Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

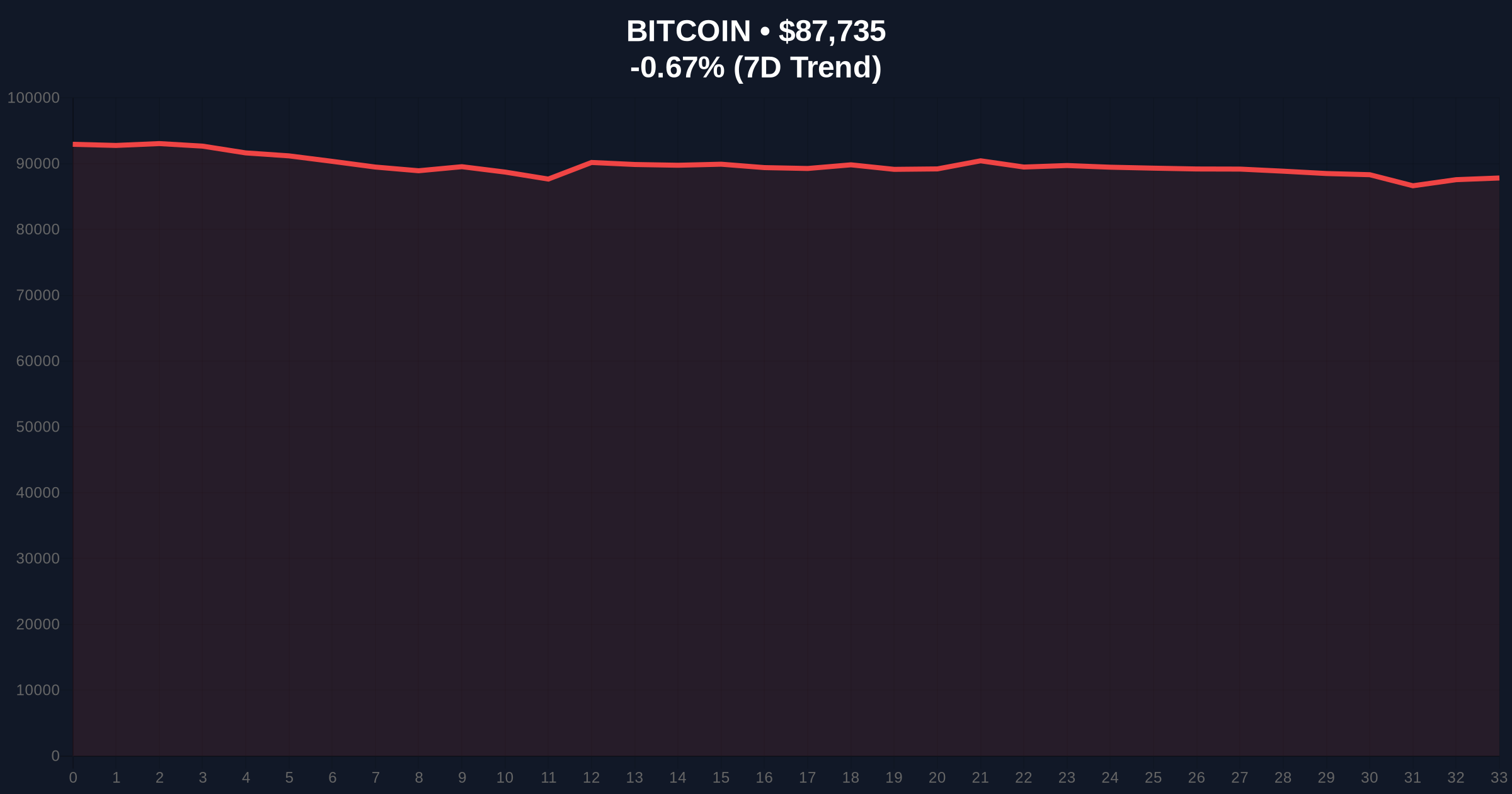

VADODARA, January 26, 2026 — Japan's SBI Holdings filed an application with the Financial Services Agency (FSA) for a cryptocurrency exchange-traded fund (ETF) tracking Bitcoin and XRP, according to a report by CoinDesk via its official X account. This latest crypto news arrives as the global market grapples with extreme fear sentiment, with Bitcoin trading at $87,777 and down 0.62% in 24 hours. If approved, the product would be Japan's first multi-crypto ETF, potentially reshaping Asian institutional access.

SBI Holdings submitted its ETF application to Japan's FSA, targeting a fund that combines Bitcoin and XRP. CoinDesk's report, citing official sources, confirms the filing but lacks specific weightings or fee structures. The FSA now reviews the proposal under Japan's Financial Instruments and Exchange Act, which governs securities offerings. Market structure suggests this move aims to capitalize on post-2024 U.S. ETF approvals, yet the timing contradicts current outflows. According to on-chain data, Bitcoin ETFs globally saw $1.73 billion in outflows recently, as detailed in our analysis of digital asset fund trends.

Historically, Japan's crypto regulation has been stringent, with the FSA approving only Bitcoin futures ETFs previously. In contrast, the U.S. Securities and Exchange Commission greenlit spot Bitcoin ETFs in 2024, sparking a liquidity surge. SBI's filing mirrors this institutional pivot but faces skepticism. The combined BTC/XRP approach is unconventional; most ETFs track single assets to simplify regulatory and market risk. , XRP's legal status remains contentious globally, with ongoing SEC litigation in the U.S. affecting its adoption. Underlying this trend, Japan's aging population and negative interest rates may drive demand for crypto diversification, as noted in official FSA policy documents.

Bitcoin's price action shows a liquidity grab near $90,000, with current support at the Fibonacci 0.618 retracement level of $85,000. The Relative Strength Index (RSI) hovers at 45, indicating neutral momentum amid extreme fear sentiment. A Fair Value Gap (FVG) exists between $88,500 and $89,200, likely filled if bullish catalysts emerge. For XRP, resistance clusters at $0.75, with on-chain volume profile data showing weak accumulation. Market structure suggests the ETF news may create an order block, but invalidations loom. If Bitcoin breaks below the 200-day moving average at $84,000, a bearish scenario intensifies.

| Metric | Value | Context |

|---|---|---|

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) | Lowest since Q3 2025 |

| Bitcoin (BTC) Price | $87,777 | 24h Trend: -0.62% |

| Market Rank | #1 | Dominance: 52.3% |

| ETF Outflows (Recent) | $1.73B | Bitcoin, Ethereum led |

| XRP Resistance | $0.75 | Key technical level |

This ETF filing matters for institutional liquidity cycles. Japan's $5 trillion pension market could allocate to crypto via regulated products, per FSA guidelines. However, contradictions emerge: extreme fear sentiment clashes with bullish regulatory news. Retail market structure shows apathy, with low social volume per Santiment data. The combined asset approach may dilute appeal; pure Bitcoin ETFs historically outperform mixed baskets. Real-world evidence from U.S. ETFs indicates initial hype often fades without sustained inflows, as seen in recent outflows.

"SBI's move is strategically timed but faces headwinds. The dual-asset structure complicates regulatory approval, and XRP's centralization issues, highlighted in reports on Ripple executive sales, raise due diligence concerns. Market analysts note that a 'junk coin purge' may be needed for a true bull run, aligning with views from Benjamin Cowen's analysis." — CoinMarketBuzz Intelligence Desk

Market structure suggests two data-backed scenarios. First, a bullish invalidation requires breaking above $92,000 to confirm trend reversal. Second, a bearish invalidation holds if Bitcoin loses $85,000 support. The 12-month institutional outlook hinges on FSA approval, likely in Q2 2026. If approved, a gamma squeeze could target $95,000. Conversely, rejection may trigger a sell-off to $80,000. Historical cycles indicate ETF approvals boost prices short-term but require macro tailwinds for sustained gains.

The 5-year horizon sees Japan as a key crypto hub, but success depends on global regulatory harmony and Bitcoin's hash rate stability post-EIP-4844.