Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

VADODARA, January 22, 2026 — JPMorgan's latest institutional analysis presents a skeptical view of Ethereum's Fusaka upgrade sustainability, creating a critical divergence between on-chain metrics and price action that demands daily crypto analysis. According to the bank's report, while the January 8 upgrade temporarily boosted transaction volume and active addresses, historical patterns suggest this momentum faces structural headwinds from Layer 2 migration and competitive pressure.

Ethereum's upgrade cycle has followed a predictable pattern since the Merge: initial metrics surge followed by gradual normalization. The Fusaka upgrade represents the latest attempt to optimize gas efficiency and transaction throughput, but market structure suggests diminishing returns from sequential hard forks. Historical cycles indicate that post-merge issuance adjustments have created temporary liquidity events rather than sustained network effects. This development occurs alongside other market tests, including the Robinhood SKY listing that challenged exchange liquidity profiles and broader concerns reflected in global liquidity warnings affecting multiple asset classes.

JPMorgan's quantitative team analyzed Ethereum's Fusaka upgrade completion on January 8, 2026. According to their report, the upgrade initially increased mainnet transaction volume by approximately 18% and active addresses by 12% in the subsequent week. However, the bank's analysis notes that similar spikes following previous upgrades like Shanghai and Cancun typically reverted to baseline within 30-45 days. The report specifically cites data showing Layer 2 networks now processing 68% of Ethereum-ecosystem transactions, creating what technical analysts would identify as a structural Fair Value Gap between mainnet utility and valuation. JPMorgan's models suggest this migration pattern could reduce network fee burns by 22-35% annually, potentially increasing ETH supply pressure.

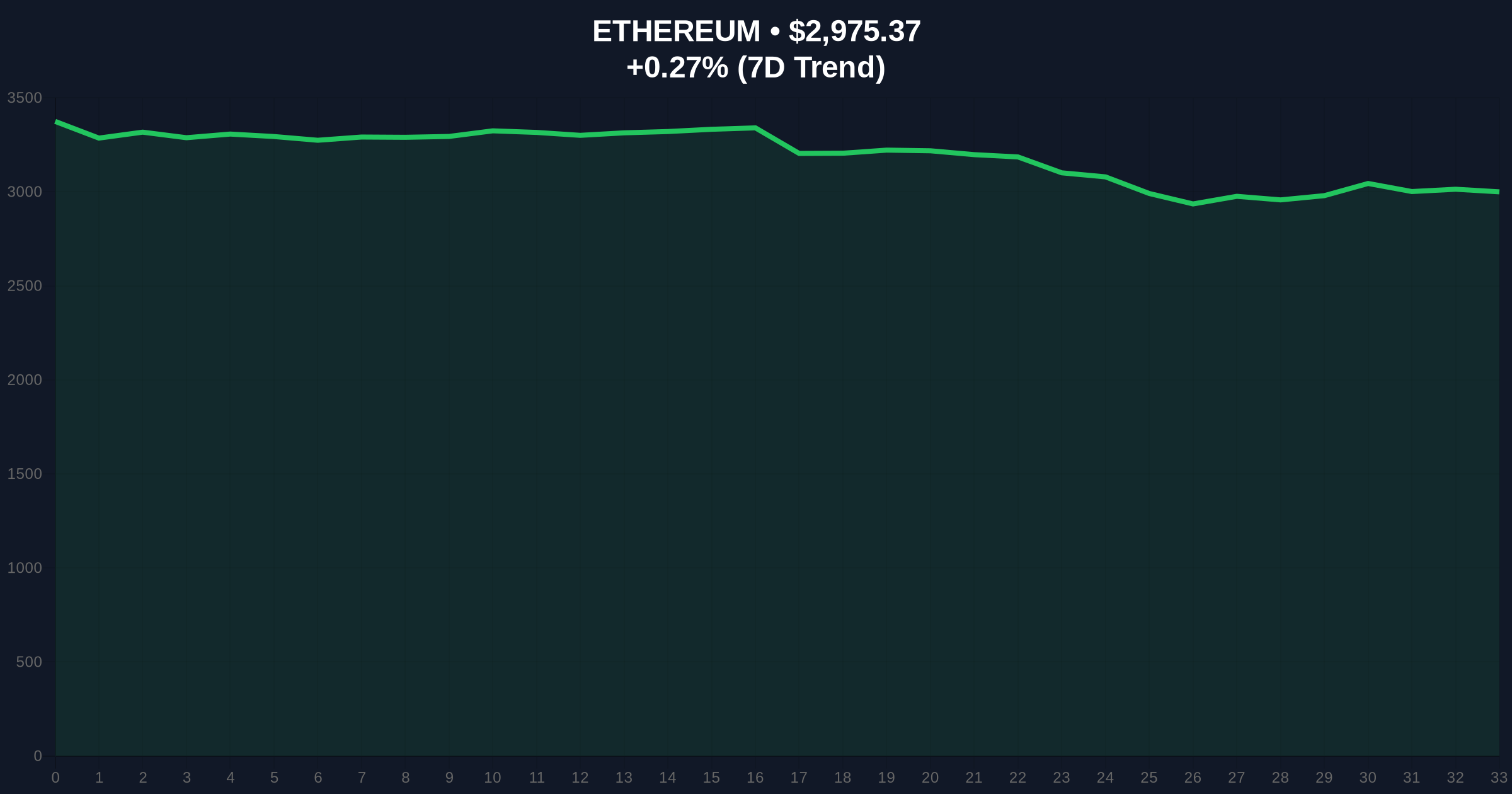

Ethereum currently trades at $2,968.04, showing minimal 24-hour movement at +0.55%. Volume profile analysis reveals weak accumulation between $2,950 and $3,050, suggesting this range represents a liquidity void rather than genuine support. The 200-day moving average at $3,150 acts as immediate resistance, while the 50-day EMA at $2,880 provides temporary dynamic support. RSI readings at 42 indicate neutral momentum with bearish divergence from on-chain activity metrics. Market structure suggests the critical Fibonacci support at $2,750 (61.8% retracement from December highs) must hold to maintain the broader uptrend structure. According to Ethereum's official Pectra upgrade documentation, network improvements typically face a 6-8 week adoption curve before revealing their true impact on valuation metrics.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) | Contrarian signal amid upgrade activity |

| ETH Current Price | $2,968.04 | Testing key psychological level |

| 24-Hour Change | +0.55% | Minimal reaction to upgrade analysis |

| Market Rank | #2 | Maintains position despite competition |

| Layer 2 Transaction Share | 68% | Structural shift in network utility |

For institutional portfolios, the divergence between upgrade-driven activity and sustainable valuation drivers creates allocation challenges. The migration to Layer 2 solutions represents a fundamental shift in Ethereum's economic model, where mainnet increasingly serves as a settlement layer rather than execution environment. This has implications for ETH's monetary policy, as reduced fee burns could increase net issuance despite EIP-1559 mechanisms. Retail investors face different considerations: while short-term upgrade narratives may create trading opportunities, the structural trends identified by JPMorgan suggest longer-term portfolio adjustments toward Layer 2 tokens and alternative execution layers.

Market analysts on X/Twitter present conflicting interpretations. Bulls highlight the immediate metrics improvement as evidence of network resilience, with one quantitative researcher noting, "Fusaka's gas optimization represents meaningful progress in Ethereum's scalability roadmap." Skeptics echo JPMorgan's concerns, pointing to declining social volume metrics and what they identify as a "liquidity grab" around upgrade announcements. The broader sentiment aligns with the Extreme Fear reading, as seen in parallel developments like luxury asset tests during risk-off periods and declining retail engagement across major assets.

Bullish Case: If Ethereum maintains above the $2,850 support and demonstrates sustained adoption of Fusaka's optimizations, a retest of the $3,300 resistance becomes probable. This scenario requires Layer 2 networks to drive increased mainnet settlement demand rather than cannibalizing activity. Network fee burns would need to exceed current projections by 15-20% to validate the upgrade's economic impact.

Bearish Case: Failure to hold $2,750 Fibonacci support would confirm JPMorgan's thesis of diminishing upgrade returns. Increased competition from Solana and other alternative Layer 1s could accelerate the migration trend, potentially pushing ETH toward the $2,400 volume node. This scenario assumes continued reduction in speculative activity around NFTs and memecoins, further pressuring network fee economics.

Bullish Invalidation: $2,850 - A break below this level would invalidate the immediate upgrade-driven momentum thesis.

Bearish Invalidation: $3,200 - Sustained trading above this resistance would contradict the migration pressure narrative.

Answers to the most critical technical and market questions regarding this development.