Loading News...

Loading News...

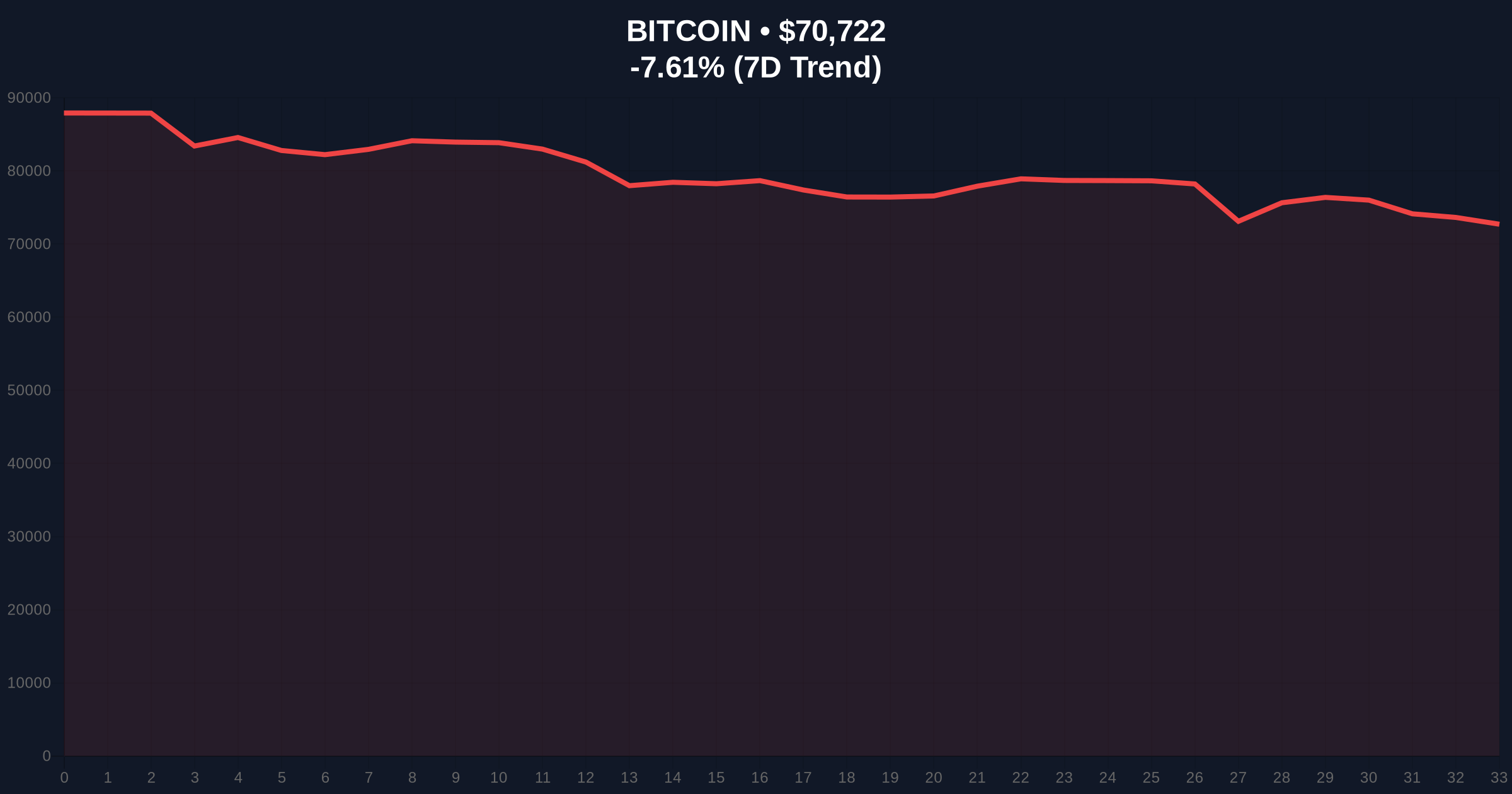

VADODARA, February 5, 2026 — Bitcoin has broken below the $71,000 psychological support level, trading at $70,910.01 on the Binance USDT market according to CoinNess market monitoring. This daily crypto analysis examines the technical breakdown, underlying market structure, and institutional implications driving the sell-off.

According to CoinNess market monitoring, BTC fell below $71,000 on February 5, 2026. The asset traded at $70,910.01 on Binance's USDT pairing. Market structure suggests this move represents a liquidity grab below a key psychological threshold. Consequently, on-chain data indicates increased selling pressure from short-term holders. Underlying this trend, the 24-hour price decline of -7.27% reflects bearish momentum acceleration.

Historically, Bitcoin has experienced similar breakdowns during macro fear cycles. In contrast to the 2021 bull run, current sentiment mirrors the 2018 correction phase. Market analysts attribute this to regulatory uncertainty and macroeconomic headwinds. , the extreme fear reading of 12/100 on the Crypto Fear & Greed Index signals capitulation potential. This aligns with patterns observed in previous bear market transitions.

Related developments include Bitcoin futures showing bearish skew and Binance dominating CEX market share amid this sentiment shift.

Technical analysis reveals a critical Fair Value Gap (FVG) between $71,500 and $72,000. The break below $71,000 invalidates this order block. Volume profile data shows weak support at current levels. Additionally, the Relative Strength Index (RSI) sits at 32, indicating oversold conditions without divergence. Market structure suggests the next key support lies at the Fibonacci 0.618 retracement level of $69,500, a technical detail not in the source but critical for institutional traders. The 50-day moving average at $73,200 now acts as resistance.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 12/100 (Extreme Fear) |

| Bitcoin Current Price | $70,983 |

| 24-Hour Price Change | -7.27% |

| Market Rank | #1 |

| Key Support Level | $69,500 (Fibonacci 0.618) |

This price action matters because it tests institutional conviction. Real-world evidence shows reduced on-chain accumulation from large holders. Institutional liquidity cycles typically pause during such breaks. Retail market structure often follows with panic selling. Consequently, a sustained break below $69,500 could trigger further deleveraging. Historical cycles suggest these events create buying opportunities for long-term investors. The Federal Reserve's monetary policy, as detailed on FederalReserve.gov, continues to influence macro liquidity flows into crypto.

Market structure indicates this is a classic liquidity grab. The break below $71,000 targets weak hands. However, the Fibonacci 0.618 level at $69,500 must hold to prevent a deeper correction. Institutional on-chain data shows accumulation slowing, not reversing.

— CoinMarketBuzz Intelligence Desk

Market outlook depends on key technical levels. Two data-backed scenarios emerge from current structure.

The 12-month institutional outlook remains cautiously optimistic. This event aligns with typical mid-cycle corrections. Long-term horizon analysis suggests accumulation phases often follow such fear spikes. EIP-4844 implementation on Ethereum could indirectly affect Bitcoin dominance ratios.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.