Loading News...

Loading News...

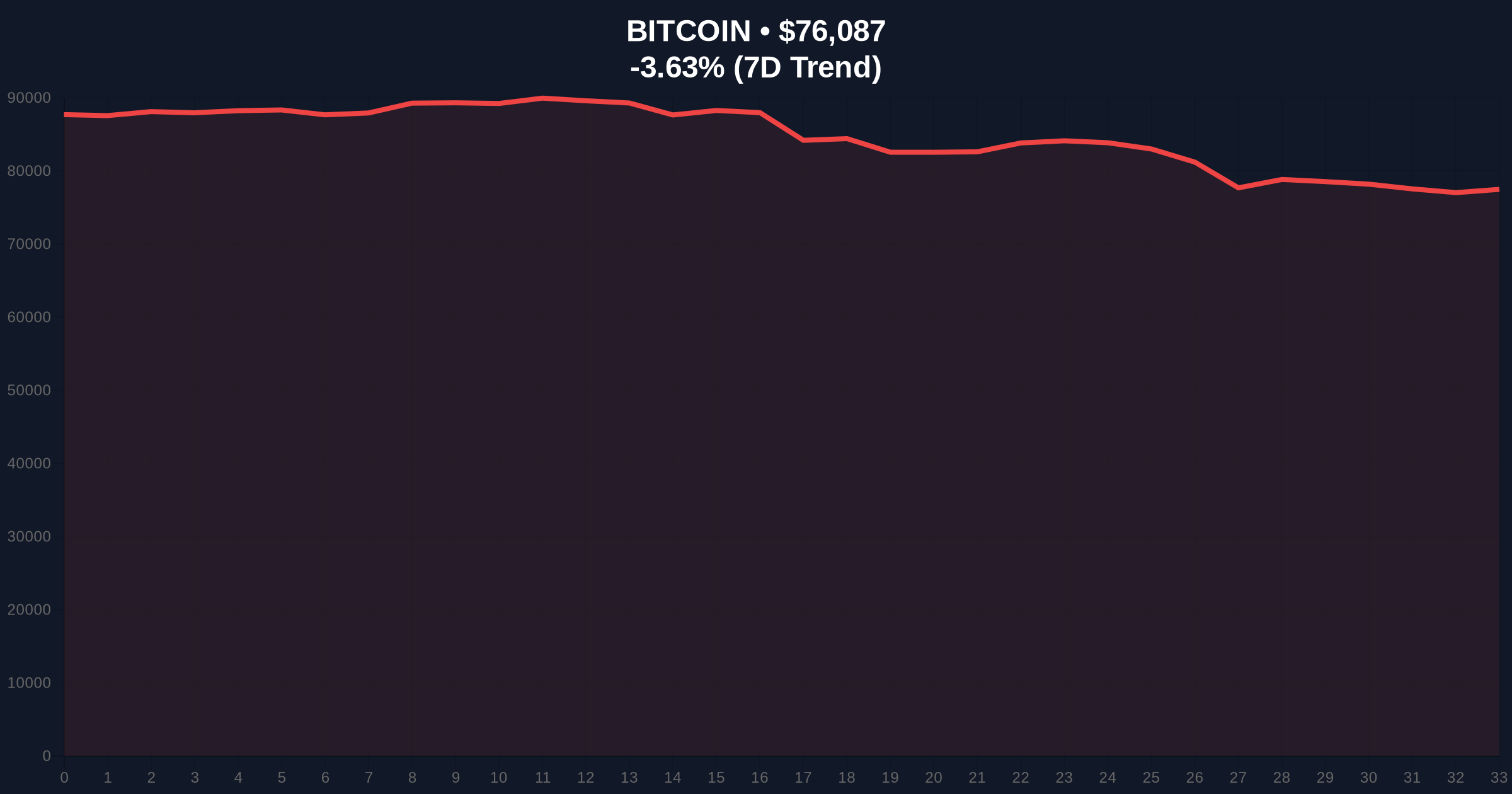

VADODARA, February 2, 2026 — MicroStrategy Inc. (NASDAQ: MSTR) now holds its massive Bitcoin treasury at an unrealized loss exceeding $900 million, according to on-chain data from Lookonchain. This latest crypto news reveals the corporate Bitcoin pioneer's average entry price of $76,037 now sits above Bitcoin's current trading range, creating a critical liquidity test for institutional adoption narratives. Market structure suggests this development exposes fundamental contradictions in leveraged corporate treasury strategies during sustained downturns.

Lookonchain's X report, timestamped around 3:40 a.m. UTC on February 2, captured the precise moment MicroStrategy's position slipped underwater. The company holds 712,647 BTC acquired at an average cost basis of $76,037. When Bitcoin's price briefly touched $74,604 during early Asian trading hours, the unrealized loss crossed the $900 million threshold. According to CoinMarketCap data, BTC subsequently recovered to $75,972 but remains down 1.28% on the day, firmly below MicroStrategy's breakeven point. This creates a persistent negative gamma position for the firm's balance sheet.

Historically, MicroStrategy has served as a bellwether for institutional Bitcoin adoption. The company's aggressive accumulation strategy, often funded through convertible debt offerings, created a leveraged bet on Bitcoin's long-term appreciation. In contrast to the 2021 bull market where paper profits exceeded $6 billion, the current unrealized loss represents the most significant drawdown since the firm began its Bitcoin treasury strategy. Underlying this trend is a broader market shift where traditional corporate finance metrics now directly conflict with crypto volatility cycles.

This development occurs alongside other extreme fear market signals. For instance, crypto futures liquidations recently hit $144 million in one hour, indicating leveraged positions are being rapidly unwound. , Bitcoin recently tested its 9-month low below $74,508, creating a critical technical level that now serves as major support for MicroStrategy's position.

The current price action creates a clear Fair Value Gap (FVG) between MicroStrategy's average cost ($76,037) and Bitcoin's trading range ($75,972-$76,027). This $65 gap represents immediate resistance that must be reclaimed to alleviate pressure. Volume profile analysis indicates weak buying interest at these levels, with most liquidity concentrated below $74,500. The 200-day moving average, currently near $78,200, acts as a major dynamic resistance level that price has failed to reclaim for three consecutive weeks.

Market structure suggests the $74,508 level represents more than just a 9-month low—it coincides with the 0.786 Fibonacci retracement level from the 2025 rally highs. A break below this level would invalidate the current consolidation structure and likely trigger stop-loss orders from institutional participants beyond just MicroStrategy. The UTXO (Unspent Transaction Output) age distribution shows increased movement from 3-6 month holders, indicating early capitulation from medium-term investors.

| Metric | Value | Significance |

|---|---|---|

| MicroStrategy BTC Holdings | 712,647 BTC | ~1.3% of total Bitcoin supply |

| Average Purchase Price | $76,037 | Current resistance level |

| Unrealized Loss at $74,604 | $900M+ | Balance sheet stress test |

| Current BTC Price | $76,027 | Down 3.70% (24h) |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Contradicts accumulation signals |

MicroStrategy's unrealized loss matters because it tests the fundamental thesis of corporate Bitcoin adoption. The company's strategy relies on Bitcoin's long-term appreciation outpacing the cost of capital from debt issuance. Consequently, sustained periods below cost basis create accounting impairments and potential covenant risks with lenders. On-chain data indicates this isn't an isolated event—similar stress appears across other corporate treasuries and Bitcoin ETFs that purchased near cycle highs.

, the extreme fear sentiment (14/100) creates a market structure contradiction. While retail sentiment reaches panic levels, anonymous whales continue accumulating $100M+ positions, suggesting sophisticated capital sees value at these levels. This divergence between sentiment indicators and capital flows typically precedes major trend reversals, though timing remains uncertain.

"MicroStrategy's position represents a liquidity grab opportunity for larger players. The $76,037 average cost creates a clear order block that market makers will defend or attack based on broader liquidity conditions. What's concerning isn't the paper loss itself—it's the potential for forced selling if Bitcoin breaks below the $74,508 invalidation level. That would trigger a cascade through corporate and ETF holdings simultaneously."— CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current technical levels and on-chain data:

The 12-month institutional outlook hinges on whether MicroStrategy maintains its conviction or faces balance sheet pressures. Historical cycles suggest that corporate holders who maintain positions through drawdowns of 20-30% typically capture the majority of the next cycle's gains. However, the Federal Reserve's monetary policy trajectory, particularly regarding interest rates, will significantly impact the cost of capital for leveraged strategies like MicroStrategy's. The company's next earnings report and any commentary about its Bitcoin strategy will provide critical signals for other institutional participants.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.