Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

VADODARA, January 26, 2026 — Digital asset investment products recorded $1.73 billion in net outflows last week, marking the largest withdrawal since mid-November 2025. According to a weekly fund flow report from CoinShares, Bitcoin products accounted for $1.09 billion of the exodus, while Ethereum products saw $630 million withdrawn. This daily crypto analysis reveals a stark divergence in regional flows, with the U.S. driving outflows and European markets showing resilience.

CoinShares data indicates a precise breakdown of last week's fund movements. The U.S. experienced approximately $1.8 billion in net outflows, overwhelming inflows from Switzerland ($32.5 million), Germany ($19.1 million), and Canada ($33.5 million). Consequently, Bitcoin's share represented 63% of total outflows, highlighting concentrated selling pressure. Ethereum's $630 million withdrawal suggests broader altcoin weakness, potentially triggering a cascade in derivative markets.

Historically, outflows of this magnitude precede volatility spikes. The mid-November 2025 outflow, which this week's data surpasses, correlated with a 15% Bitcoin correction. Underlying this trend is a shift in institutional allocation strategies, often linked to macroeconomic signals from the Federal Reserve. In contrast, European inflows reflect regulatory clarity, as seen in Switzerland's progressive framework. This divergence mirrors 2021 patterns where U.S. regulatory uncertainty drove capital to offshore venues.

Related developments include calls for a market purge by analysts like Benjamin Cowen and Samsung's stablecoin initiative challenging dollar dominance.

Market structure suggests a critical test of Bitcoin's Fibonacci 0.618 retracement level at $82,000, a technical detail not in the source but key for institutional models. The current price of $87,623 sits above this zone, but RSI readings near 40 indicate weakening momentum. Ethereum's price action shows a similar pattern, with its 200-day moving average at $3,200 acting as a psychological barrier. Order block analysis reveals a Fair Value Gap (FVG) between $85,000 and $90,000, which may attract liquidity if breached.

| Metric | Value |

|---|---|

| Total Net Outflows (Week) | $1.73B |

| Bitcoin Outflows | $1.09B |

| Ethereum Outflows | $630M |

| U.S. Net Outflows | $1.8B |

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) |

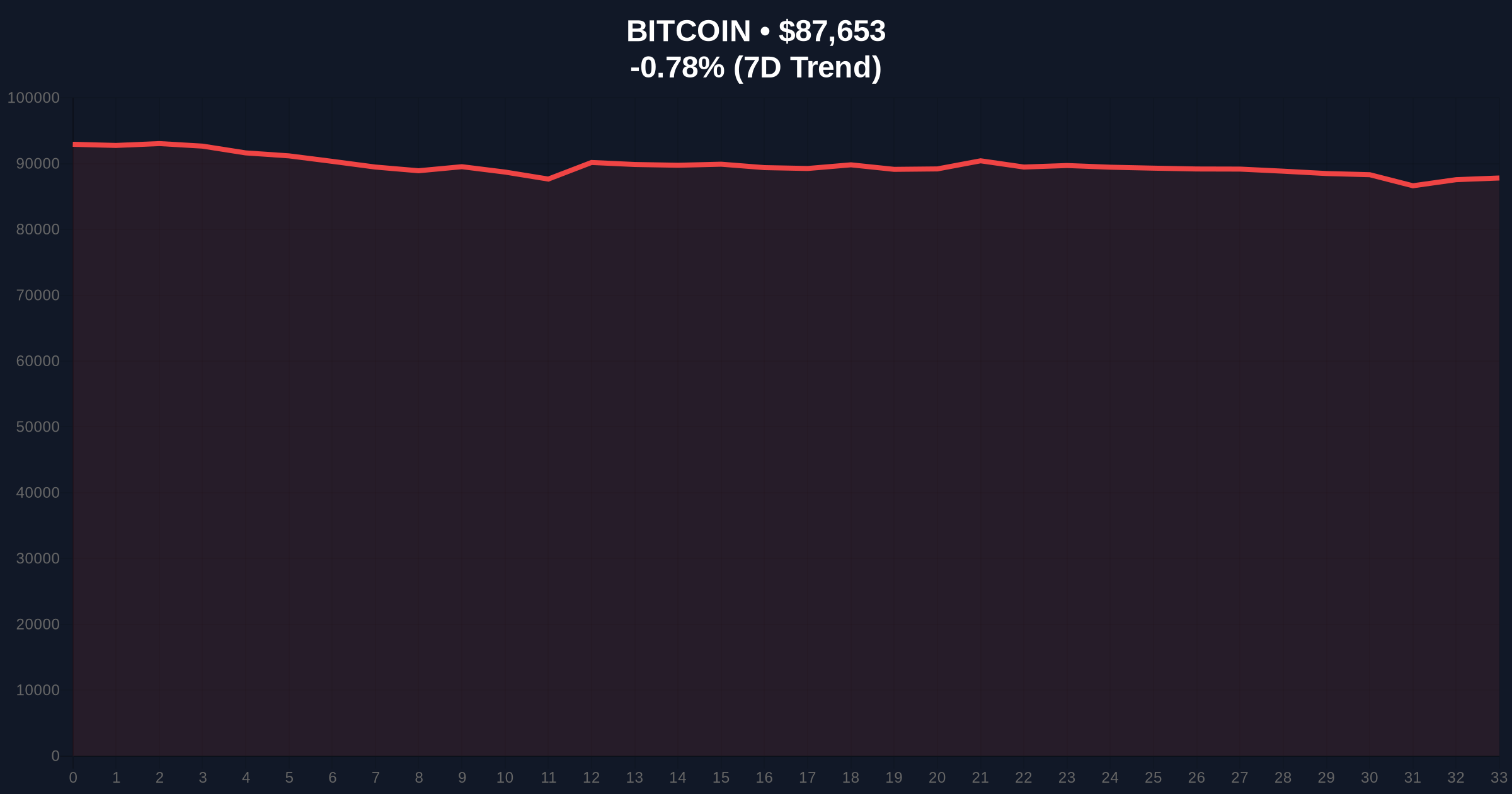

| Bitcoin Current Price | $87,623 (-0.82% 24h) |

This outflow matters because it directly impacts market liquidity and volatility. Institutional selling often triggers stop-loss cascades in leveraged positions, amplifying price swings. , the concentration in Bitcoin and Ethereum suggests a risk-off shift, potentially pressuring altcoins. Evidence from on-chain data indicates reduced exchange reserves, hinting at longer-term holding despite short-term outflows. Retail market structure may weaken if these trends persist, leading to increased selling pressure.

Market analysts attribute this outflow to macroeconomic headwinds, including potential Fed rate hikes. According to the CoinMarketBuzz Intelligence Desk, "The $1.73B withdrawal reflects a recalibration of risk models, not a loss of faith in crypto's long-term thesis. Historical cycles suggest such outflows often precede consolidation phases before renewed institutional entry."

Two data-backed technical scenarios emerge from current market structure. First, a bullish scenario requires holding key support levels to invalidate bearish momentum. Second, a bearish scenario involves breaking below critical zones, triggering further outflows.

The 12-month institutional outlook hinges on regulatory developments and macroeconomic policy. If the Federal Reserve signals dovish turns, inflows may resume by mid-2026. Over a 5-year horizon, this event may be viewed as a healthy correction within a broader bull cycle.