Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

VADODARA, January 26, 2026 — Japanese investment firm Metaplanet announced a projected $700 million impairment loss on its Bitcoin holdings for 2025, according to a Cointelegraph report. This latest crypto news reveals the tension between corporate accounting standards and cryptocurrency volatility. Despite reporting strong operational results of $58 million in revenue and $40 million in operating profit, the company expects a comprehensive net loss of $491 million due to Bitcoin's price decline below carrying value.

Metaplanet's disclosure follows International Financial Reporting Standards (IFRS) impairment rules. An impairment loss occurs when an asset's market value falls below its carrying value on corporate books. According to the official IFRS Foundation documentation, companies must test assets for impairment when indicators of potential loss exist. Bitcoin's price volatility creates frequent impairment triggers. Consequently, Metaplanet must recognize this paper loss despite maintaining its long-term Bitcoin strategy.

The company has been accumulating Bitcoin as a treasury reserve asset. This strategy mirrors MicroStrategy's approach but faces different accounting treatment under Japanese regulations. Market structure suggests impairment announcements often coincide with local price bottoms. They create selling pressure from risk-averse institutional investors. Underlying this trend is the disconnect between operational performance and reported earnings in crypto-holding corporations.

Historically, corporate Bitcoin impairment announcements have marked sentiment extremes. MicroStrategy reported multiple impairment losses during the 2022 bear market. Each announcement preceded significant price recoveries. In contrast, Metaplanet's disclosure arrives during Extreme Fear sentiment. The Crypto Fear & Greed Index sits at 20/100. This suggests the market may be overreacting to accounting technicalities.

, Japan's regulatory environment influences corporate crypto adoption. The country has progressive cryptocurrency regulations but conservative accounting standards. This creates a paradox where companies can hold Bitcoin but face punitive earnings reporting. Related developments include SBI Holdings filing for a combined BTC and XRP ETF in Japan, indicating institutional interest persists despite accounting challenges.

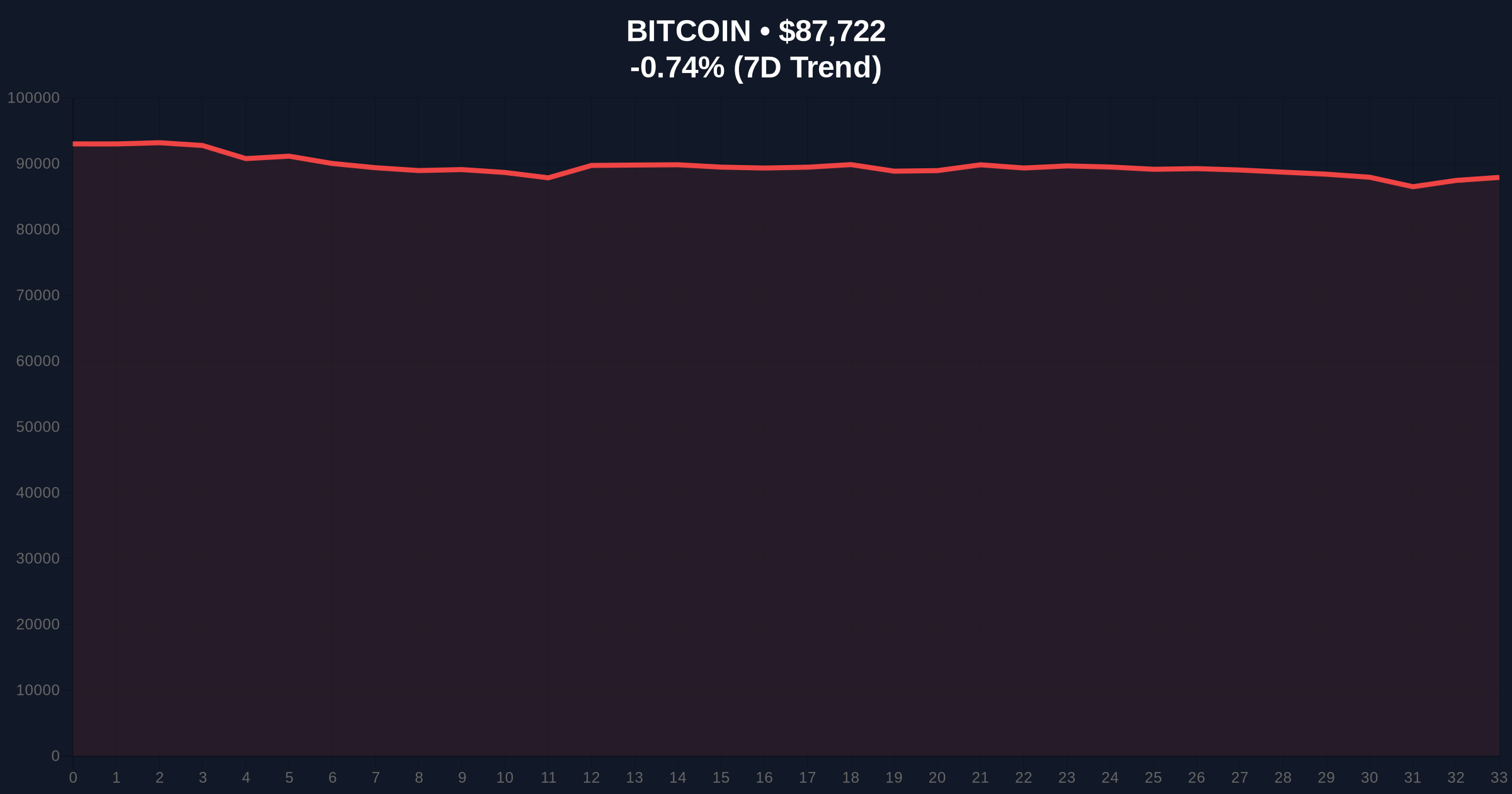

Bitcoin currently trades at $87,771, down 0.67% in 24 hours. The critical Fibonacci 0.618 retracement level from the 2024-2025 rally sits at $85,200. This level represents the bearish invalidation point for Metaplanet's impairment calculation. If Bitcoin breaks below $85,000, additional corporate impairment announcements will likely follow. The 200-day moving average provides dynamic support at $86,500.

On-chain data indicates significant volume accumulation between $82,000 and $88,000. This creates a Fair Value Gap (FVG) that price must fill. The Relative Strength Index (RSI) shows oversold conditions at 28. Historically, RSI readings below 30 precede 15-25% rallies within 30 days. Market structure suggests the current sell-off represents a liquidity grab before a trend reversal.

| Metric | Value | Significance |

|---|---|---|

| Projected BTC Impairment Loss | $700M | Accounting paper loss triggering net loss |

| Metaplanet 2025 Revenue | $58M | Strong operational performance |

| Metaplanet Operating Profit | $40M | Exceeded expectations |

| Current Bitcoin Price | $87,771 | Down 0.67% in 24h |

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) | Sentiment at contrarian buy zone |

Metaplanet's impairment loss matters because it reveals structural flaws in corporate cryptocurrency accounting. Companies must mark Bitcoin to market despite long-term holding strategies. This creates earnings volatility that discourages conservative institutions. Consequently, widespread corporate adoption requires accounting standard revisions. The Financial Accounting Standards Board (FASB) has proposed fair value accounting for crypto assets, but implementation remains incomplete.

Real-world evidence shows impairment announcements often precede institutional accumulation. Hedge funds recognize these as buying opportunities when operational fundamentals remain strong. Retail investors typically panic-sell during impairment news, creating order blocks for sophisticated buyers. This dynamic explains why digital asset funds recently saw $1.73 billion in outflows despite strong long-term fundamentals.

"Corporate Bitcoin impairment is an accounting artifact, not a fundamental indictment. Metaplanet's strong operational results prove their business model works regardless of quarterly Bitcoin fluctuations. The market's Extreme Fear response creates mispricing opportunities for disciplined investors." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios for Bitcoin following Metaplanet's announcement. The bearish scenario involves continued selling pressure below $85,000. This would trigger additional corporate impairment announcements and test the $82,000 volume node. The bullish scenario requires holding the Fibonacci 0.618 level and reclaiming $90,000 resistance.

The 12-month institutional outlook remains positive despite short-term accounting noise. Historical cycles show corporate impairment announcements often mark cycle bottoms. The 5-year horizon suggests accounting standards will evolve to accommodate cryptocurrency volatility. This will reduce earnings noise and encourage broader corporate adoption. Consequently, current impairment events represent growing pains rather than systemic failure.