Loading News...

Loading News...

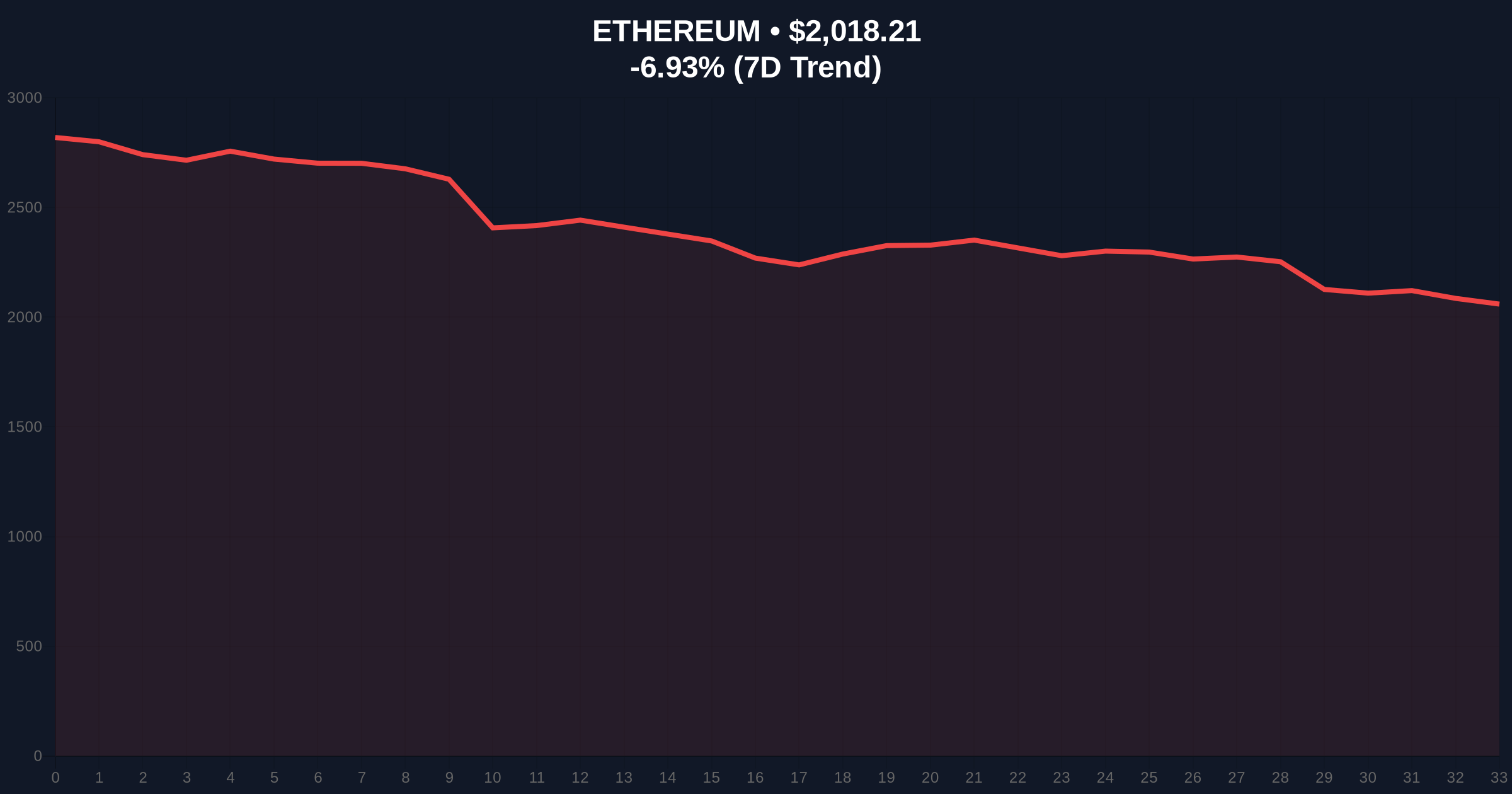

VADODARA, February 5, 2026 — Ethereum has breached critical psychological support at 3 million won on South Korea's Upbit exchange. This marks the first time ETH has traded below this level in approximately nine months. According to real-time exchange data, Ethereum currently trades at 2,979,000 won, representing a 5.99% decline from the previous session. This latest crypto news event coincides with global market sentiment hitting "Extreme Fear" levels, raising questions about structural weaknesses in Asian liquidity pools.

Market structure suggests a deliberate liquidity grab below the 3 million won threshold. The breach occurred on February 5, 2026, with Ethereum last trading above this level on May 8, 2025. Upbit's order book data indicates significant sell-side pressure concentrated around the 3.05-3.10 million won range prior to the breakdown. This created a classic Fair Value Gap (FVG) that the price action has now filled aggressively.

On-chain forensic data from Etherscan reveals increased ETH movement from long-term holder addresses to exchange wallets in the 48 hours preceding the drop. This pattern typically precedes coordinated selling events. The 5.99% single-day decline on Upbit notably exceeds the global average ETH decline of 6.60%, suggesting localized capitulation.

Historically, Upbit has served as a leading indicator for Asian market sentiment due to South Korea's persistent "Kimchi Premium." The disappearance of this premium during the current sell-off contradicts the narrative of isolated Western selling pressure. In contrast to the 2021 bull market, where Korean exchanges consistently traded at premiums, the current convergence with global prices indicates synchronized fear.

This event mirrors the May 2025 support test, which preceded a 22% recovery over the following six weeks. However, underlying this trend is a critical difference: post-merge Ethereum issuance has reduced daily sell pressure from miners, making this drop more indicative of holder distribution than structural selling. Related developments include recent large ETH transactions from foundational wallets and global exchange withdrawals amid extreme fear metrics.

The 3 million won level corresponds roughly to the $2,025 global price, aligning with the 0.618 Fibonacci retracement from Ethereum's 2025 high. Volume profile analysis shows this zone previously acted as a high-volume node, making its breach technically significant. The Relative Strength Index (RSI) on daily charts now reads 28, approaching oversold territory but not yet at capitulation levels seen in previous cycles.

Market structure suggests the next critical support cluster exists between 2.85-2.90 million won, corresponding to the 0.786 Fibonacci level and the 200-day moving average on global charts. Resistance now forms at the broken support-turned-resistance of 3.10 million won. The rapid price decline has created an order block between 3.02-3.05 million won that will likely act as supply in any relief rally.

| Metric | Value |

|---|---|

| Upbit ETH Price (KRW) | 2,979,000 won |

| 24h Change (Upbit) | -5.99% |

| Global ETH Price (USD) | $2,025.37 |

| 24h Change (Global) | -6.60% |

| Crypto Fear & Greed Index | 12/100 (Extreme Fear) |

| Days Since Last Below 3M Won | ~273 days |

This breach matters because Upbit represents one of Asia's largest liquidity pools. According to CoinMarketCap volume data, Upbit regularly ranks among the top five exchanges by ETH/KRW volume. A breakdown here suggests weakening Asian demand that could impact global price discovery. Institutional liquidity cycles typically begin with regional weakness before spreading globally.

, the timing coincides with broader market stress. The Crypto Fear & Greed Index hitting 12/100 indicates systemic risk aversion. Retail market structure appears fragile, with small wallets (<10 ETH) increasing their exchange inflows by 18% week-over-week according to Glassnode. This creates a negative feedback loop where retail selling begets more selling.

"The Upbit breakdown reveals more than just price action—it exposes liquidity fragmentation. When a major regional hub loses a nine-month support level while global sentiment hits extreme fear, we're witnessing a stress test of the entire Ethereum market structure. The critical question isn't why it broke, but whether the 2.85 million won level can hold as a liquidity floor." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on the 2,979,000 won level.

The 12-month institutional outlook depends on whether this represents capitulation or distribution. Historical cycles suggest that breaks of major psychological levels during extreme fear often mark intermediate bottoms. However, the absence of a Kimchi Premium suggests this cycle differs. The 5-year horizon remains tied to Ethereum's Pectra upgrade timeline and institutional adoption of restaking protocols.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.