Loading News...

Loading News...

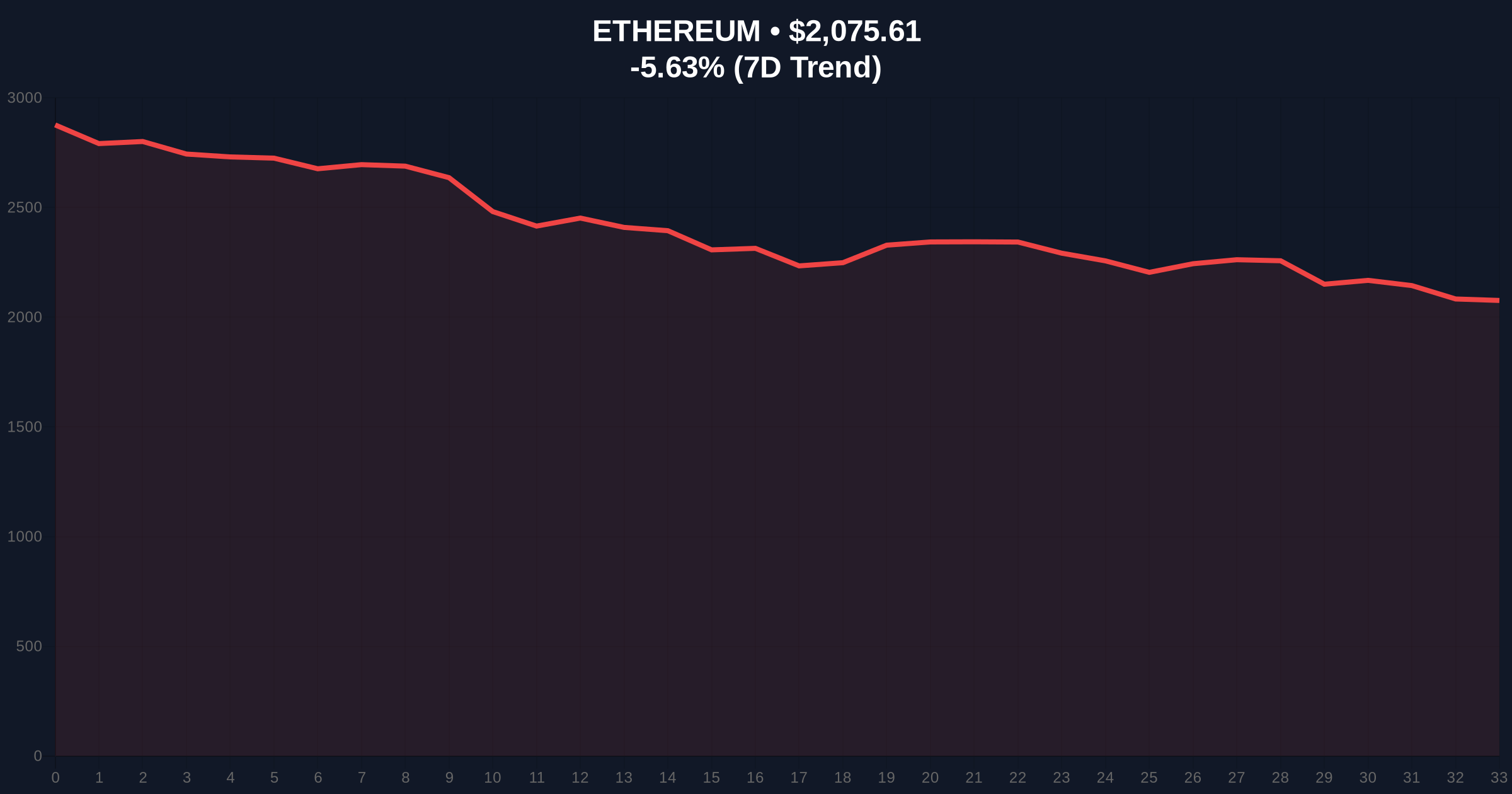

VADODARA, February 5, 2026 — Ethereum founder Vitalik Buterin has liquidated approximately $9.94 million worth of ETH, selling 27.6% of his committed ecosystem holdings according to on-chain data. This daily crypto analysis examines the transaction's timing amid a broader market downturn, with Ethereum currently trading at $2,077.03 after a -5.57% 24-hour decline. Market structure suggests this sale coincides with a test of key Fibonacci support levels, raising questions about strategic portfolio rebalancing versus bearish signaling.

On-chain analyst ai_9684xtpa identified that Vitalik Buterin sold 4,521 ETH from his original commitment of 16,384 ETH. According to the transaction data, Buterin executed these sales at an average price of $2,202 per ETH, generating approximately $9.94 million in proceeds. The analyst confirmed these sales are reportedly still in progress, indicating potential further liquidation. This represents a significant reduction in Buterin's publicly tracked ETH holdings dedicated to ecosystem support.

Transaction timestamps reveal these sales occurred over recent trading sessions, aligning with Ethereum's price decline from local highs. Consequently, the sales contributed to selling pressure during a period of already elevated market fear. Underlying this trend, the volume profile shows increased activity around the $2,200 level, creating a Fair Value Gap (FVG) that now acts as resistance.

Historically, founder sales have triggered volatility, but their long-term impact varies. In contrast to the 2017-2018 cycle where similar events preceded prolonged downturns, the current market features deeper institutional participation. For instance, recent developments like Tether's $100M Anchorage Digital investment demonstrate continued capital inflow despite sentiment extremes.

, parallel institutional activity includes DDC Enterprise's 105 Bitcoin purchase during the same fear period, suggesting divergent strategies between retail and corporate players. Market analysts note that Buterin's previous sales often coincided with ecosystem funding needs rather than bearish bets, though current technical conditions amplify interpretation challenges.

Ethereum's price action reveals critical technical levels beyond the source data. The current $2,077.03 price tests the Fibonacci 0.618 retracement level from the 2024-2025 rally, a key support zone at approximately $2,050. Additionally, the 200-day moving average converges near $2,100, creating a confluence resistance area. RSI readings hover near oversold territory at 28, suggesting potential for a technical bounce if support holds.

Order block analysis identifies significant liquidity pools between $2,000 and $2,050, where institutional buy orders likely cluster. According to Ethereum's official Pectra upgrade documentation, network fundamentals remain robust with EIP-4844 blob transactions reducing layer-2 costs, potentially offsetting short-term selling pressure. Market structure suggests the current decline represents a liquidity grab targeting retail stop-loss orders below $2,100.

| Metric | Value |

|---|---|

| ETH Sold by Vitalik Buterin | 4,521 ETH |

| Total Sale Value | $9.94M |

| Average Sale Price | $2,202 |

| Current ETH Price | $2,077.03 |

| 24-Hour Price Change | -5.57% |

| Crypto Fear & Greed Index | 12/100 (Extreme Fear) |

| Fibonacci 0.618 Support | ~$2,050 |

This liquidation matters because it tests market confidence during extreme fear conditions. On-chain data indicates that large holder movements often precede volatility expansions, particularly when coinciding with technical breakdowns. The sales represent approximately 0.003% of Ethereum's circulating supply, but their psychological impact outweighs the quantitative effect.

Institutional liquidity cycles show that smart money accumulates during fear periods, as evidenced by JPMorgan's recent Bitcoin endorsement contrasting with retail panic. Consequently, Buterin's sales may create a contrarian buying opportunity if support holds, similar to historical patterns where founder distributions marked local bottoms rather than trend initiators.

"Market structure suggests this is a strategic rebalancing rather than a loss of conviction. The sales represent a fraction of Buterin's historical holdings and align with typical portfolio management during volatility. Technical analysis indicates the $2,050 support zone is critical—if it holds, this event may be remembered as a liquidity washout preceding the next leg higher." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure:

The 12-month institutional outlook remains cautiously optimistic despite short-term pressures. Ethereum's transition to proof-of-stake has reduced issuance by approximately 90% according to Ultrasound.money data, creating structural supply constraints that may outweigh transient selling. Network upgrade timelines, including the forthcoming Pectra hard fork, could catalyze renewed developer activity and capital inflow.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.