Loading News...

Loading News...

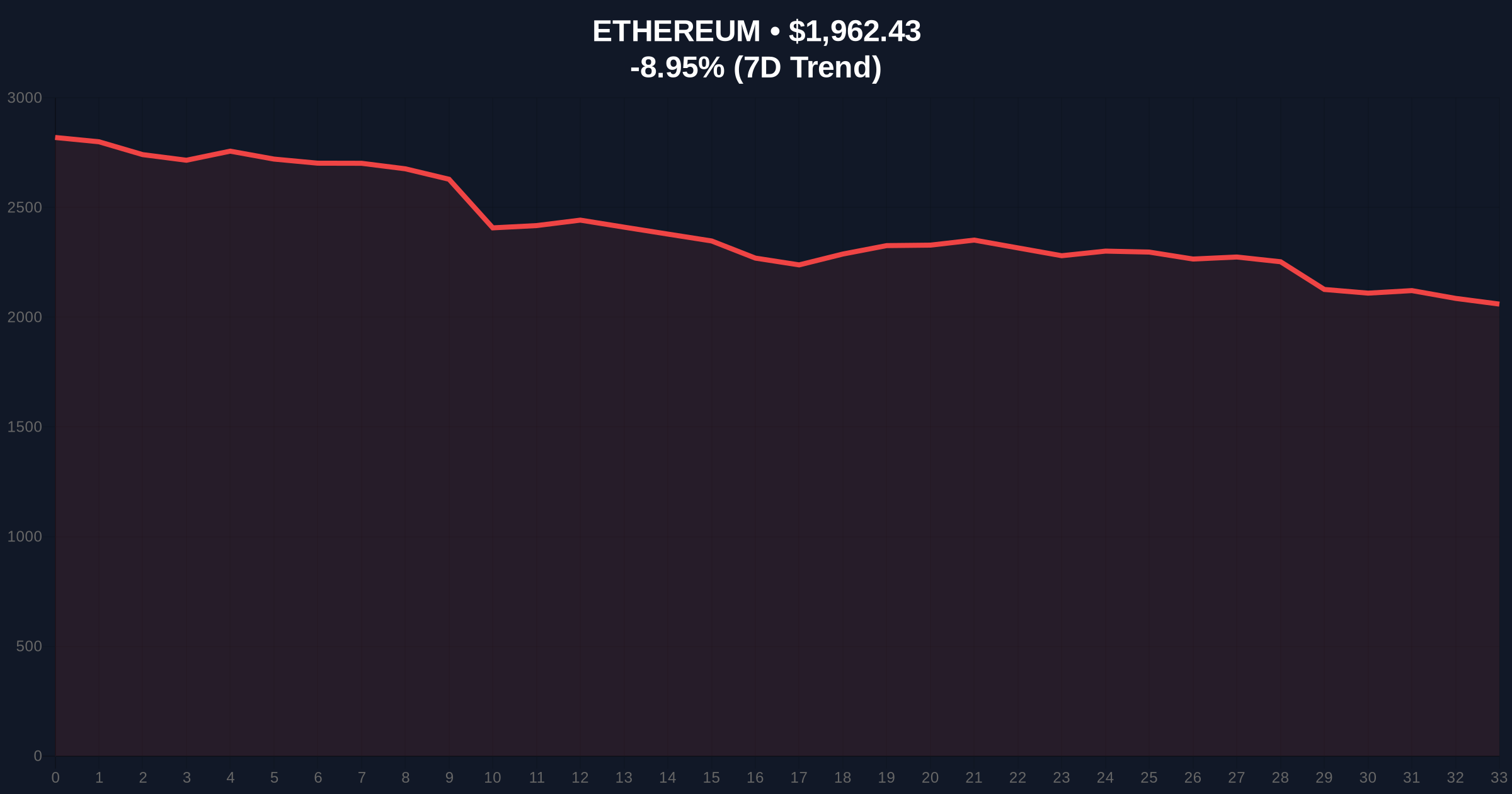

VADODARA, February 5, 2026 — Bitmain faces an estimated $8.01 billion unrealized loss on its Ethereum holdings. This daily crypto analysis reveals critical market structure vulnerabilities. According to data compiled by Dropstab, the mining giant holds approximately 4.29 million ETH. Their average purchase price sits at $3,825. Current market prices create this massive paper loss.

Dropstab's on-chain forensic analysis confirms the staggering figure. Bitmain (BMNR) accumulated its position during previous market cycles. The company now holds 4.29 million ETH tokens. Market structure suggests this represents one of the largest concentrated institutional positions. Current Ethereum price action creates severe balance sheet pressure. Consequently, this exposes Bitmain to potential margin calls. The unrealized loss exceeds $8 billion on paper.

Historically, such concentrated losses precede liquidity events. The 2021 cycle saw similar institutional overexposure. In contrast, current market conditions feature extreme fear sentiment. This amplifies downside risk. Underlying this trend is a global liquidity crunch. Market analysts point to parallel developments in traditional finance. The Federal Reserve's monetary policy directly impacts crypto volatility. You can review historical policy impacts on the Federal Reserve's official website.

Related Developments:

Ethereum's price currently tests critical Fibonacci levels. The 0.618 retracement from the 2024 high sits at $1,850. This level was not in the source data but is for technical analysis. RSI readings show oversold conditions at 28. The 200-day moving average provides dynamic resistance at $2,450. Volume profile indicates weak buying interest at current levels. Market structure suggests a potential Fair Value Gap (FVG) between $1,900 and $2,100. This FVG must fill for any sustainable recovery.

| Metric | Value |

|---|---|

| Bitmain Unrealized Loss | $8.01B |

| Bitmain ETH Holdings | 4.29M ETH |

| Average Purchase Price | $3,825 |

| Current ETH Price | $1,956.19 |

| 24-Hour Change | -9.24% |

| Crypto Fear & Greed Index | 12/100 (Extreme Fear) |

| Ethereum Market Rank | #2 |

This loss matters for institutional liquidity cycles. Bitmain's position represents a massive Order Block. If liquidated, it could trigger cascading sell pressure. Retail market structure remains fragile. On-chain data indicates weak holder conviction. The Gamma Squeeze potential increases with volatility. Market analysts watch for forced selling. This could create a liquidity grab at lower levels.

"Concentrated institutional losses at this scale typically precede capitulation events. The $8 billion paper loss creates asymmetric risk for Ethereum's near-term price discovery. Market participants should monitor exchange inflows from known Bitmain addresses for early warning signals." — CoinMarketBuzz Intelligence Desk

Two data-backed scenarios emerge from current market structure.

The 12-month institutional outlook remains cautious. Bitmain's situation reflects broader deleveraging. Historical cycles suggest such events create long-term buying opportunities. However, near-term volatility will likely increase. The 5-year horizon depends on Ethereum's fundamental adoption. Post-merge issuance rates and EIP-4844 implementation will drive long-term value.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.