Loading News...

Loading News...

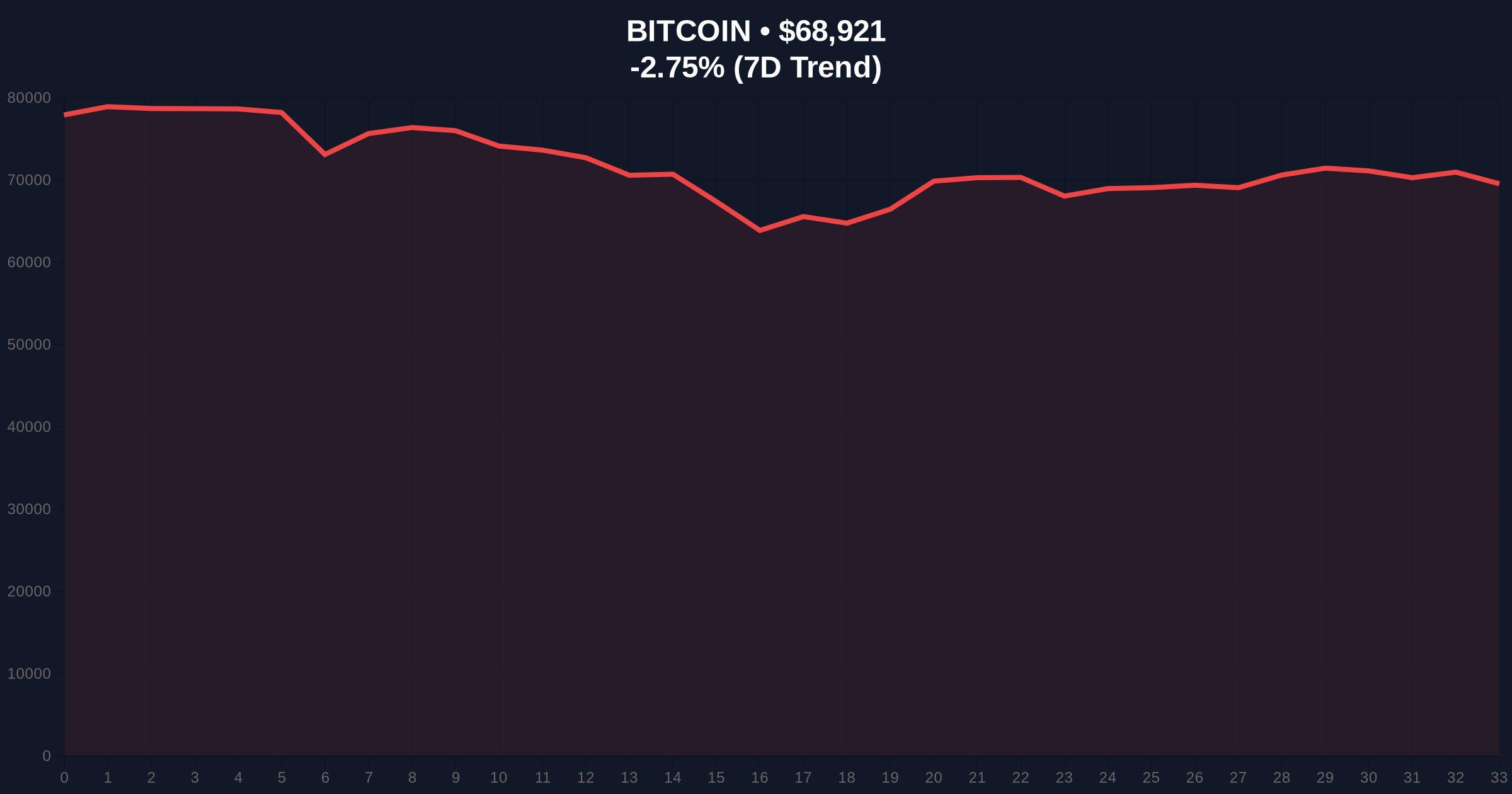

VADODARA, February 9, 2026 — Bitcoin whales holding over 1,000 BTC accumulated approximately 40,000 BTC during a recent market downturn, according to Glassnode data cited by Cointelegraph. This daily crypto analysis reveals a strategic liquidity grab by large holders, fueling a 20% rebound from $60,000 to $72,000. The Binance Secure Asset Fund for Users (SAFU) added 4,225 BTC, worth $300 million, amplifying recovery momentum.

Glassnode liquidity maps indicate two distinct whale cohorts drove the accumulation. Addresses holding 1,000 to 10,000 BTC added around 22,000 BTC. Those with 10,000 to 100,000 BTC purchased about 18,000 BTC. Consequently, total whale inflows reached 40,000 BTC during the dip.

Market structure suggests this was a coordinated buy-the-dip event. The Binance SAFU address purchased an additional 4,225 BTC. Its total holdings now stand at 10,455 BTC. This institutional activity created a significant Fair Value Gap (FVG) between $60,000 and $68,000.

Historically, whale accumulation during downturns precedes major rallies. The 2021 cycle saw similar patterns before Bitcoin's all-time high. In contrast, retail sentiment remains in Extreme Fear at 14/100. This divergence often signals a bottoming phase.

Underlying this trend is Bitcoin's post-halving supply shock. Miner issuance has dropped, increasing whale influence. , regulatory clarity around Bitcoin ETFs has bolstered institutional participation. Related developments include increased derivatives selling pressure ahead of US CPI data and converging factors threatening a $60K retest.

On-chain data indicates strong support at the $60,000 level. This aligns with the Fibonacci 0.618 retracement from the 2025 high. The RSI hovered near oversold conditions during accumulation. The 50-day moving average at $70,000 now acts as resistance.

Volume profile shows high buying volume between $60,000 and $65,000. This created a bullish order block. A break above $72,000 would confirm a trend reversal. UTXO age bands reveal long-term holders are not distributing. This reduces sell-side pressure.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 14 (Extreme Fear) |

| Bitcoin Current Price | $68,954 |

| 24-Hour Price Change | -2.70% |

| Whale Accumulation (1,000+ BTC) | 40,000 BTC |

| Binance SAFU Purchase | 4,225 BTC ($300M) |

Whale accumulation impacts market liquidity and price stability. Large holders often act as market makers. Their buying provides a floor during sell-offs. This reduces volatility and attracts institutional capital.

Real-world evidence includes the 20% price rebound. The SAFU purchase adds credibility. It signals exchange confidence in Bitcoin's long-term value. Retail sentiment remains fearful, creating a contrarian opportunity. Market analysts note this pattern often precedes rallies.

"Whale accumulation at key support levels is a classic bullish signal. The 40,000 BTC purchase represents a significant liquidity injection. This suggests smart money is positioning for the next leg up. However, traders must watch the $60,000 invalidation level closely." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios. First, whale support holds, leading to a grind toward $80,000. Second, macroeconomic headwinds break support, triggering a deeper correction.

The 12-month institutional outlook remains positive. Whale accumulation aligns with Bitcoin's 5-year horizon as a digital gold. Regulatory developments, such as those detailed on SEC.gov, will further influence adoption. Expect continued volatility but upward bias.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.