Loading News...

Loading News...

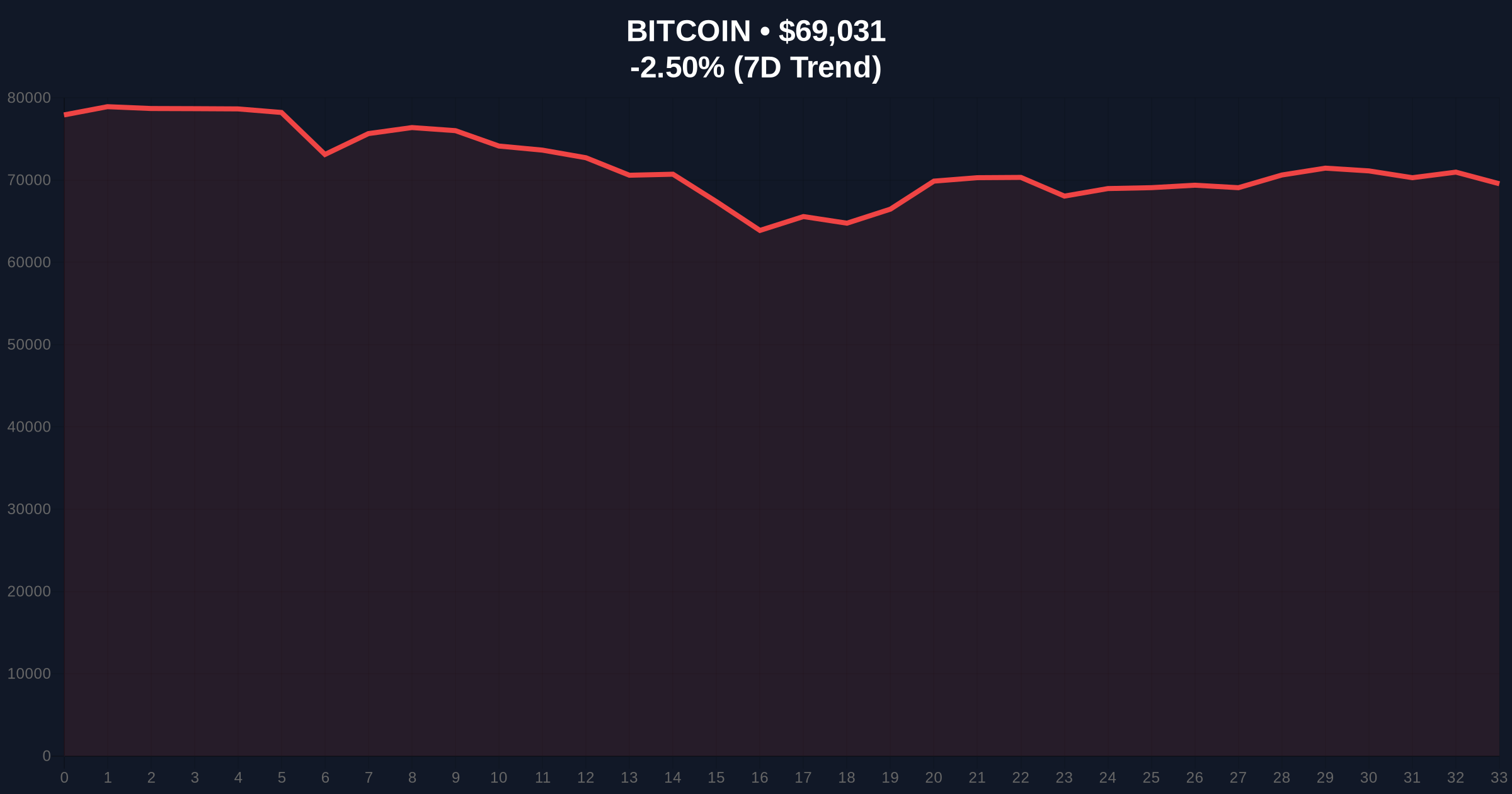

VADODARA, February 9, 2026 — Bitcoin faces accelerating selling pressure in derivatives markets as traders position defensively ahead of critical US macroeconomic data releases. According to CryptoQuant analyst Darkfost, the monthly average market order buy volume in futures markets has turned negative, reversing a brief bullish period from November to January. Market structure suggests futures trading now dominates price action, creating an unstable foundation for the recent rebound.

On-chain data from CryptoQuant reveals a sharp deterioration in derivatives market sentiment. The monthly average market order buy volume has turned negative, indicating sustained selling pressure. Binance's market buy-to-sell ratio has declined from 1 to 0.97, confirming the shift toward seller dominance. Darkfost's analysis indicates this trend is accelerating, requiring significantly stronger spot demand to reverse. Current spot trading volumes and ETF inflows appear insufficient to counter futures-driven momentum.

Market analysts attribute this shift to positioning ahead of US macroeconomic releases. The January non-farm payrolls and unemployment rate data arrive on February 11, followed by the Consumer Price Index (CPI) on February 13. These events historically trigger volatility in risk assets, particularly when Federal Reserve policy expectations are in flux. Consequently, derivatives traders are reducing exposure to avoid potential liquidation events.

Historically, Bitcoin has shown heightened sensitivity to US inflation data during periods of monetary policy uncertainty. The current environment mirrors the 2022-2023 cycle when CPI prints above expectations triggered cascading liquidations across leveraged positions. In contrast, the brief November-January bullish period coincided with declining inflation expectations and stable Fed commentary.

Underlying this trend is a fundamental shift in market structure. Spot ETF inflows, while positive, have failed to offset derivatives market dominance. This creates a fragile equilibrium where price movements amplify through futures liquidations rather than organic spot accumulation. Related developments include analysis of Bitcoin's potential retest of $60K amid similar macroeconomic pressures and Bernstein's $150K target facing extreme fear sentiment.

Technical analysis reveals critical support and resistance levels shaping current price action. Bitcoin currently trades at $69,043, representing a 24-hour decline of 2.48%. The Relative Strength Index (RSI) on daily timeframes approaches oversold territory, but derivatives selling pressure may override traditional momentum signals. A key Fibonacci retracement level at $67,200 (0.618 from the recent swing high) serves as critical support.

Market structure suggests the presence of a Fair Value Gap (FVG) between $71,500 and $73,200 created during the recent rebound. This gap represents an imbalance that price may revisit to fill liquidity. The 50-day moving average at $70,800 acts as immediate resistance, while the 200-day moving average at $65,400 provides longer-term structural support. Volume profile analysis indicates thin trading at current levels, increasing susceptibility to sharp moves.

| Metric | Value | Interpretation |

|---|---|---|

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Historically contrarian buy signal |

| Bitcoin Current Price | $69,043 | -2.48% 24h change |

| Binance Buy/Sell Ratio | 0.97 | Seller dominance confirmed |

| Fibonacci 0.618 Support | $67,200 | Critical technical level |

| Monthly Futures Buy Volume | Negative | Sustained selling pressure |

This derivatives-driven selling pressure matters because it exposes structural weaknesses in Bitcoin's current market architecture. When futures markets dominate price discovery, volatility amplifies through liquidation cascades rather than organic supply-demand dynamics. Institutional liquidity cycles typically follow spot accumulation patterns, but current data suggests speculative positioning precedes fundamental flows.

Retail market structure appears particularly vulnerable. High leverage ratios in derivatives markets create gamma squeeze potential during volatile CPI reactions. , the disconnect between spot ETF inflows and futures sentiment indicates institutional caution despite retail speculation. This divergence often precedes corrective phases as seen in Q2 2024 when similar dynamics triggered a 15% correction.

"The derivatives market structure creates a feedback loop where selling begets more selling through liquidations. Current spot volumes cannot absorb this pressure without significant institutional buying, which appears hesitant ahead of CPI data. Market participants should monitor liquidation clusters around $67,000 and $72,000 as potential acceleration points." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary technical scenarios based on CPI outcomes and derivatives positioning.

The 12-month institutional outlook remains cautiously optimistic despite near-term headwinds. Historical cycles suggest Extreme Fear readings often precede significant rallies once macroeconomic uncertainty resolves. However, the 5-year horizon depends on Bitcoin's ability to decouple from traditional risk assets, which currently appears limited based on correlation metrics. Institutional adoption through ETP listings in regulated markets provides a counterbalancing force to derivatives volatility.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.