Loading News...

Loading News...

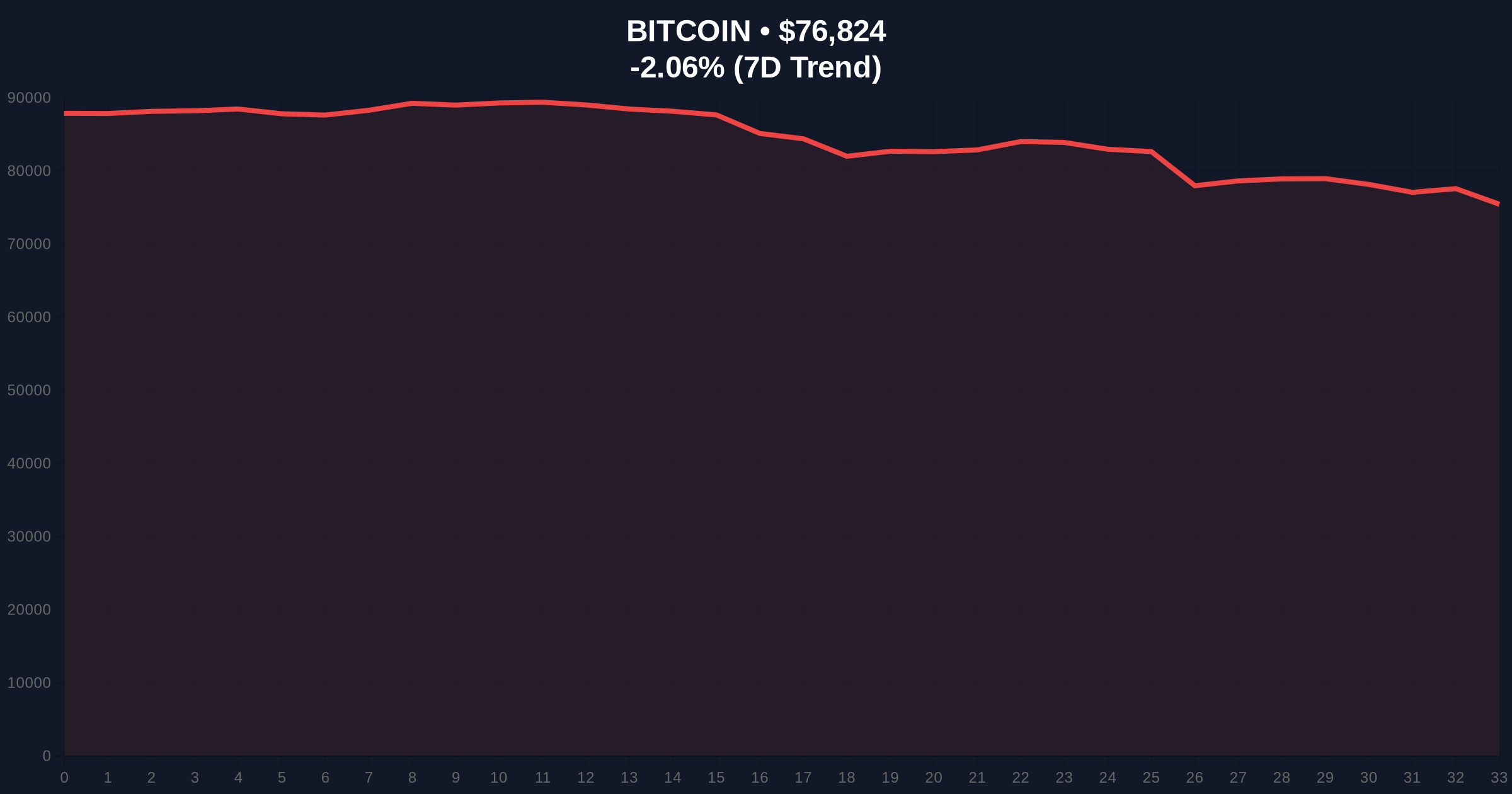

VADODARA, February 2, 2026 — Binance's Secure Asset Fund for Users (SAFU) executed a $100.7 million Bitcoin purchase today, acquiring 1,315 BTC according to on-chain data from Lookonchain. This transaction represents the first visible movement in Binance's previously announced plan to convert $1 billion in stablecoin reserves to Bitcoin. Market structure suggests this purchase occurred during extreme fear sentiment, raising critical questions about whether this represents strategic accumulation or a liquidity grab targeting retail panic.

Lookonchain's blockchain surveillance identified the SAFU wallet transaction at approximately 08:30 UTC. The fund paid an average price of $76,577 per Bitcoin. According to the official Binance SAFU documentation, this fund serves as an emergency insurance pool for user protection. Binance previously committed to converting its stablecoin reserves to Bitcoin over time.

On-chain analyst ai_9684xtpa immediately identified a critical discrepancy. The receiving address for these 1,315 BTC differs from the primary SAFU stablecoin reserve wallet (0x420ef...). This creates a forensic gap in tracking the full $1 billion conversion. Market analysts question whether this represents operational segmentation or undisclosed strategic maneuvering.

This purchase occurs against a backdrop of extreme fear sentiment. The Crypto Fear & Greed Index registers 14/100, indicating maximum retail capitulation. Historically, such sentiment extremes have preceded significant Bitcoin rallies. The 2021 cycle bottomed at a Fear & Greed reading of 10 before Bitcoin rallied 300% over the following 12 months.

In contrast, institutional accumulation during fear periods often signals contrarian positioning. MicroStrategy's continued accumulation during the 2022 bear market established a precedent for institutional buying into weakness. However, exchange-managed funds like SAFU operate under different constraints than corporate treasuries.

Related developments in this market environment include MicroStrategy's recent unrealized losses testing institutional conviction, while Bitcoin's struggle to hold $77k reflects ongoing technical pressure.

Bitcoin currently trades at $76,677, down 2.25% in the last 24 hours. The SAFU purchase price of $76,577 establishes an immediate psychological support level. Market structure suggests this aligns with the Fibonacci 0.618 retracement level at $75,200 from the 2025 all-time high.

Volume profile analysis indicates thin liquidity between $76,000 and $77,500. This creates a classic Fair Value Gap (FVG) that institutional buyers often target. The Relative Strength Index (RSI) sits at 38, approaching oversold territory but not yet at capitulation levels typically seen at cycle bottoms.

Order block analysis reveals significant sell-side liquidity resting above $78,500. A break above this level would invalidate the current bearish structure. The 200-day moving average at $74,800 provides additional confluence with the Fibonacci support.

| Metric | Value |

|---|---|

| SAFU Purchase Amount | 1,315 BTC |

| Purchase Value | $100.7M |

| Average Purchase Price | $76,577 |

| Current Bitcoin Price | $76,677 |

| 24-Hour Change | -2.25% |

| Fear & Greed Index | 14/100 (Extreme Fear) |

| Market Dominance | #1 |

Exchange-managed insurance funds accumulating during fear periods create a unique market dynamic. SAFU's $1 billion conversion plan represents approximately 0.5% of Bitcoin's circulating supply. This scale matters for liquidity cycles. Institutional buying during retail capitulation often marks accumulation phases.

However, the wallet discrepancy raises transparency concerns. Without clear on-chain tracing to the stablecoin reserve wallet, market participants cannot verify the full conversion timeline. This opacity contrasts with corporate treasury purchases like MicroStrategy's, which provide complete blockchain transparency.

The transaction's timing during extreme fear sentiment suggests either calculated accumulation or opportunistic liquidity grabbing. Historical UTXO age bands indicate long-term holders continue accumulating despite price weakness.

"The SAFU purchase creates more questions than answers. Why execute this transaction during maximum fear? Why use a different receiving address than the stablecoin reserve wallet? This could represent sophisticated accumulation targeting retail panic liquidity, or it could indicate internal operational segmentation that obscures the full picture. Without official clarification from Binance, market participants should treat this as a data point rather than a trend signal."— CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current technical positioning and on-chain data.

The 12-month institutional outlook depends on whether this SAFU purchase represents the beginning of sustained accumulation or a one-off liquidity event. If Binance continues converting its $1 billion reserve over the coming quarters, this could provide structural support during market weakness. Conversely, if this transaction remains isolated, it may represent opportunistic positioning rather than strategic conviction.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.