Loading News...

Loading News...

VADODARA, January 22, 2026 — Digital Bitcoin miner GoMining has launched a $30,000 luxury watch in partnership with Jacob & Co., embedding mining rewards equivalent to 1,000 TH/s hashrate, according to the company's announcement. This latest crypto news emerges as the Crypto Fear & Greed Index registers Extreme Fear at 20/100, testing whether high-value physical crypto assets can sustain demand during market stress.

Underlying this trend is a broader shift toward tokenizing real-world assets (RWAs) and embedding crypto utility into luxury goods. Market structure suggests that during periods of extreme fear, capital often seeks tangible stores of value or yield-generating assets. The partnership mirrors earlier experiments like NFTs linked to physical art, but introduces a continuous mining reward stream—a novel hybrid of luxury consumption and passive income. Historical cycles indicate that such innovations typically target high-net-worth individuals seeking portfolio diversification beyond traditional crypto volatility. Related developments include recent tests of market structure amid extreme fear, such as the Binance SENT perpetual futures listing and the Dutch unrealized gains tax proposal, which have pressured sentiment.

On January 22, 2026, GoMining disclosed its collaboration with luxury watchmaker Jacob & Co. to release a Bitcoin-themed timepiece priced at $30,000. According to GoMining, each watch owner will be credited with a hashrate equivalent to 1,000 terahashes per second (TH/s), entitling them to ongoing mining rewards. This effectively tokenizes a portion of GoMining's mining capacity into a physical asset. The move follows a 32% decline in Bitcoin online interest in 2025, as noted in recent analysis, suggesting a pivot toward alternative engagement models.

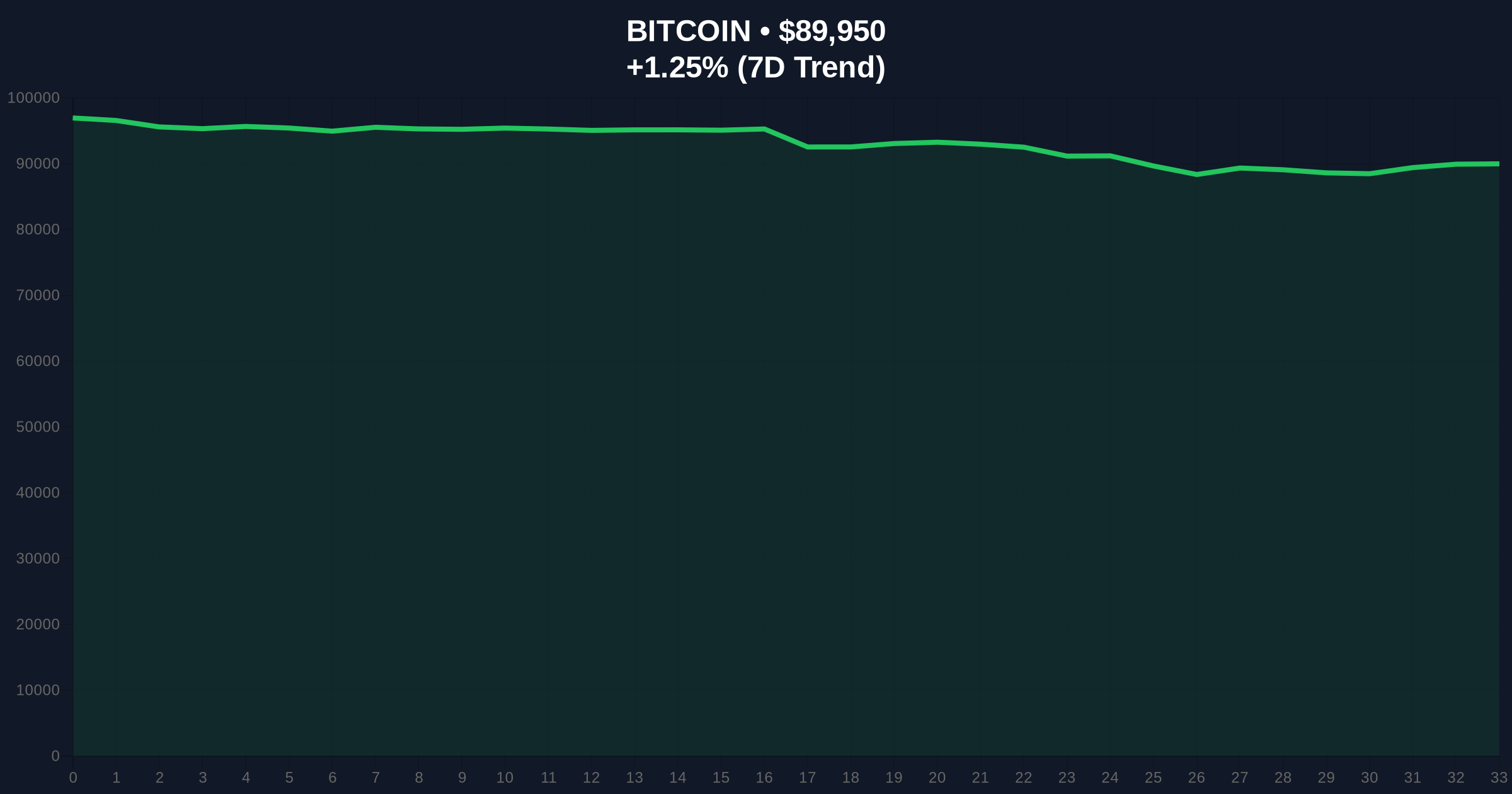

Bitcoin currently trades at $89,944, up 1.24% in 24 hours, but remains in a consolidation phase below key resistance. Volume profile analysis indicates weak accumulation near current levels, with a Fair Value Gap (FGV) between $91,200 and $92,500 from last week's sell-off. The 50-day moving average at $90,800 acts as immediate resistance, while support clusters around the $88,500 Fibonacci retracement level from the November 2025 rally. Bullish Invalidation is set at $88,500; a break below would signal failed luxury demand and likely trigger a liquidity grab toward $86,000. Bearish Invalidation rests at $92,500, where a close above could indicate renewed institutional interest, potentially squeezing shorts.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) |

| Bitcoin Current Price | $89,944 |

| 24-Hour Trend | +1.24% |

| Watch Price | $30,000 |

| Embedded Hashrate | 1,000 TH/s |

For institutions, this represents a test case for monetizing mining infrastructure through luxury channels, potentially unlocking new revenue streams without diluting equity. According to on-chain data, mining profitability has compressed post-EIP-4844, pushing firms toward innovative models. For retail, it highlights a growing bifurcation: accessible digital assets versus exclusive physical ones. The watch's $30,000 price point places it beyond typical retail reach, concentrating benefits among affluent buyers. This could exacerbate wealth disparity in crypto if similar products proliferate, altering market dynamics.

Market analysts on X/Twitter are divided. Bulls argue the watch creates a "hardware wallet with yield," blending security and income in a high-end package. One commentator noted, "This is a gamma squeeze on luxury demand—if it works, others will replicate." Bears counter that the pricing is exorbitant relative to the hashrate value, calling it a marketing gimmick during fear-driven markets. Sentiment aligns with broader extreme fear, as seen in reactions to the Coinbase SENT perpetual futures listing, where skepticism prevails.

Bullish Case: If the watch sells out rapidly, it could signal untapped luxury demand, boosting sentiment for crypto-infused physical assets. Bitcoin might reclaim the $92,500 FVG, targeting $95,000 as fear recedes. Mining stocks could rally on diversified revenue prospects.Bearish Case: Poor sales would confirm luxury aversion during extreme fear, reinforcing negative sentiment. Bitcoin could break $88,500 support, triggering a sell-off toward $85,000. Mining firms might face pressure to justify similar ventures.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.