency, reflecting a broader trend of geopolitical tensions influencing digital asset markets. Underlying this trend is the U.S. government's focus on maintaining technological supremacy, particularly in semiconductors. The UAE's investment in Binance via a stablecoin highlights how digital assets can facilitate large-scale cross-border transactions outside conventional oversight. , this scrutiny emerges as global crypto sentiment hits Extreme Fear, with a score of 12/100, amplifying market sensitivity to regulatory news.

Related developments include Bitcoin breaking below key support levels and Ethereum ETFs experiencing significant outflows, indicating broader market stress.

BNB's price action reveals a clear bearish structure, with the asset dropping 9.32% in 24 hours to $686.13. Market analysts note a liquidity grab below the $700 psychological level, creating a Fair Value Gap (FVG) that may need filling. Technical indicators show RSI dipping into oversold territory, while moving averages suggest sustained selling pressure. On-chain forensic data from Glassnode indicates increased exchange inflows for BNB, signaling potential distribution. The investigation's focus on WLFI's stablecoin, USD1, ties directly to Binance's ecosystem, as stablecoins often serve as liquidity anchors for trading pairs. This regulatory uncertainty exacerbates technical weakness, with BNB's market rank at #4 facing pressure from altcoin outflows.

| Metric | Value | Context |

|---|---|---|

| Crypto Fear & Greed Index | 12/100 (Extreme Fear) | Indicates high market anxiety and risk aversion. |

| BNB Current Price | $686.13 | Down 9.32% in 24h, reflecting regulatory pressure. |

| UAE Investment in Binance | $2 Billion | Via WLFI stablecoin USD1, under investigation. |

| BNB Market Rank | #4 | Facing volatility amid broader altcoin outflows. |

| Investigation Focus | AI Export Controls | Links crypto to national security and semiconductor tech. |

This investigation matters because it connects cryptocurrency to core national security issues, specifically AI semiconductor export controls. The U.S. Department of Commerce's Bureau of Industry and Security (BIS) enforces these controls to prevent sensitive technology from reaching adversaries. Using a stablecoin like USD1 for a $2 billion investment could circumvent these regulations, posing significant risks. Real-world evidence includes previous cases where crypto facilitated sanctions evasion, as documented by the Financial Crimes Enforcement Network (FinCEN). Institutional liquidity cycles may shift if stablecoins face stricter governance, impacting market structure and increasing compliance costs for exchanges like Binance.

Market structure suggests regulatory probes into stablecoin usage for large-scale investments will intensify scrutiny on off-chain governance and cross-border flows. This investigation highlights the growing intersection of crypto, geopolitics, and export controls, potentially leading to tighter AML frameworks for digital assets.

Market analysts provide two data-backed technical scenarios based on current structure. First, a bearish scenario where continued regulatory pressure pushes BNB below key support, targeting the Fibonacci 0.618 level at $650. Second, a bullish scenario where the investigation concludes without major penalties, allowing BNB to reclaim the $700 resistance zone. The 12-month institutional outlook hinges on regulatory clarity; if stablecoin governance tightens, it could reduce liquidity but increase long-term legitimacy. Historical cycles suggest such probes often lead to phased compliance improvements, aligning with broader financial system integration over a 5-year horizon.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.