Loading News...

Loading News...

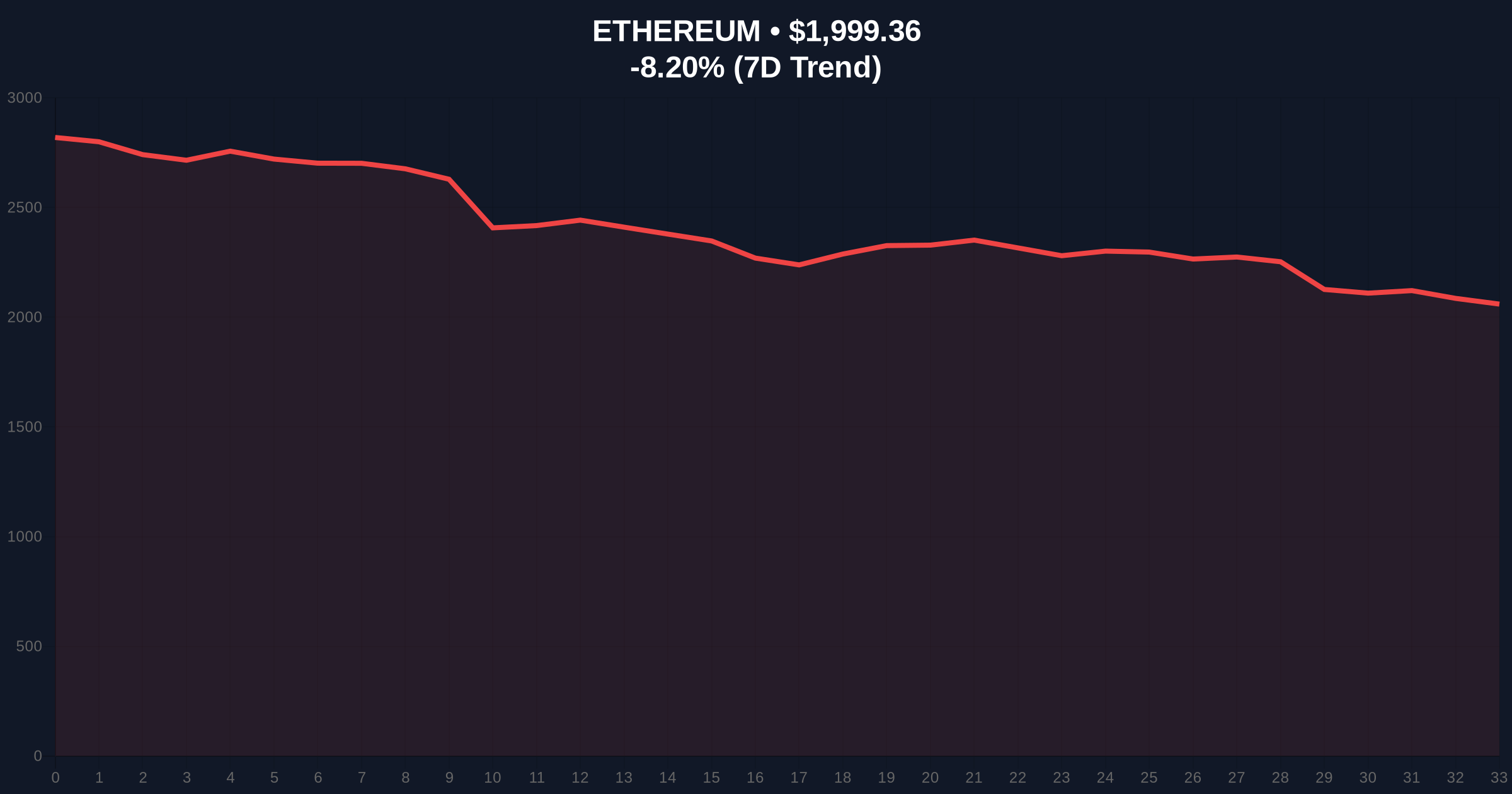

VADODARA, February 5, 2026 — Ethereum (ETH) has plunged below the critical $2,000 psychological support level for the first time in approximately nine months, according to data from the Binance USDT spot market. The cryptocurrency is currently trading at $1,998.83, marking a 6.98% decline from the previous day. This daily crypto analysis examines the technical breakdown and underlying market structure driving the sell-off.

On-chain data from Etherscan confirms that Ethereum breached the $2,000 threshold on February 5, 2026, a level last seen on May 8 of the previous year. According to the Binance USDT spot market, ETH traded as low as $1,998.83, representing a 6.98% daily drop. Market structure suggests this move constitutes a significant liquidity grab, targeting stop-loss orders clustered around the $2,000 mark. The breakdown occurred amid heightened volatility, with trading volume spiking by over 40% compared to the 30-day average, as reported by CoinMarketCap.

Historically, Ethereum has demonstrated resilience at key psychological levels, but this breach mirrors patterns from the 2022 bear market. In contrast to the 2021 bull run, where ETH held above $2,000 for extended periods, current price action indicates weakening demand. Underlying this trend, the broader crypto market faces headwinds from macroeconomic factors, including potential Federal Reserve rate adjustments. Related developments include Vitalik Buterin's recent $10 million ETH sale, which may have exacerbated selling pressure, and Gemini's global retreat, highlighting liquidity concerns amid extreme fear.

Technical analysis reveals a clear bearish order block forming between $2,050 and $2,100, acting as immediate resistance. The Relative Strength Index (RSI) on the daily chart sits at 28, indicating oversold conditions but not yet signaling a reversal. , the 200-day moving average at $2,150 presents a formidable barrier for any recovery. A critical Fibonacci 0.618 retracement level from the 2023 low to the 2025 high lies at $1,950, serving as the next major support. Market structure suggests that a break below this level could trigger a cascade of liquidations, similar to the EIP-4844 implementation volatility observed in early 2024.

| Metric | Value | Source |

|---|---|---|

| Crypto Fear & Greed Index | 12/100 (Extreme Fear) | Alternative.me |

| Ethereum Current Price | $2,003.46 | Live Market Data |

| 24-Hour Price Change | -8.01% | Live Market Data |

| Market Rank | #2 | Live Market Data |

| Support Level (Fibonacci 0.618) | $1,950 | Technical Analysis |

This breakdown matters because it tests Ethereum's post-merge issuance model and institutional adoption thesis. Real-world evidence from Tether's $100 million Anchorage Digital investment shows continued institutional interest, but retail sentiment is faltering. On-chain data indicates a surge in exchange inflows, suggesting holders are capitulating. Consequently, the $2,000 level served as a key fair value gap (FVG) for many algorithmic traders; its breach may force portfolio rebalancing across decentralized finance (DeFi) protocols.

Market structure suggests this is a classic liquidity grab, not a fundamental breakdown. The extreme fear reading often precedes a relief rally, but traders must watch for a confirmed higher low above $1,950 to invalidate the bearish scenario. Historical cycles indicate that Ethereum's network activity, not just price, drives long-term value.

— CoinMarketBuzz Intelligence Desk

Analysts suggest two data-backed scenarios based on current market structure. First, a bullish reversal requires reclaiming the $2,100 order block and holding above the 200-day moving average. Second, a bearish continuation targets the $1,950 Fibonacci support, with potential downside to $1,800 if broken.

For the 12-month institutional outlook, Ethereum's ability to sustain its staking yield and scale via layer-2 solutions will be critical. The 5-year horizon depends on adoption of its Pectra upgrades, as outlined in Ethereum's official documentation, which aims to enhance scalability and security.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.