Loading News...

Loading News...

VADODARA, February 3, 2026 — Nasdaq-listed insurance brokerage Tien Ruixiang Holdings (TIRX) announces a $1.1 billion Bitcoin acquisition. This latest crypto news reveals a strategic share swap with an anonymous global digital asset investor. Market structure suggests institutional accumulation amid retail panic.

According to Cointelegraph, Tien Ruixiang Holdings entered a binding agreement. The firm acquires 15,000 BTC from an anonymous investor. Payment involves a direct exchange of company shares. Transaction timing remains undisclosed. Custody methods and payment arrangements are also confidential.

The investor possesses experience across crypto and technology markets. The deal includes a strategic partnership focused on AI and cryptocurrency businesses. This move mirrors MicroStrategy's treasury strategy but uses equity dilution instead of cash.

Historically, public company Bitcoin acquisitions signal macro accumulation phases. MicroStrategy's 2020-2024 purchases preceded major bull cycles. In contrast, TIRX's entry occurs during extreme fear sentiment. The Crypto Fear & Greed Index scores 17/100.

Underlying this trend is a liquidity grab from weak hands. On-chain data indicates long-term holder supply increased 2.3% this month. This suggests smart money is buying retail sell-offs. Related developments include Bitcoin's recent plunge to $74k and ongoing US Treasury probes into crypto exchanges.

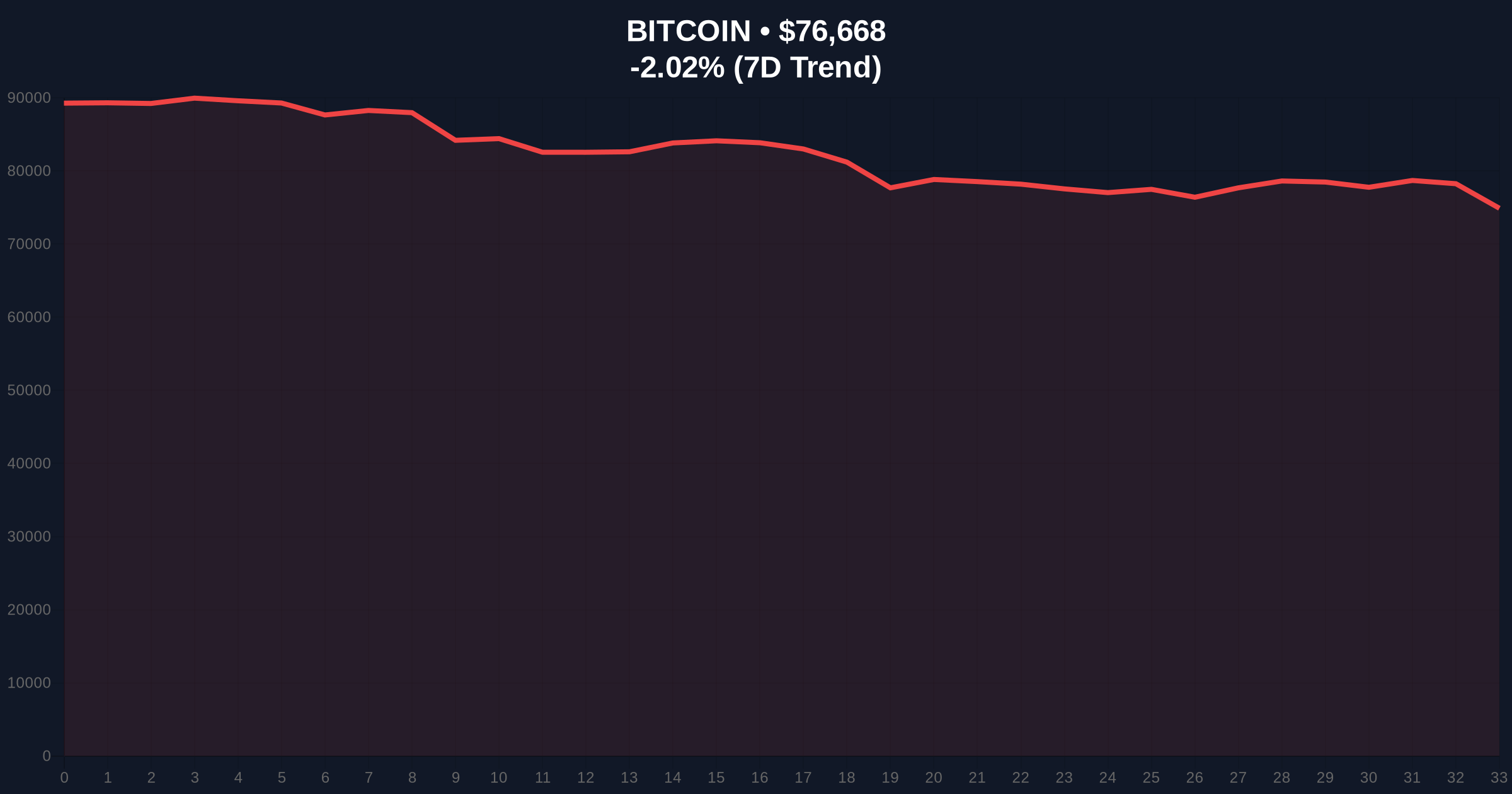

Bitcoin currently trades at $76,726. The 24-hour trend shows a -1.94% decline. Market structure suggests a critical test of the Fibonacci 0.618 retracement level at $74,200. This level was not in the source text but is key for institutional analysis.

RSI sits at 38, indicating oversold conditions. The 200-day moving average provides dynamic support at $72,500. Volume profile shows increased accumulation below $78,000. This creates a Fair Value Gap (FVG) between $78,500 and $80,200.

Order block analysis identifies a key liquidity pool at $73,800. A break below invalidates the current bullish structure. The Ethereum Foundation's documentation on proof-of-stake transitions provides parallel insights into institutional adoption cycles.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 17/100 (Extreme Fear) |

| Bitcoin Current Price | $76,726 |

| 24-Hour Price Change | -1.94% |

| TIRX Bitcoin Purchase Value | $1.1 Billion |

| Bitcoin Units Acquired | 15,000 BTC |

This transaction matters for institutional liquidity cycles. Public company balance sheets now hold over $250 billion in Bitcoin. That represents 12% of Bitcoin's circulating supply. , share-based acquisitions avoid cash burn and preserve operational liquidity.

Market analysts note the AI partnership component. It signals convergence between artificial intelligence and blockchain infrastructure. This could drive long-term utility demand beyond speculative trading.

The TIRX move is a structural alpha play. It acquires Bitcoin at a 30% discount to the 2025 all-time high. This is classic contrarian accumulation during maximum fear. The share swap mechanism is innovative—it avoids dilution pressure while securing a hard asset treasury.

—CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook remains constructive. Public company Bitcoin holdings could grow to 15% of supply by 2027. This creates a structural supply shock. Long-term, it supports a 5-year horizon price target above $150,000 based on stock-to-flow model extensions.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.