Loading News...

Loading News...

VADODARA, February 9, 2026 — NYSE-listed Bitcoin miner Cango executed a massive 4,451 BTC liquidation over the weekend. The sale generated $305 million in proceeds. According to the company's official statement, all funds went toward repaying BTC-collateralized loans. This latest crypto news highlights mounting pressure on mining operations amid Bitcoin's price decline.

Cango (NYSE: CANG) confirmed the transaction in a regulatory filing. The miner sold its entire Bitcoin position. Proceeds directly serviced outstanding debt. Market structure suggests this was a forced liquidity grab. The sale occurred during weekend thin liquidity. This amplified downward price pressure.

Company executives cited strategic restructuring. Cango aims to transition into AI computing infrastructure. The Bitcoin sale funds this pivot. Consequently, the mining firm exits its core BTC treasury position entirely. This mirrors actions seen during previous bear market cycles.

Historically, miner capitulation signals local bottoms. The 2022 cycle saw similar large-scale liquidations. Companies like Core Scientific and Compute North faced identical pressures. They sold BTC holdings to manage debt obligations. Bitcoin's price subsequently found support at macro lows.

In contrast, current conditions differ. The Federal Reserve maintains restrictive monetary policy. High interest rates increase borrowing costs for leveraged miners. According to data from the Federal Reserve's H.8 report, commercial bank lending to businesses remains tight. This squeezes miners' access to refinancing options.

, Bitcoin's hash rate faces downward pressure. Miner revenue declines as transaction fees normalize post-halving. The network's difficulty adjustment may provide temporary relief. However, sustained price weakness could trigger more forced selling.

Related Developments:

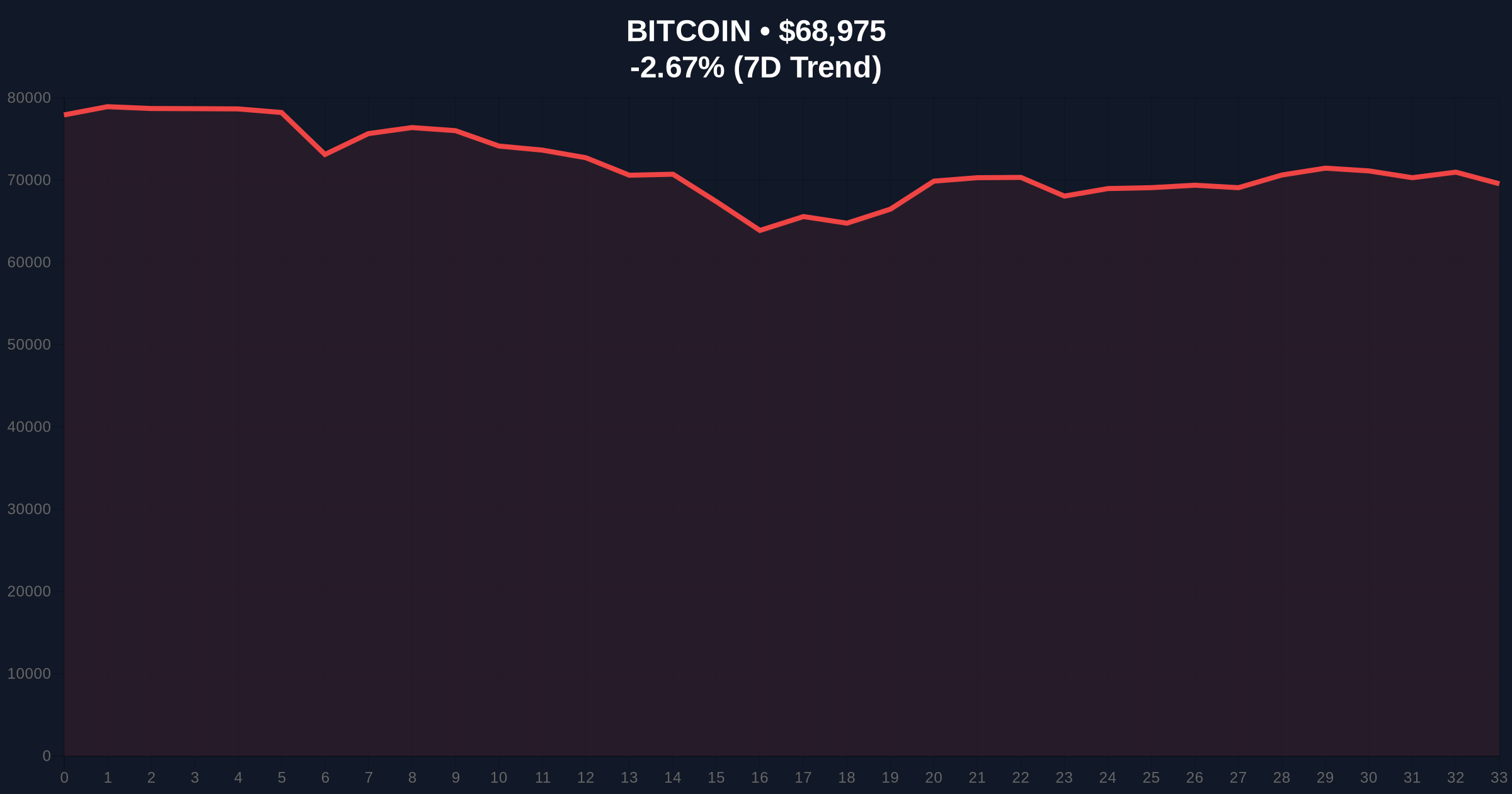

Bitcoin currently trades at $68,956. The 24-hour trend shows a -2.53% decline. Market structure broke below the 50-day exponential moving average. This creates a bearish Fair Value Gap (FVG) between $71,200 and $73,800.

Critical support resides at the Fibonacci 0.618 retracement level of $65,200. This level aligns with the 200-day simple moving average. A breakdown here would invalidate the current bullish market structure. Resistance forms at the previous order block near $72,500.

On-chain data from Glassnode indicates rising exchange inflows. The Miner Position Index (MPI) shows increased selling pressure. Miner reserves have declined by approximately 15,000 BTC over the past month. This confirms the capitulation narrative.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

| Bitcoin Current Price | $68,956 |

| 24-Hour Price Change | -2.53% |

| BTC Sold by Cango | 4,451 BTC |

| Proceeds from Sale | $305 Million |

Miner selling directly impacts market liquidity. Large block sales create immediate supply overhangs. This exacerbates downward momentum during weak sentiment periods. Institutional investors monitor miner behavior closely. Capitulation events often precede accumulation phases.

The transition to AI infrastructure reflects broader industry trends. Companies seek diversified revenue streams beyond pure mining. However, forced liquidations damage balance sheets. They reduce future Bitcoin exposure during potential price recoveries.

"Miner capitulation typically marks cyclical lows. The scale of Cango's liquidation suggests debt pressures are mounting across the sector. Market participants should watch for follow-on selling from other leveraged miners. The $65,200 Fibonacci level becomes critical for maintaining structural integrity." — CoinMarketBuzz Intelligence Desk

Two primary scenarios emerge from current market structure.

The 12-month outlook remains cautiously optimistic. Historical cycles show miner capitulation precedes strong recoveries. However, macroeconomic headwinds persist. The Federal Reserve's policy trajectory will influence institutional capital flows. Bitcoin's long-term adoption thesis remains intact despite near-term volatility.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.