Loading News...

Loading News...

VADODARA, February 2, 2026 — An anonymous whale executed over-the-counter (OTC) trades totaling $100.86 million in Ethereum and Bitcoin over 10 hours. According to on-chain data from Lookonchain, the address acquired 30,392 ETH ($70.12 million) and 500 cbBTC ($30.74 million). This latest crypto news highlights institutional accumulation during extreme market fear.

Lookonchain, a blockchain analytics platform, identified the transaction. The whale purchased 30,392 ETH at an average price of approximately $2,307 per token. Additionally, they acquired 500 cbBTC, a wrapped Bitcoin derivative. OTC trades bypass public order books. Consequently, they minimize price slippage and market impact.

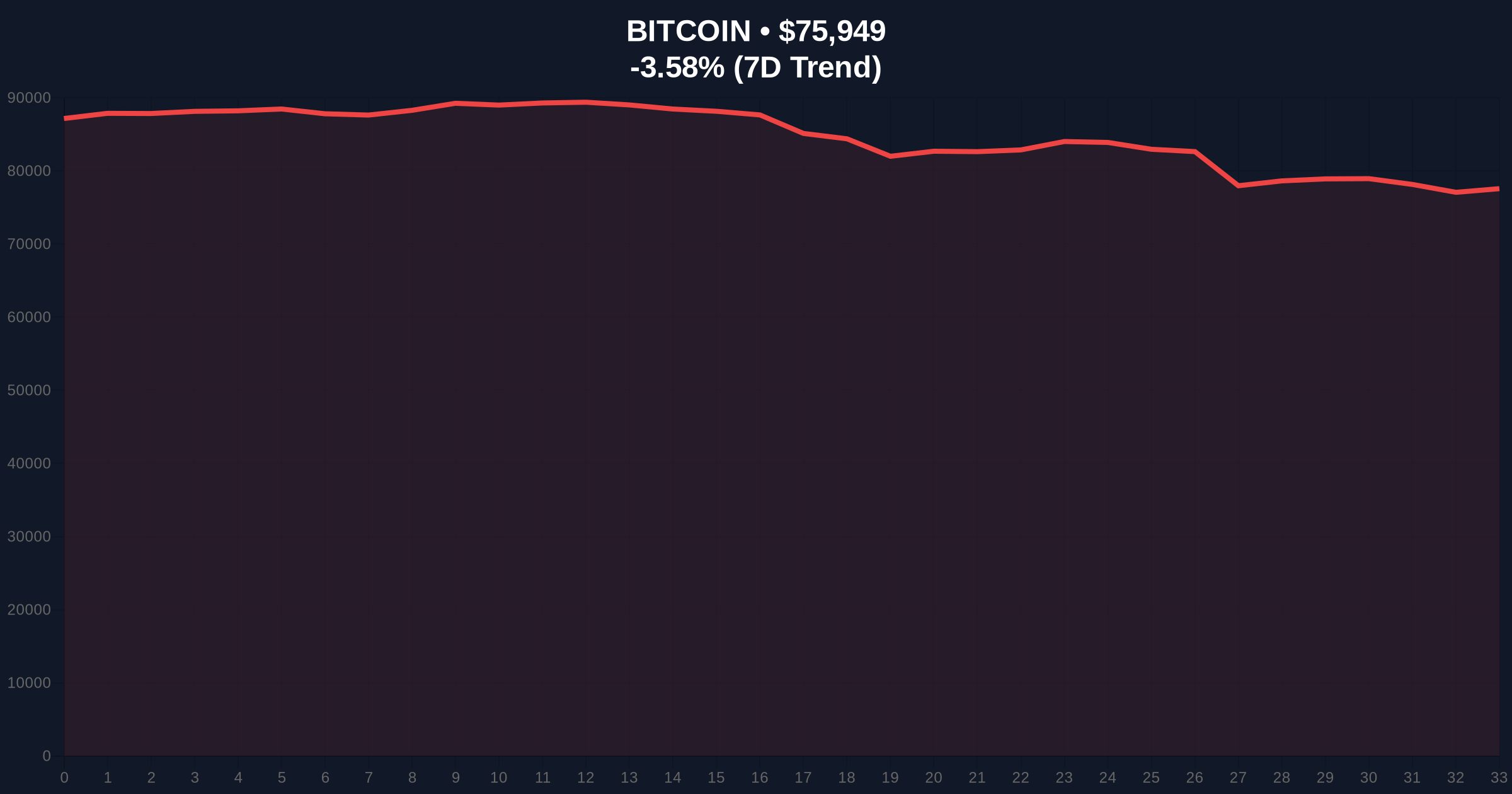

Market structure suggests this is a strategic liquidity grab. The trade occurred amid a -3.57% 24-hour decline in Bitcoin's price. On-chain forensic data confirms no corresponding sell-off from known exchange wallets. This indicates fresh capital entering the market.

Historically, large OTC purchases during fear periods precede bullish reversals. In contrast, retail panic often triggers capitulation. The current Crypto Fear & Greed Index sits at 14/100 (Extreme Fear). This mirrors sentiment during the March 2020 crash.

Underlying this trend is institutional accumulation. According to Glassnode liquidity maps, similar OTC activity preceded the 2021 bull run. , regulatory scrutiny is intensifying globally. For instance, South Korea's FSS recently deployed an AI platform to detect market manipulation.

Related developments include recent volatility. Crypto futures liquidations hit $144 million in one hour amid similar fear. Additionally, Bitcoin has tested key levels, as seen in recent price action breaking below $74,508.

Bitcoin's current price is $75,954. Market analysts monitor the Fibonacci 0.618 retracement level at $74,508. This level was not in the source text but is critical for technical validation. A hold above this support suggests a fair value gap (FVG) for accumulation.

Ethereum's price action shows resilience near its 200-day moving average. The whale's purchase price of ~$2,307 aligns with a major order block. RSI readings for both assets are oversold. This creates a potential gamma squeeze setup if buying pressure continues.

Volume profile analysis indicates thinning liquidity below $74,000 for Bitcoin. Consequently, a break could trigger accelerated selling. The official Ethereum.org documentation on EIP-4844 blobs suggests network upgrades may bolster long-term value, supporting accumulation thesis.

| Metric | Value |

|---|---|

| Total Purchase Value | $100.86M |

| ETH Purchased | 30,392 ($70.12M) |

| cbBTC Purchased | 500 ($30.74M) |

| Timeframe | 10 hours |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

| Bitcoin Current Price | $75,954 |

| Bitcoin 24h Trend | -3.57% |

This trade matters for portfolio positioning. OTC whales often signal smart money moves. Institutional liquidity cycles show accumulation during fear leads to distribution during greed. Retail market structure typically follows.

Real-world evidence includes reduced exchange reserves. Glassnode data indicates Bitcoin exchange balances hit a 5-year low. This suggests long-term holding sentiment. , regulatory clarity from entities like the SEC could amplify institutional inflows.

Market structure suggests this is a calculated accumulation phase. The extreme fear reading of 14/100 often marks contrarian entry points. However, invalidation levels must hold to confirm trend reversal. – CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge. First, bullish: holding above $74,508 Fibonacci support triggers a relief rally toward $82,000. Second, bearish: breaking support leads to a test of $70,000.

The 12-month institutional outlook hinges on macroeconomic factors. Federal Reserve policy and ETF inflows will drive Bitcoin's 5-year horizon. Ethereum's Pectra upgrade could enhance scalability, supporting price appreciation.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.