Loading News...

Loading News...

VADODARA, February 9, 2026 — Hong Kong-based blockchain infrastructure firm MATH has executed a strategic pivot into Bitcoin treasury management. According to the company's official announcement, MATH will allocate 20% of its annual net profit to purchasing Bitcoin, completing an initial $1 million acquisition at an average price of $54,000. This latest crypto news highlights a calculated corporate accumulation strategy deployed through proprietary derivative contracts, directly contrasting with prevailing market fear.

MATH deployed its Accumulator financial product for the purchase. This derivative contract facilitates regular acquisitions below spot market rates over predetermined periods. The company completed the transaction on February 9, 2026, sourcing the capital from operational profits. MATH's leadership explicitly stated that Bitcoin represents the foundational asset of the blockchain industry. Consequently, they view strategic accumulation at current valuations as a primary mechanism for enhancing long-term shareholder value. The move establishes a recurring capital allocation model rather than a one-time treasury rebalancing.

This announcement arrives during a period of significant market stress. The Crypto Fear & Greed Index registers 14/100, indicating Extreme Fear. Historically, such sentiment extremes have preceded major accumulation phases by sophisticated players. In contrast, recent headlines have highlighted miner capitulation and derivative selling pressure. For instance, Cango's sale of 4,451 BTC to repay debt exemplifies forced selling. , intensifying derivatives selling pressure ahead of US CPI data adds to the liquidity drain. MATH's programmatic buy-side commitment provides a countervailing force to this narrative.

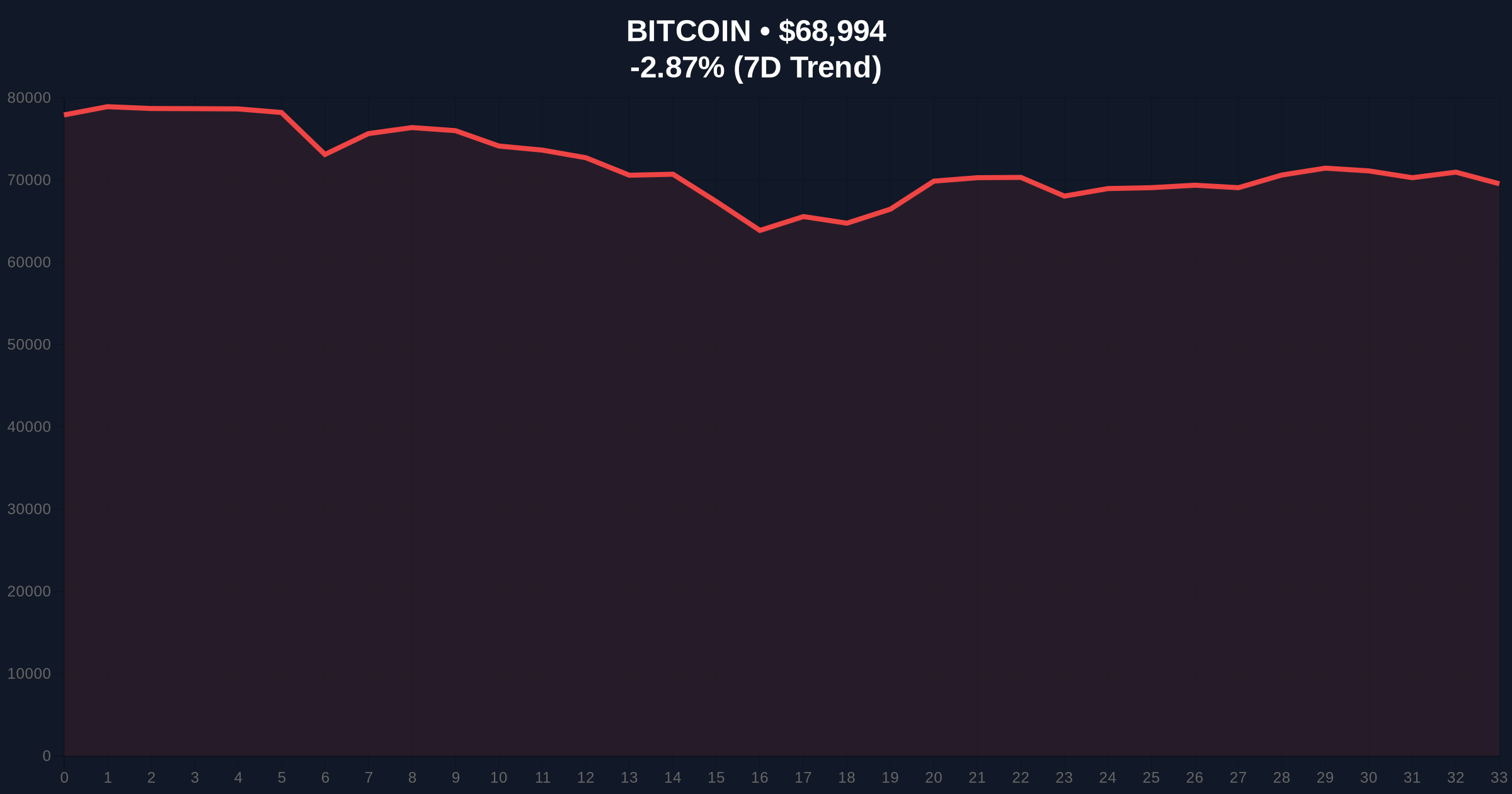

Market structure suggests Bitcoin is testing critical macro support levels. The current price of $68,989 represents a -2.87% decline over 24 hours. A key technical level not mentioned in the source is the Fibonacci 0.618 retracement support near $60,000, drawn from the 2023 low to the 2025 high. This zone coincides with a high-volume node on the Volume Profile, indicating a potential liquidity grab. The 200-week moving average, currently near $58,000, provides additional structural support. MATH's purchase at $54,000 likely targeted a Fair Value Gap (FVG) created during the recent sell-off, demonstrating precise execution.

| Metric | Value | Context |

|---|---|---|

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Contrarian buy signal historically |

| Bitcoin Current Price | $68,989 | #1 by market cap, -2.87% 24h |

| MATH Initial Purchase Price | $54,000 (avg) | Executed via Accumulator derivative |

| MATH Allocation Commitment | 20% of annual net profit | Recurring treasury strategy |

| Key Fibonacci Support | $60,000 (0.618 level) | Critical macro liquidity zone |

This move matters because it institutionalizes Bitcoin accumulation within a corporate financial framework. MATH is not speculating; it is executing a defined capital allocation policy. Underlying this trend is a broader shift where blockchain-native firms use their profits to back their core technological belief. This creates a reflexive feedback loop: company success fuels Bitcoin demand, potentially increasing Bitcoin's value and, consequently, the value of the company's treasury. It directly counters the narrative of impending miner exodus and CPI-driven retests. For evidence of parallel institutional adoption, one can review the SEC's archived filings on corporate treasury disclosures, which show a growing trend.

"MATH's strategy is quantitatively disciplined. Allocating a fixed percentage of profit removes emotion from the buying decision. Using a derivative like the Accumulator to secure prices below market is a sophisticated hedge against volatility. This is not a retail FOMO trade; it's a corporate treasury operation built for multi-year horizons. It signals to the market that foundational value accumulation is prioritized over short-term price gyrations," stated the CoinMarketBuzz Intelligence Desk.

Market structure suggests two primary scenarios based on the interaction of corporate accumulation and macro sell-pressure.

The 12-month outlook hinges on whether disciplined accumulation from entities like MATH can offset forced selling from miners and leveraged traders. If the $60,000 support holds, it could form a powerful Order Block for the next leg up. Over a 5-year horizon, such corporate adoption protocols could significantly reduce Bitcoin's circulating supply, applying structural upward pressure on price.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.