Loading News...

Loading News...

VADODARA, January 19, 2026 — Bitcoin's four-year halving cycle has structurally broken. According to research from NYDIG and Wintermute cited by CoinDesk's latest market analysis, three variables now dominate price action: a new market structure decoupled from halving events, institutional ETF fund flows, and macroeconomic conditions. This daily crypto analysis examines the data.

Historical Bitcoin cycles followed predictable post-halving supply shocks. The 2016-2017 and 2020-2021 bull markets demonstrated clear 12-18 month lag effects from block reward reductions. Market structure suggests this pattern has fractured. The January 2024 U.S. spot Bitcoin ETF approvals created permanent structural change. According to on-chain data, ETF holdings now represent 4.2% of Bitcoin's circulating supply. This institutional footprint creates continuous buy-side pressure independent of mining economics. The transition mirrors traditional finance's evolution from commodity cycles to capital flow-driven markets.

NYDIG and Wintermute's quantitative research identifies three primary variables replacing the halving cycle. First: a new market structure where ETF flows dominate price discovery. Second: institutional capital allocation decisions based on macro conditions rather than crypto-native events. Third: geopolitical and macroeconomic risk assessments determining capital rotation between asset classes. The analysis indicates retail investors may shift capital from equities to crypto if risk-adjusted returns favor digital assets. This represents a fundamental regime change in Bitcoin's valuation framework.

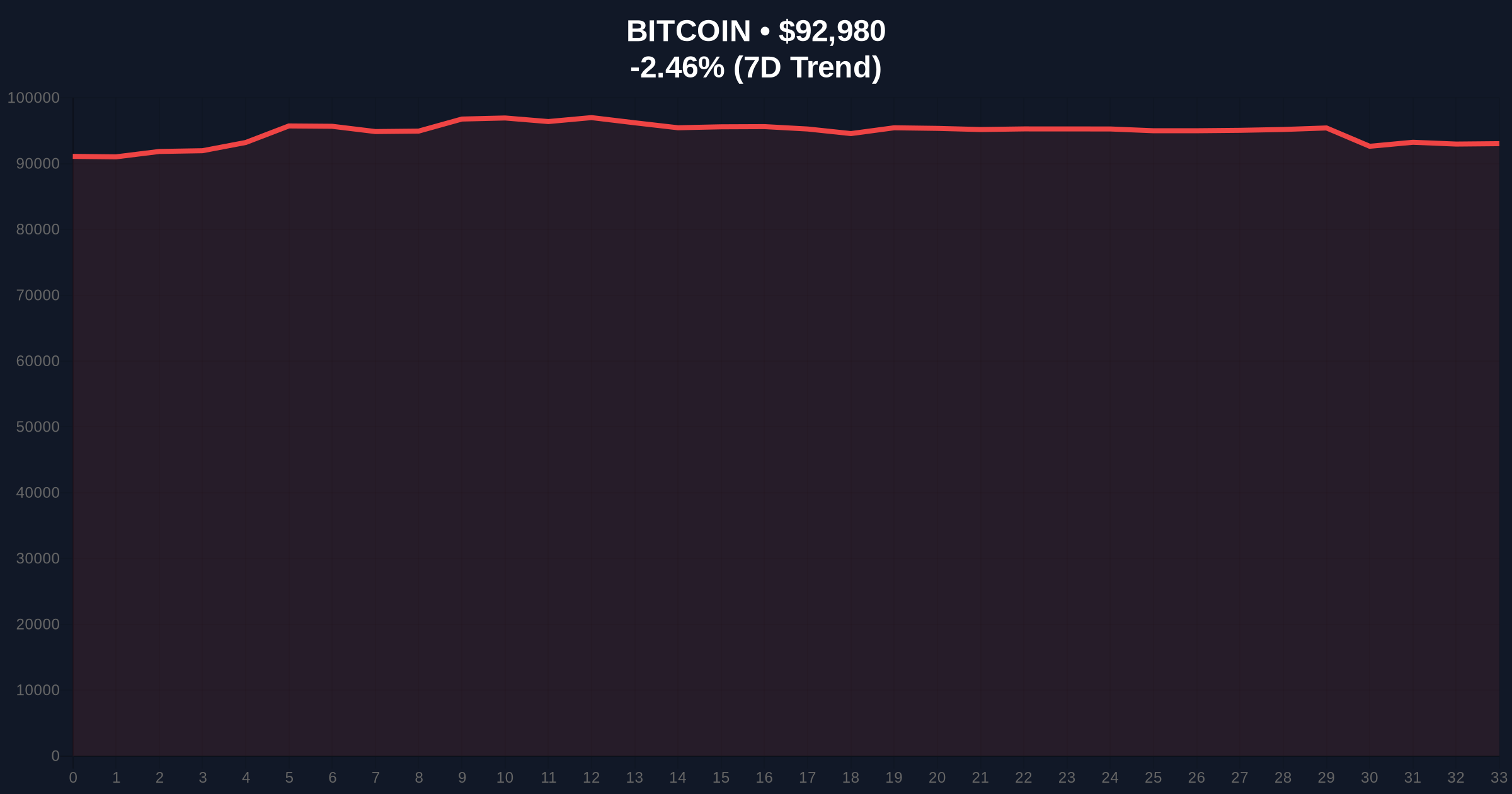

Bitcoin currently tests $92,980 with -2.46% 24-hour movement. Volume profile analysis shows significant liquidity between $90,000 and $93,500. The $92,000 level represents a critical psychological support zone tested during recent volatility. Market structure suggests a fair value gap exists between $94,800 and $96,200 from January's rapid decline. A sustained break above the 20-day exponential moving average at $93,400 would signal short-term bullish momentum. The relative strength index (RSI) at 42 indicates neutral momentum with bearish bias. Fibonacci retracement from the all-time high shows key support at $88,500 (61.8% level). Bullish invalidation occurs below $88,500 (200-day EMA confluence). Bearish invalidation requires closing above $95,200 (weekly order block resistance).

| Metric | Value | Significance |

|---|---|---|

| Current Bitcoin Price | $92,980 | Testing key support zone |

| 24-Hour Change | -2.46% | Moderate selling pressure |

| Crypto Fear & Greed Index | 44/100 (Fear) | Structural uncertainty dominates |

| ETF Holdings Percentage | 4.2% of supply | Institutional footprint metric |

| Critical Support Level | $88,500 | 200-day EMA + Fibonacci confluence |

Institutional impact is profound. ETF flows create continuous demand-side pressure uncorrelated with mining economics. According to the Federal Reserve's monetary policy framework, interest rate decisions now directly affect Bitcoin through institutional capital allocation decisions. Retail impact involves changed timing models. Traditional "post-halving accumulation" strategies may underperform in this new regime. The structural shift suggests Bitcoin behaves more like a risk asset than a commodity. This alters portfolio construction and hedging strategies across all market participants.

Market analysts express cautious adaptation. "The halving narrative provided clear timing signals," noted one quantitative researcher. "ETF flows introduce noise and different volatility characteristics." Bulls emphasize long-term institutional adoption despite short-term structural uncertainty. Bears point to potential gamma squeeze scenarios if ETF options volumes increase during volatility events. The consensus: traditional cycle analysis requires fundamental revision.

Bullish Case: Sustained ETF inflows exceed $500 million daily. Macro conditions favor risk assets with Federal Reserve easing. Price targets $110,000 by Q2 2026 as new market structure stabilizes. Retail capital rotation from equities provides additional momentum.

Bearish Case: ETF outflows persist amid regulatory uncertainty. Macro deterioration triggers risk-off sentiment. Price tests $82,000 support (EIP-4844 implementation anniversary level). Traditional cycle believers face maximum pain as old models fail.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.