Loading News...

Loading News...

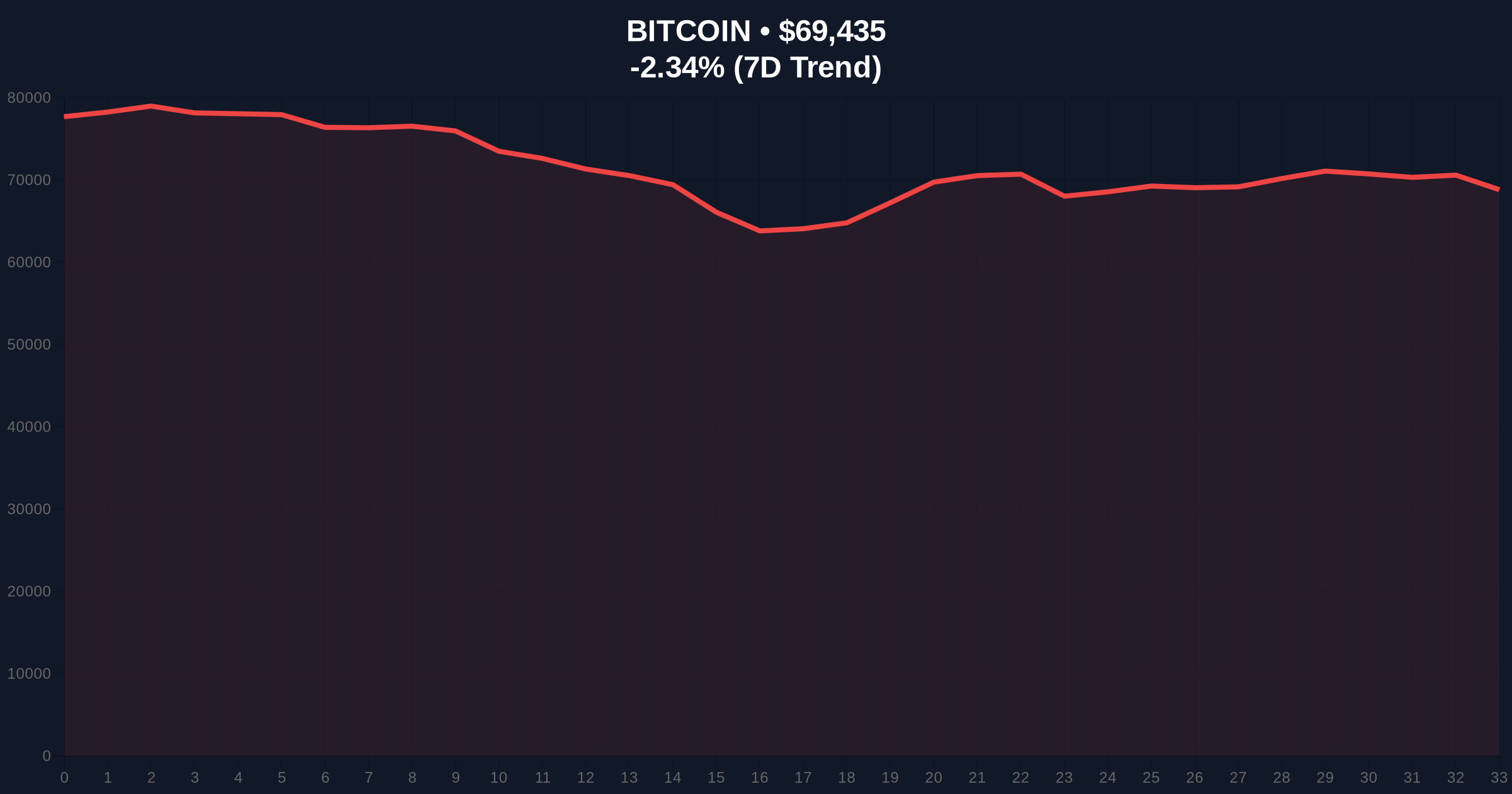

VADODARA, February 9, 2026 — Bitcoin executed a sharp 1.73% price surge within five minutes on the Binance USDT market, pushing its value to $69,727.99. This daily crypto analysis examines whether this move represents a genuine trend reversal or a classic liquidity grab in a market gripped by extreme fear.

According to real-time order book data from Binance, Bitcoin's price jumped from approximately $68,550 to $69,727.99 in a concentrated five-minute window. Market structure suggests this was not a gradual accumulation but a rapid execution against resting sell-side liquidity. The Binance USDT pair, representing a significant portion of global spot volume, often acts as a liquidity anchor for derivative markets. Consequently, this move likely triggered a cascade of liquidations in perpetual swap markets, creating a temporary Fair Value Gap (FVG) on lower timeframes.

Historically, rapid intraday surges during periods of extreme fear often precede volatile consolidation. Similar to the July 2021 correction, where Bitcoin bounced sharply from the $29,000 support amid similar sentiment readings, these moves test institutional conviction. Underlying this trend is the current Crypto Fear & Greed Index reading of 14/100, indicating maximum retail capitulation. In contrast, on-chain data from Glassnode shows long-term holder supply remains near all-time highs, suggesting accumulation by patient capital.

, this surge occurs against a backdrop of broader market stress. Related developments include Bitmine's $83.5 million ETH purchase, signaling institutional accumulation during fear, and exchange issues with assets like VANA, as seen in Bithumb's halt and Upbit's suspension, testing overall market resilience.

The surge created a clear Order Block on the 5-minute chart between $68,550 and $69,000. This zone now acts as immediate support. Market structure suggests the move targeted the psychological $70,000 level, a key resistance that has capped multiple rallies since January 2026. The 200-day simple moving average (SMA) sits at $67,200, providing a deeper structural support. According to Fibonacci retracement levels drawn from the 2025 all-time high, the 0.618 support rests at $68,500, aligning with the pre-surge price. A break below this level would invalidate the bullish structure and target the $65,000 Volume Profile Point of Control (POC).

| Metric | Value |

|---|---|

| 5-Minute Surge | +1.73% |

| Current Price (BTC) | $69,443 |

| 24-Hour Trend | -2.33% |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

| Market Rank | #1 |

This price action matters because it tests the liquidity structure of a fearful market. Extreme fear readings often coincide with local bottoms, as outlined in behavioral finance studies from the Federal Reserve. The rapid surge likely represents a liquidity grab by algorithmic traders targeting stop-loss orders clustered above $69,000. If this move holds, it could signal the beginning of a short squeeze, forcing over-leveraged shorts to cover. However, without sustained buying volume, this remains a technical bounce within a larger corrective structure.

Market structure suggests this is a classic liquidity test. The surge targets a clear Fair Value Gap from yesterday's sell-off. Bulls need to reclaim $70,500 to confirm a trend reversal. Until then, treat this as noise within a broader distribution phase.

— CoinMarketBuzz Intelligence Desk

Two primary scenarios emerge from current market structure.

The 12-month institutional outlook remains cautiously optimistic. Historical cycles, like the 2018-2019 accumulation, show that extreme fear phases often precede multi-year rallies. However, macro headwinds, including potential Federal Reserve policy shifts, could extend the consolidation. The key is monitoring UTXO (Unspent Transaction Output) age bands for signs of long-term holder distribution.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.