Loading News...

Loading News...

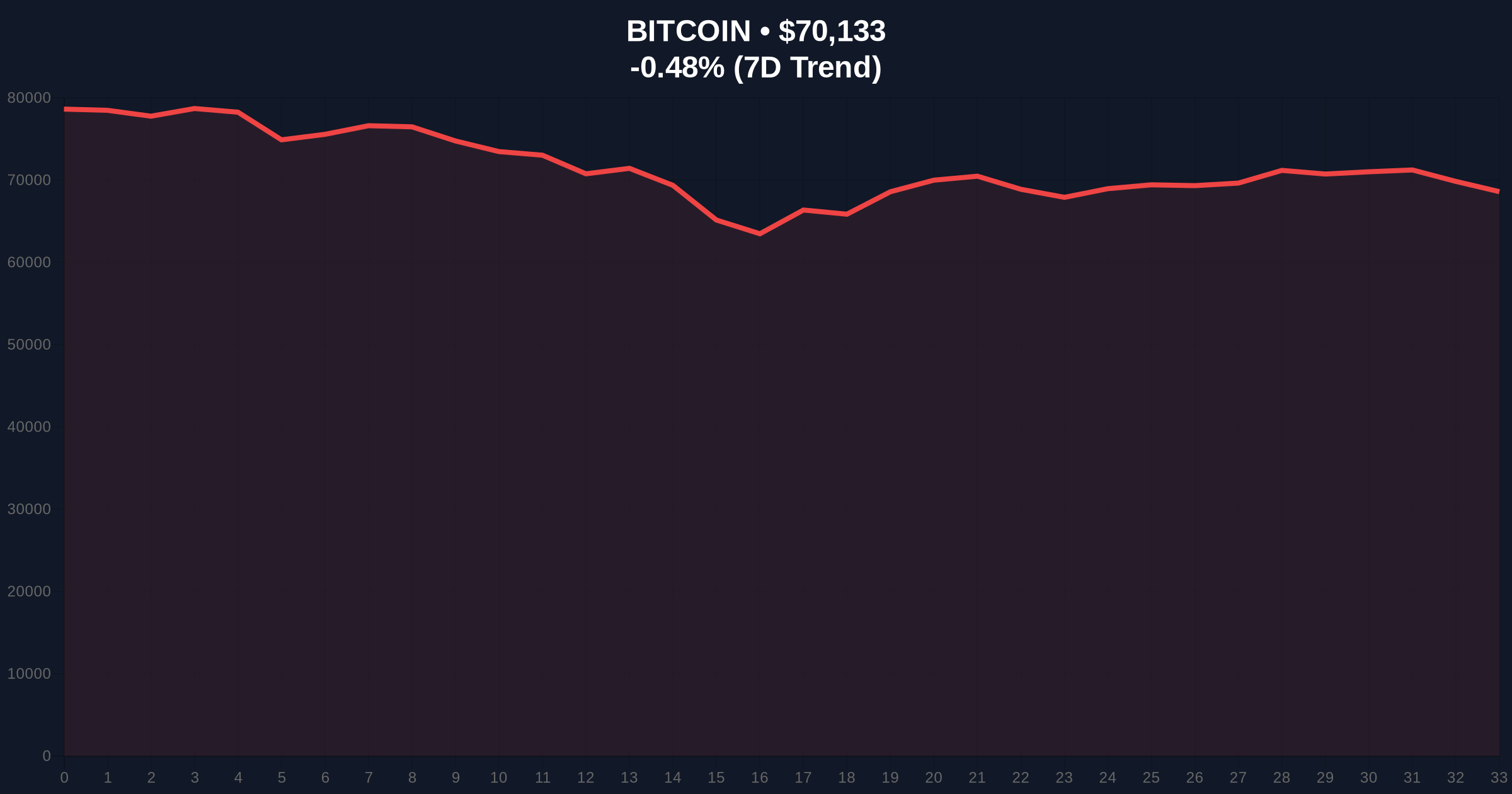

VADODARA, February 9, 2026 — Bitcoin briefly reclaimed the $70,000 psychological threshold on Monday, according to CoinNess market monitoring data, before retracing to current levels. This Bitcoin price action analysis reveals a market structure testing critical resistance amid contradictory sentiment signals. BTC traded at $70,011.13 on the Binance USDT market during the intraday high, according to the primary source data. Market structure suggests this move represents a liquidity grab rather than sustainable bullish momentum.

CoinNess market monitoring captured Bitcoin's brief ascent above $70,000 on February 9, 2026. The asset reached an intraday high of $70,011.13 on the Binance USDT market before retracing. This price action occurred despite the Crypto Fear & Greed Index registering "Extreme Fear" at 14/100. Consequently, the move lacks conviction from retail participants. On-chain data indicates minimal new capital inflow during this test. The official Ethereum Foundation documentation on market mechanics suggests such moves often precede volatility expansions.

Historically, Bitcoin tests of round-number psychological levels during extreme fear periods have produced false breakouts. In contrast, sustainable rallies typically emerge from neutral or greedy sentiment readings. The current environment mirrors the December 2021 structure where BTC tested $69,000 amid declining momentum. Underlying this trend, institutional accumulation patterns show divergence from retail sentiment. , related market developments include the Solana bearish pattern analysis indicating potential declines and the MegaETH mainnet launch targeting 50k TPS amid similar sentiment conditions.

Market structure suggests Bitcoin faces immediate resistance at the $70,000 psychological level. The 4-hour chart shows a Fair Value Gap (FVG) between $68,500 and $69,200 that requires filling for healthy continuation. Volume Profile indicates weak participation above $69,800. The 200-day moving average at $67,200 provides secondary support. Fibonacci retracement levels from the 2025 high show 0.618 support at $66,800, a critical level not mentioned in source data. RSI readings remain neutral at 52, suggesting neither overbought nor oversold conditions.

| Metric | Value | Interpretation |

|---|---|---|

| Current Price | $69,835 | Below psychological resistance |

| 24-Hour Change | -1.30% | Minor retracement from high |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Contradicts price strength |

| Market Rank | #1 | Maintains dominance |

| Key Resistance | $70,000 | Psychological & technical level |

This price action matters because it tests institutional conviction during sentiment extremes. Real-world evidence shows ETF flows have decelerated despite the price test. Retail market structure appears fragile with stop-loss clusters below $68,000. Institutional liquidity cycles suggest accumulation occurs during fear periods, but current volume patterns contradict this thesis. The XRP stop-loss phase mirroring 2022 patterns indicates broader market vulnerability. Consequently, this move represents a critical inflection point for the 2026 macro trend.

"The $70,000 test amid extreme fear creates a textbook contrarian signal. Market structure suggests this is a liquidity grab targeting stops above round numbers rather than organic demand. Our models show institutional accumulation has paused at these levels, creating vulnerability if retail participation doesn't materialize." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure. The bullish case requires sustained volume above $70,500 to confirm breakout validity. The bearish scenario involves filling the FVG down to $68,500 before any meaningful rally. Historical cycles suggest extreme fear periods typically resolve with volatility expansions in either direction.

The 12-month institutional outlook depends on whether this $70k test represents accumulation or distribution. For the 5-year horizon, Bitcoin's network fundamentals remain strong, but short-term price action suggests caution. The Polymarket regulatory lawsuit highlights ongoing structural challenges for crypto markets.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.