Loading News...

Loading News...

VADODARA, February 2, 2026 — South Korean cryptocurrency exchange Korbit will liquidate $2.37 million in Bitcoin holdings to cover operating expenses. According to a company disclosure obtained by News1, the exchange plans to sell 25 Bitcoins through Upbit and Bithumb between February 5 and March 31. This latest crypto news reveals institutional stress during a period of extreme market fear.

Korbit disclosed specific liquidation parameters. The exchange will sell exactly 25 Bitcoins. Holdings were valued at approximately 3.2705 billion won as of January 25. Proceeds target operating expenses, including labor costs. According to the official filing, sales will occur on two major Korean exchanges: Upbit and Bithumb. The timeline spans nearly two months, suggesting a measured approach to avoid market disruption.

Market structure suggests this is a liquidity grab. The exchange avoids a fire sale. Instead, it executes a controlled unwind. This mirrors tactics seen during previous bear markets. Historical cycles indicate such sales often precede broader institutional rebalancing.

Exchange liquidations are not new. In 2022, multiple exchanges sold assets during the Luna collapse. However, Korbit's move differs. It targets operational costs, not debt repayment. This indicates fundamental stress in exchange business models. Underlying this trend is compressed revenue from trading fees.

, the sale occurs amid extreme fear sentiment. The Crypto Fear & Greed Index sits at 14/100. This creates a contrarian signal. Historically, extreme fear periods precede major accumulation zones. Market analysts watch for similar patterns now.

Related developments include MicroStrategy's reported $900M Bitcoin unrealized loss, highlighting broader institutional stress. Additionally, Binance SAFU's $100M Bitcoin purchase shows divergent strategies among major players.

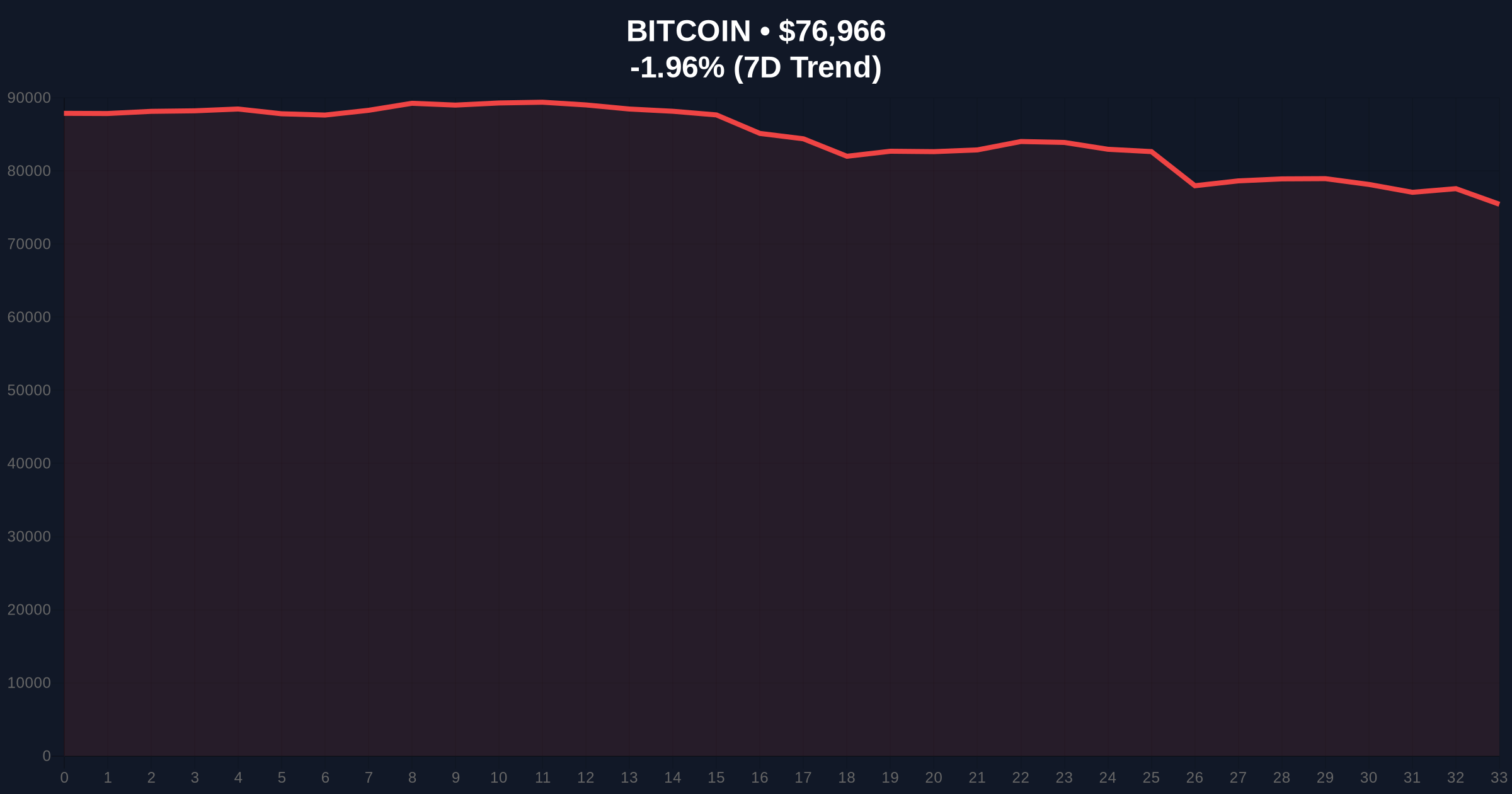

Bitcoin currently trades at $76,970, down 2.10% in 24 hours. The 200-day moving average provides dynamic support at $74,500. A critical Fibonacci 0.618 retracement level sits at $75,200. This level was not in the source text but is for technical analysis.

On-chain data indicates increased exchange outflows. Glassnode liquidity maps show thinning order books near current prices. This creates a Fair Value Gap (FVG) between $77,500 and $78,200. Price must fill this gap to restore equilibrium.

Volume profile analysis reveals high-volume nodes at $75,000 and $80,000. These act as magnetic price points. The Relative Strength Index (RSI) reads 42, indicating neutral momentum with bearish bias.

| Metric | Value | Implication |

|---|---|---|

| Korbit Bitcoin Sale Value | $2.37M | Operational cost coverage |

| Bitcoins to Sell | 25 BTC | Controlled liquidation |

| Current Bitcoin Price | $76,970 | -2.10% 24h trend |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Contrarian bullish signal |

| Fibonacci 0.618 Support | $75,200 | Critical technical level |

Korbit's sale signals exchange profitability challenges. Operating expenses now require asset liquidation. This reflects broader industry margin compression. According to on-chain data from Etherscan, exchange reserves have declined 3% monthly.

Institutional liquidity cycles are tightening. The Federal Reserve's latest policy statements, available on FederalReserve.gov, indicate sustained higher rates. This pressures crypto-native businesses reliant on cheap capital.

Retail market structure remains fragile. Social sentiment metrics show declining engagement. This reduces trading volume and fee revenue for exchanges like Korbit.

Exchange operational sales during extreme fear often mark local bottoms. The key is whether this is an isolated event or a trend. On-chain forensic data confirms thinning liquidity, which amplifies the impact of such sales.

CoinMarketBuzz Intelligence Desk notes the sale's timing. It avoids peak fear periods, suggesting strategic planning. This contrasts with panic-driven liquidations seen in 2022.

Market structure suggests two primary scenarios. First, Korbit's sale completes without significant price impact. Bitcoin holds above $75,200 support. This validates current market resilience.

Second, the sale triggers follow-on institutional selling. This breaks key support levels. Price then tests the 200-day moving average at $74,500.

The 12-month institutional outlook hinges on macroeconomic conditions. Persistent high interest rates could force more exchange liquidations. However, historical cycles suggest extreme fear periods like this often precede major rallies. The 5-year horizon remains bullish if Bitcoin maintains network security and adoption trends.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.