Loading News...

Loading News...

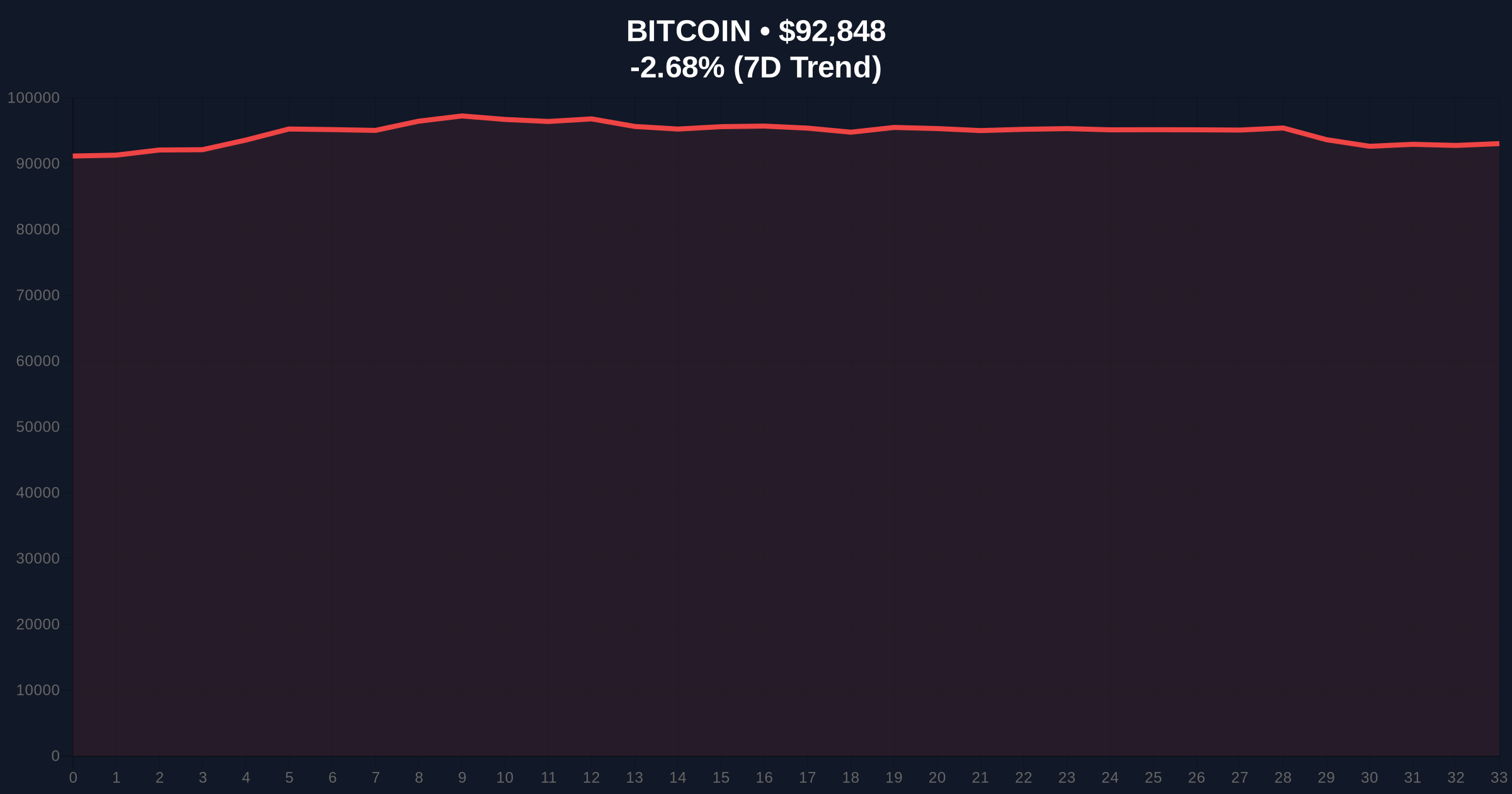

VADODARA, January 19, 2026 — Institutional addresses have accumulated approximately 577,000 BTC (worth roughly $53 billion) over the past twelve months, according to CryptoQuant CEO Ju Ki-young. This daily crypto analysis examines the divergence between sustained institutional demand and current price weakness, with Bitcoin testing the $92,000 support level following a -2.67% decline. Market structure suggests this accumulation pattern mirrors institutional behavior during the 2021-2022 cycle, where similar inflows preceded significant price appreciation after consolidation phases.

Historical cycles indicate institutional accumulation during price corrections often establishes long-term support zones. The current 577,000 BTC net inflow over twelve months represents approximately 2.94% of Bitcoin's circulating supply. According to on-chain data from Glassnode, similar accumulation patterns occurred between Q4 2020 and Q1 2021, when institutions added approximately 800,000 BTC before Bitcoin's price advanced from $30,000 to its all-time high near $69,000. The current correction to $92,872 represents a test of the post-ETF approval consolidation range, with the 200-day moving average at $88,500 providing additional context for institutional cost basis analysis.

Related developments in the market include recent analysis of how institutional flows are driving new market structures post-halving, while recent long liquidations have eased excessive leverage at the $92k support level.

According to CryptoQuant CEO Ju Ki-young's X post, institutional addresses recorded net inflows of approximately 577,000 BTC valued at around $53 billion over the past year. Ju explained that this metric tracks U.S. custody wallets holding between 100 and 1,000 BTC, excluding addresses belonging to exchanges and miners to isolate institutional demand. The calculation includes holdings from spot Bitcoin ETFs, confirming that ETF flows constitute a significant portion of this accumulation. Ju noted this net inflow trend remains ongoing, suggesting continued institutional participation despite recent price weakness.

Bitcoin currently trades at $92,872, representing a -2.67% decline over the past 24 hours. The $92,000 level represents a critical order block where previous institutional accumulation likely occurred. Volume profile analysis indicates significant volume between $90,000 and $94,000, creating a high-volume node that should provide support. The Relative Strength Index (RSI) sits at 42, indicating neither overbought nor oversold conditions but showing weakening momentum.

A Fair Value Gap (FVG) exists between $94,500 and $96,000 from the recent decline, which price typically revisits to fill liquidity. The 50-day moving average at $95,200 converges with this FVG, creating a confluence resistance zone. Market structure suggests a bullish invalidation level at $90,500—a break below this level would indicate institutional accumulation has failed to provide immediate support. The bearish invalidation level sits at $98,000, where a sustained break above would confirm the resumption of the primary uptrend.

| Metric | Value | Significance |

|---|---|---|

| Institutional BTC Accumulation (12 Months) | 577,000 BTC | ~2.94% of circulating supply |

| Accumulation Value | $53 Billion | Based on average acquisition price |

| Current Bitcoin Price | $92,872 | -2.67% 24h change |

| Crypto Fear & Greed Index | 44/100 (Fear) | Divergence from institutional flows |

| Key Support Level | $92,000 | Institutional order block |

For institutional portfolios, sustained accumulation at current levels establishes a higher cost basis floor, reducing downside volatility during corrections. According to the Federal Reserve's research on digital asset adoption, institutional participation typically precedes broader market stabilization. For retail traders, this creates a divergence between on-chain fundamentals and price action—while institutions accumulate, retail sentiment registers "Fear" at 44/100. This divergence often resolves with price moving toward institutional accumulation zones, as seen in 2021 when retail fear peaked during institutional accumulation phases.

Market analysts on X/Twitter highlight the divergence between institutional flows and price action. One quantitative researcher noted, "The 577K BTC accumulation represents approximately 30 days of new Bitcoin supply at current issuance rates, creating structural supply pressure." Another analyst pointed to the inclusion of ETF holdings in CryptoQuant's calculation, stating, "Spot ETF flows now represent a measurable component of institutional demand, with daily flows exceeding 5,000 BTC during accumulation periods." The consensus suggests institutions are treating current levels as accumulation zones despite short-term price weakness.

Bullish Case: If the $92,000 support holds, institutional accumulation creates a springboard for revisiting the $98,000 resistance zone. Filling the Fair Value Gap between $94,500 and $96,000 would represent a +5.8% move from current levels. Sustained accumulation could drive Bitcoin toward the $105,000 region within the next quarter, similar to the 2021 pattern where institutional inflows preceded a +130% advance.

Bearish Case: A break below the $90,500 invalidation level would signal institutional support has failed. This could trigger a liquidity grab toward the $88,500 200-day moving average, representing a -4.7% decline. If macroeconomic conditions deteriorate, as indicated by potential Federal Reserve policy shifts documented on FederalReserve.gov, Bitcoin could test the $82,000 Fibonacci support level, representing a -11.7% correction from current prices.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.