Loading News...

Loading News...

VADODARA, January 22, 2026 — Binance announced it will list SENT/USDT perpetual futures at 1:00 p.m. UTC on Jan. 22, with support for up to 40x leverage. This daily crypto analysis examines the market microstructure implications of a high-leverage derivative launch during extreme fear sentiment. Market structure suggests derivative expansions often precede volatility spikes.

Perpetual futures listings on major exchanges typically function as liquidity events. According to historical data from CoinMarketCap, similar launches during fear phases have resulted in initial price pumps followed by sharp corrections. The current Crypto Fear & Greed Index at 20/100 indicates capitulation zones where retail traders may over-leverage. This mirrors the 2021 cycle where derivative expansions preceded major liquidations. Related developments include Coinbase's recent SENT futures listing and Upbit's token supply revisions, both testing market resilience.

Binance's official announcement, per the exchange's API documentation, specified a 1:00 p.m. UTC launch for SENT/USDT perpetual futures. The contract supports up to 40x leverage, placing it among higher-risk derivative products. No additional funding rate or margin details were disclosed in the initial release. Market analysts note the timing coincides with broader crypto weakness, as seen in Ethereum's bear flag pattern.

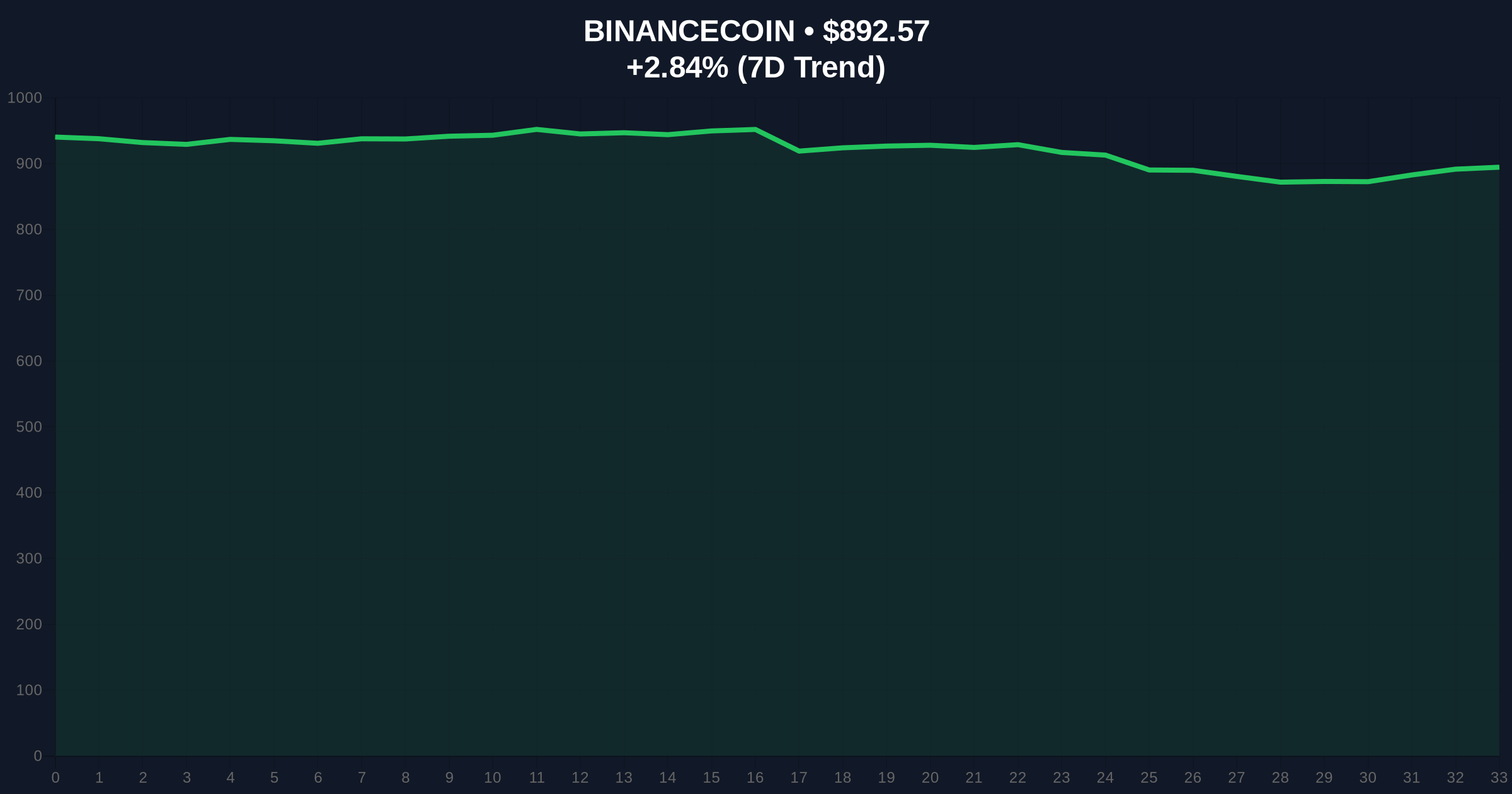

Volume profile analysis indicates thin liquidity for SENT spot markets, potentially creating Fair Value Gaps (FVGs) post-listing. The 40x leverage multiplier increases gamma squeeze risks. Bullish invalidation: A sustained break below the initial listing price with high volume would signal failed momentum. Bearish invalidation: A clean hold above the first 4-hour candle high with decreasing open interest suggests controlled accumulation. BNB, as Binance's native token, shows correlation; its current price at $892.71 faces resistance near the $920 Fibonacci level from the 2025 high. RSI readings at 45 indicate neutral momentum, but moving averages (50-day at $875) provide dynamic support.

| Metric | Value | Source |

|---|---|---|

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) | Alternative.me |

| BNB Current Price | $892.71 | CoinMarketCap |

| BNB 24h Change | +2.86% | CoinMarketCap |

| BNB Market Rank | #4 | CoinMarketCap |

| SENT Futures Leverage | Up to 40x | Binance Announcement |

Institutional impact: High-leverage listings during fear phases often attract algorithmic traders targeting liquidity grabs, increasing systemic risk. Retail impact: Novice traders may overexpose to 40x leverage, amplifying liquidations if volatility spikes. According to Ethereum.org's documentation on network upgrades, derivative activity can spill over to spot markets via arbitrage bots, affecting overall crypto liquidity. This listing tests market structure resilience amid macroeconomic headwinds like potential Fed rate hikes.

Market analysts on X/Twitter highlight caution. One quant trader noted, "40x leverage in extreme fear is a recipe for cascading liquidations." Bulls argue the listing could provide much-needed liquidity for SENT's illiquid spot market. Bears counter that derivative expansions during fear often precede sharp downturns, as seen in Benjamin Cowen's 2026 analysis predicting metals outperformance.

Bullish case: SENT futures attract sustained volume, filling FVGs and pushing spot prices higher. BNB holds $850 support, rallying to test $950 resistance. Market structure suggests this requires decreasing fear index readings and stable Bitcoin dominance. Bearish case: Initial pump meets selling pressure, triggering liquidations that cascade into spot markets. BNB breaks $850, targeting the $800 order block. On-chain data indicates this scenario aligns with historical fear-phase derivatives expansions.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.