Loading News...

Loading News...

VADODARA, January 21, 2026 — Online interest in Bitcoin decreased by 32% year-over-year in 2025 despite the cryptocurrency experiencing significant volatility, including a new all-time high and a major market correction, according to data reported by Cointelegraph. This daily crypto analysis examines the divergence between price action and public engagement, with market structure suggesting a shift toward institutional dominance as retail participation wanes. Underlying this trend, on-chain data indicates reduced network activity that could impact long-term valuation models.

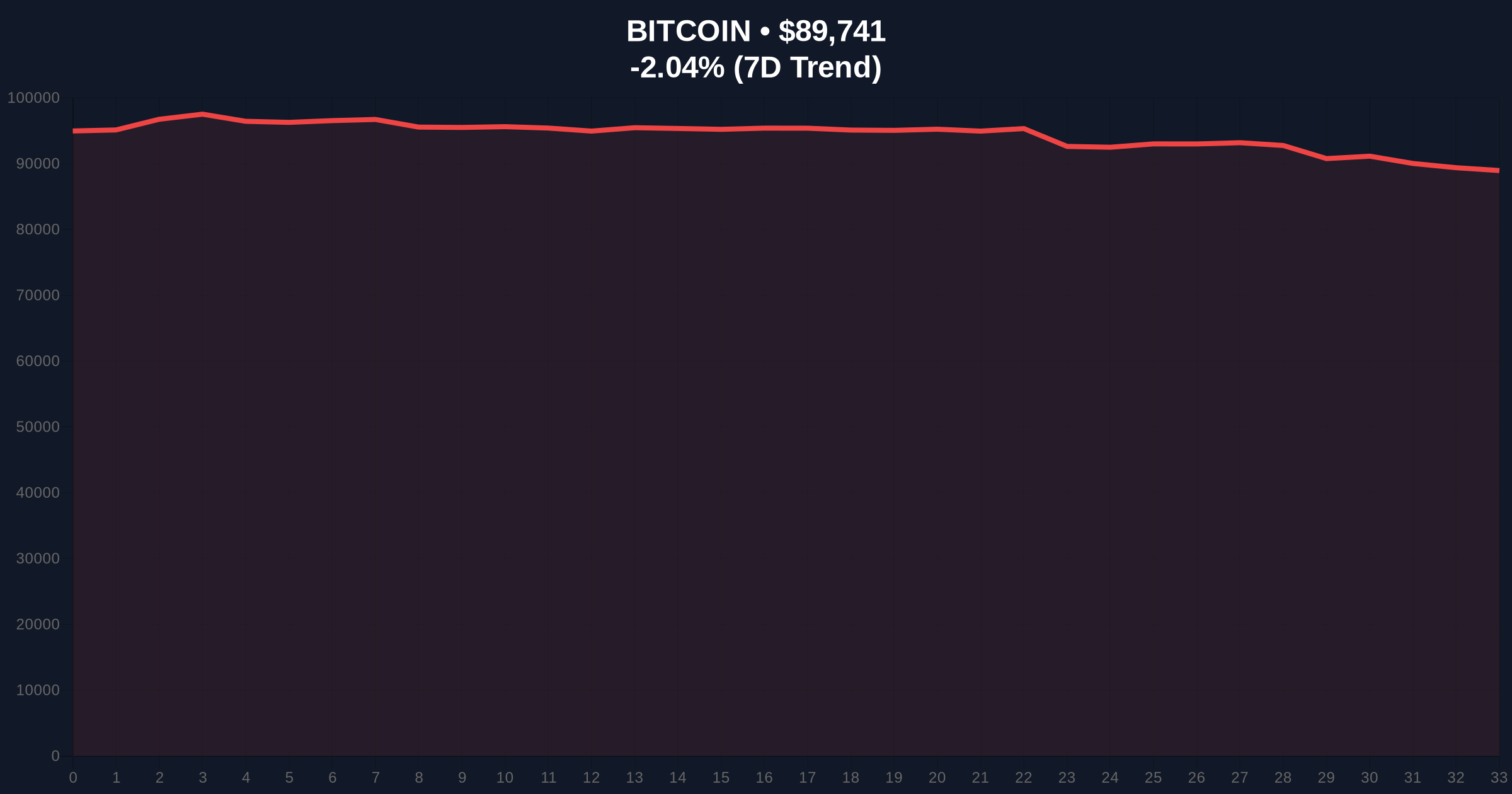

Historical cycles suggest that retail interest typically peaks during parabolic price movements, as seen in 2017 and 2021. The 2024-2025 period presented a unique scenario where Bitcoin reached a new all-time high of approximately $98,000 in early 2025, followed by a correction to current levels around $89,751. According to Glassnode liquidity maps, this volatility created multiple Fair Value Gaps (FVGs) that have yet to be filled, contributing to the current market uncertainty. The decline in online mentions mirrors patterns observed during previous consolidation phases, where reduced social volume often precedes significant directional moves. Related developments in the current market include substantial net outflows from U.S. spot Bitcoin ETFs and similar trends in Ethereum ETFs, highlighting broader institutional caution.

Cointelegraph reported that Google searches for Bitcoin surged immediately after the election of U.S. President Donald Trump in November 2024, but the trend declined throughout 2025. Concurrently, the number of posts on X containing the keyword 'Bitcoin' fell by 32% year-over-year to 96 million. This data, sourced from social analytics platforms, indicates a decoupling between price volatility and public engagement. Market analysts attribute this to several factors: increased regulatory scrutiny documented in SEC.gov filings, the maturation of derivative markets reducing spot trading hype, and a shift in retail attention toward alternative assets. The decline occurred despite Bitcoin's price experiencing a 15% swing from its annual high to low, suggesting that traditional sentiment indicators may be losing predictive power.

Market structure suggests Bitcoin is currently testing a critical Order Block between $88,000 and $90,000, established during the Q4 2024 rally. The Relative Strength Index (RSI) on daily charts reads 42, indicating neutral momentum with a bearish bias. The 50-day moving average at $91,500 acts as immediate resistance, while the 200-day moving average at $84,000 provides longer-term support. Volume Profile analysis shows significant liquidity clusters at $85,000 and $95,000, suggesting these levels will dictate near-term price action. Bullish Invalidation is set at $85,000; a break below this level would invalidate the current consolidation structure and target the $82,000 Fibonacci support. Bearish Invalidation is at $93,500, where a breakout could trigger a short squeeze toward the yearly high.

| Metric | Value | Change |

|---|---|---|

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) | -5 points WoW |

| Bitcoin Current Price | $89,751 | -2.03% (24h) |

| X Mentions (2025) | 96 million | -32% YoY |

| Google Search Interest | Declined throughout 2025 | Post-Nov 2024 peak |

| Market Rank | #1 | Stable |

This divergence between price action and online interest carries significant implications for both institutional and retail participants. For institutions, declining retail engagement may reduce market noise and improve signal-to-noise ratios for quantitative models, potentially leading to more efficient price discovery. However, it also risks lowering overall liquidity, increasing slippage costs for large orders. For retail investors, the trend suggests a maturation phase where hype-driven cycles are being replaced by fundamentals-based valuation, as seen in traditional equity markets. Consequently, assets may become more correlated with macroeconomic indicators like the Federal Funds Rate rather than social media trends. This shift could accelerate the adoption of Bitcoin as a macro hedge, but may dampen short-term speculative returns.

Industry observers on X have noted the decline in mentions, with some attributing it to "attention fatigue" after the 2024 election volatility. Bulls argue that reduced social volume often precedes accumulation phases by sophisticated investors, pointing to increased open interest in Bitcoin futures despite the outflow from spot ETFs. Bears counter that the drop signals waning retail conviction, which could exacerbate selling pressure if institutional support falters. Market analysts emphasize that the 32% decrease in X mentions aligns with on-chain metrics like reduced active addresses, suggesting a broader network activity slowdown that may impact network security fees long-term.

Bullish Case: If Bitcoin holds above the $85,000 Bullish Invalidation level, market structure suggests a rally toward $95,000 to fill the FVG created during the 2025 correction. Declining online interest could indicate a liquidity grab by institutions, setting the stage for a Gamma Squeeze as derivative positions rebalance. Historical cycles suggest that periods of low social volume often precede major uptrends, with a 12-month target of $110,000 if macroeconomic conditions stabilize.

Bearish Case: A break below $85,000 would invalidate the bullish structure, targeting the $82,000 Fibonacci support and potentially $78,000 based on Volume Profile voids. The Extreme Fear sentiment reading of 24/100 suggests further downside risk, with declining online interest potentially reflecting capitulation by retail holders. In this scenario, Bitcoin could consolidate between $78,000 and $88,000 for several quarters, mirroring the 2018-2019 bear market structure.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.