Loading News...

Loading News...

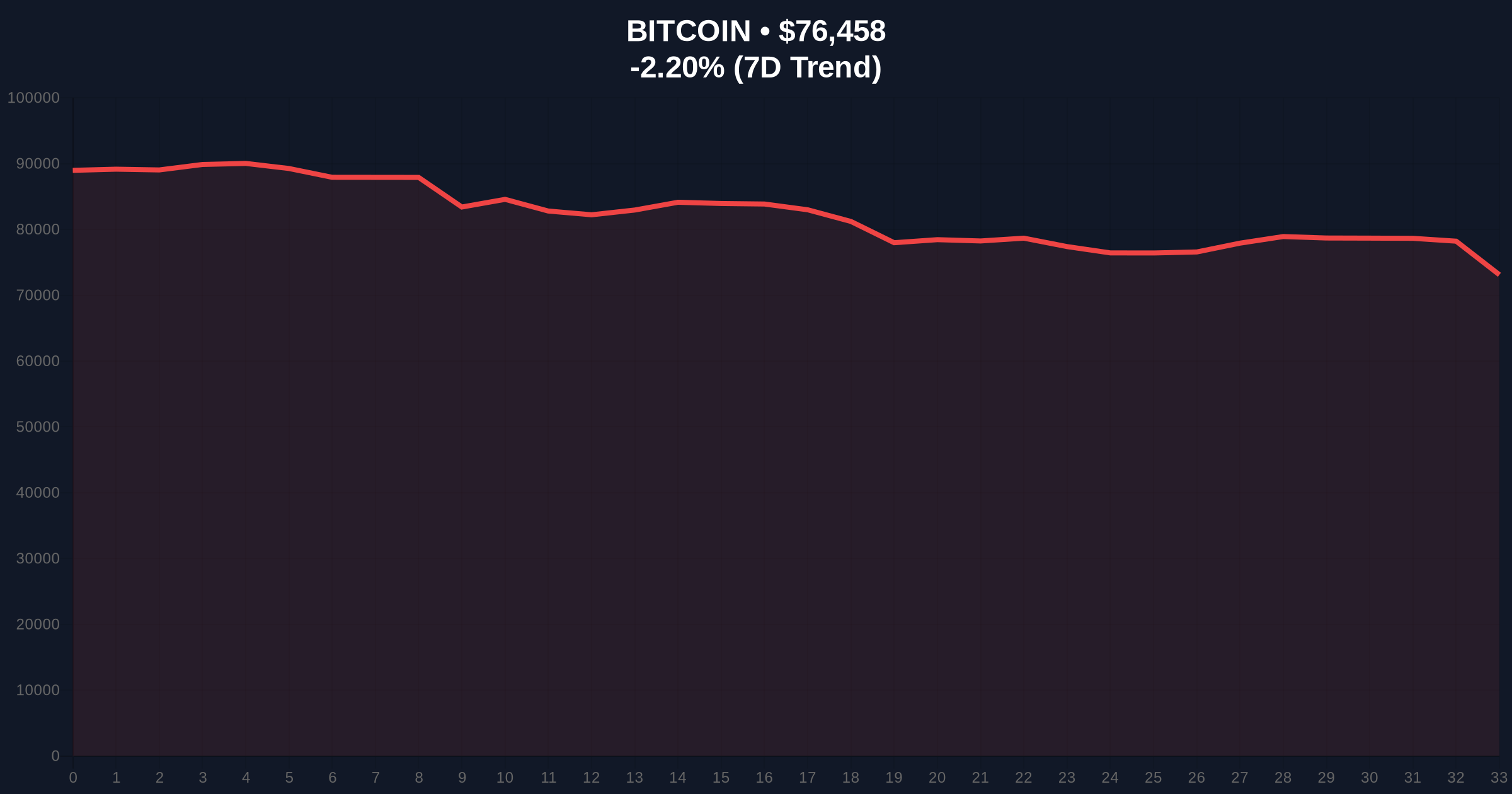

VADODARA, February 3, 2026 — MicroStrategy Inc. now carries an unrealized loss of $750 million on its Bitcoin holdings, according to data from Unfolded. This daily crypto analysis reveals the company's BTC portfolio value stands at $53.5 billion despite the significant paper loss. Market structure suggests this corporate position faces immediate pressure as Bitcoin trades at $76,434, down 2.23% in 24 hours.

Unfolded's on-chain forensic data confirms MicroStrategy's current unrealized loss equals 1.0882 trillion won. The company accumulated Bitcoin through multiple purchases over several years. Consequently, their average entry price now sits above current market levels. This creates a substantial Fair Value Gap between accounting value and market reality.

MicroStrategy's corporate treasury strategy made Bitcoin its primary reserve asset. Market analysts question whether this approach remains sustainable during extended downturns. The $750 million paper loss represents approximately 1.4% of their total Bitcoin portfolio value. However, this percentage masks the actual risk exposure relative to the company's overall market capitalization.

Historically, corporate Bitcoin adoption followed MicroStrategy's lead. Companies like Tesla and Square entered the space with similar treasury strategies. In contrast, the current market downturn tests these positions more severely than previous cycles. The 2021-2022 bear market saw corporate holders maintain positions through similar unrealized losses.

Underlying this trend is a fundamental question about Bitcoin's volatility tolerance in corporate accounting. The Financial Accounting Standards Board (FASB) now requires fair value accounting for crypto holdings. This regulatory shift makes unrealized losses immediately visible on balance sheets. Companies can no longer hide behind cost accounting methods.

Related developments in corporate Bitcoin adoption continue despite market conditions. For instance, Nasdaq-listed insurance firm TIRX recently announced a $1.1 billion Bitcoin purchase plan. , Franklin Templeton executives predict digital wallets will eventually store all financial assets, suggesting long-term institutional conviction remains intact.

Bitcoin currently tests critical support at the $74,000 level. This represents the lowest price since the 2024 U.S. presidential election, as detailed in recent market analysis. The Relative Strength Index (RSI) sits in oversold territory below 30. This suggests potential for a technical bounce if buying pressure emerges.

Market structure reveals a clear Order Block between $74,000 and $76,000. This zone previously acted as strong resistance during the 2025 rally. Volume Profile analysis shows significant liquidity accumulation at these levels. A break below $74,000 would invalidate the current support structure and likely trigger stop-loss orders from leveraged positions.

The 200-day moving average currently sits at $82,500, providing dynamic resistance. Bitcoin trades approximately 7.3% below this key trend indicator. Fibonacci retracement levels from the 2025 all-time high show the 0.618 level at $78,200. This represents the next immediate resistance if price recovers from current levels.

| Metric | Value |

|---|---|

| MicroStrategy Unrealized Loss | $750 Million |

| MicroStrategy BTC Portfolio Value | $53.5 Billion |

| Bitcoin Current Price | $76,434 |

| 24-Hour Price Change | -2.23% |

| Crypto Fear & Greed Index | 17/100 (Extreme Fear) |

MicroStrategy's position serves as a liquidity proxy for institutional Bitcoin exposure. The $750 million unrealized loss represents potential selling pressure if the company faces margin calls or decides to rebalance. According to Glassnode liquidity maps, corporate holdings now represent approximately 3.2% of Bitcoin's circulating supply.

This matters because corporate selling typically occurs in larger blocks than retail selling. Consequently, it can create disproportionate market impact. The current Extreme Fear sentiment reading of 17/100 suggests retail investors are already capitulating. Institutional holders like MicroStrategy represent the next potential wave of selling pressure if conditions worsen.

Market structure indicates that sustained prices below MicroStrategy's average cost basis could trigger broader corporate reevaluations of Bitcoin treasury strategies. The SEC's disclosure requirements now force public companies to report crypto holdings transparently. This regulatory framework increases scrutiny during periods of underperformance.

"Corporate Bitcoin strategies face their first true stress test under new accounting standards. The $750 million paper loss represents both an accounting reality and a psychological threshold. Historical cycles suggest institutions typically hold through these periods unless forced to sell by external factors like debt covenants or regulatory pressure."— CoinMarketBuzz Intelligence Desk

Two technical scenarios emerge from current market structure. The bullish scenario requires Bitcoin to reclaim the $78,200 Fibonacci level and hold above $74,000. This would suggest the current downturn represents a healthy correction within a larger uptrend. The bearish scenario involves breaking the $74,000 support and testing the $70,000 psychological level.

The 12-month institutional outlook depends on Bitcoin's ability to maintain its store-of-value narrative despite volatility. If corporate holders like MicroStrategy maintain their positions through this downturn, it could strengthen the case for Bitcoin as a legitimate reserve asset. However, forced selling would undermine this narrative and potentially delay broader institutional adoption.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.