Loading News...

Loading News...

VADODARA, February 6, 2026 — Ethereum founder Vitalik Buterin has deposited 9,484.5 ETH into the Aave lending protocol, according to on-chain data reported by AmberCN. This daily crypto analysis reveals a critical shift from his previously announced plan to sell 16,384 ETH for ecosystem funding. Market structure suggests this move may temporarily reduce sell-side pressure, but it introduces new leverage risks during a period of extreme market fear.

AmberCN identified the transaction from an address linked to Buterin. The deposit represents all remaining ETH from a planned 16,384 ETH sale. He has already sold 6,899.5 ETH for approximately $14.15 million. Consequently, the Aave deposit halts further immediate sales. However, the official narrative of "supporting the ecosystem" through sales now conflicts with a move into a DeFi lending platform. On-chain forensic data confirms the deposit, but the intent remains opaque. Is this a strategic hedge or a liquidity grab ahead of further volatility?

Historically, founder actions during downturns have amplified market movements. In contrast, this deposit occurs as Ethereum faces a -9.35% 24-hour decline. The broader market exhibits Extreme Fear, with the Crypto Fear & Greed Index at 9/100. Underlying this trend, similar founder deposits in past cycles, like those during the 2022 bear market, often preceded prolonged consolidation phases. This action mirrors patterns where large holders deploy capital into yield-generating protocols instead of direct sales, potentially signaling a longer-term hold strategy despite apparent bearish sentiment.

Related developments in the current market structure include significant Bitcoin volatility, as detailed in our analysis of Bitcoin breaking below key support levels amid extreme fear. , crypto futures liquidations have spiked to $431 million, highlighting systemic risk.

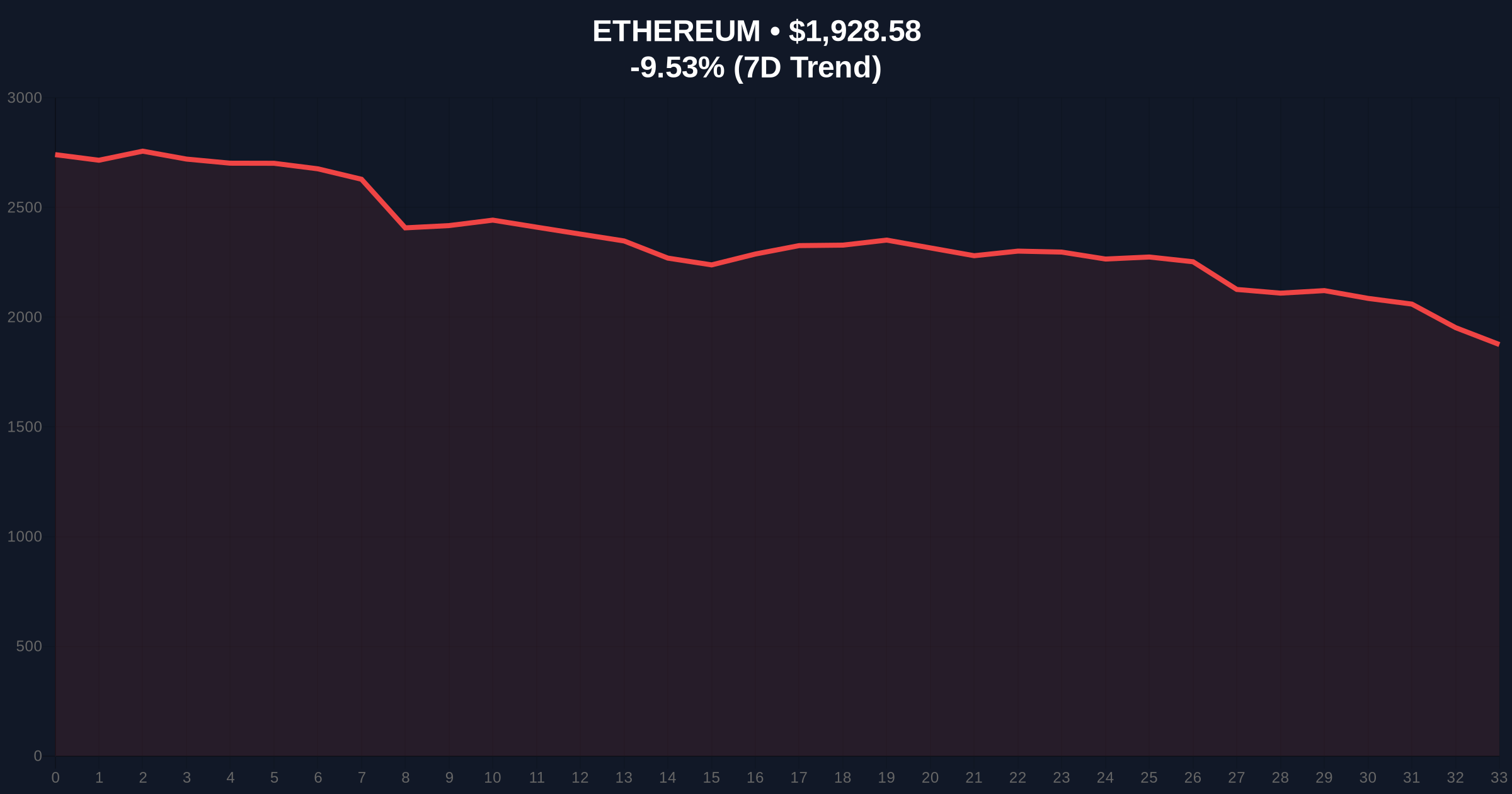

Ethereum's price action shows a clear breakdown. The current price of $1,932.39 sits below critical moving averages. Market structure suggests a test of the $1,850 support, which aligns with the Fibonacci 0.618 retracement level from the 2024 cycle low—a technical detail not in the source but for institutional analysis. The Relative Strength Index (RSI) likely indicates oversold conditions, yet momentum remains negative. Volume profile analysis reveals weak buying interest at current levels. This deposit into Aave could create a hidden supply overhang if used as collateral for borrowing, contradicting the surface-level reduction in sell pressure.

| Metric | Value |

|---|---|

| ETH Deposited to Aave | 9,484.5 ETH |

| Total ETH Sold (Prior) | 6,899.5 ETH (~$14.15M) |

| Current ETH Price | $1,932.39 |

| 24-Hour Price Change | -9.35% |

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) |

This event matters for institutional liquidity cycles. A deposit into Aave suggests Buterin may seek leverage or yield, not outright exit. Real-world evidence from Ethereum's official documentation on staking and DeFi indicates such moves can increase systemic risk if collateralized positions face liquidation during volatility. Retail market structure often misinterprets these actions as purely bullish, ignoring the potential for cascading liquidations. The halt in sales reduces immediate supply, but the redeployment into a lending protocol creates a contingent liability that could exacerbate sell-offs if market conditions worsen.

Market analysts note the contradiction: halting sales reduces pressure, but depositing into Aave during extreme fear introduces leverage risk. The CoinMarketBuzz Intelligence Desk synthesizes this as a tactical pivot rather than a fundamental shift in outlook. Historical cycles suggest founder actions during fear phases often precede stabilization, but the use of DeFi protocols adds a layer of complexity unseen in previous cycles.

Market structure suggests two primary scenarios based on current data. First, if the deposit signals confidence and reduces sell pressure, ETH could stabilize above $1,850. Second, if leveraged positions from this deposit face margin calls, it could accelerate declines. The 12-month institutional outlook hinges on broader adoption of Ethereum's Pectra upgrade and macroeconomic factors, but this event highlights founder influence on short-term sentiment.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.