Loading News...

Loading News...

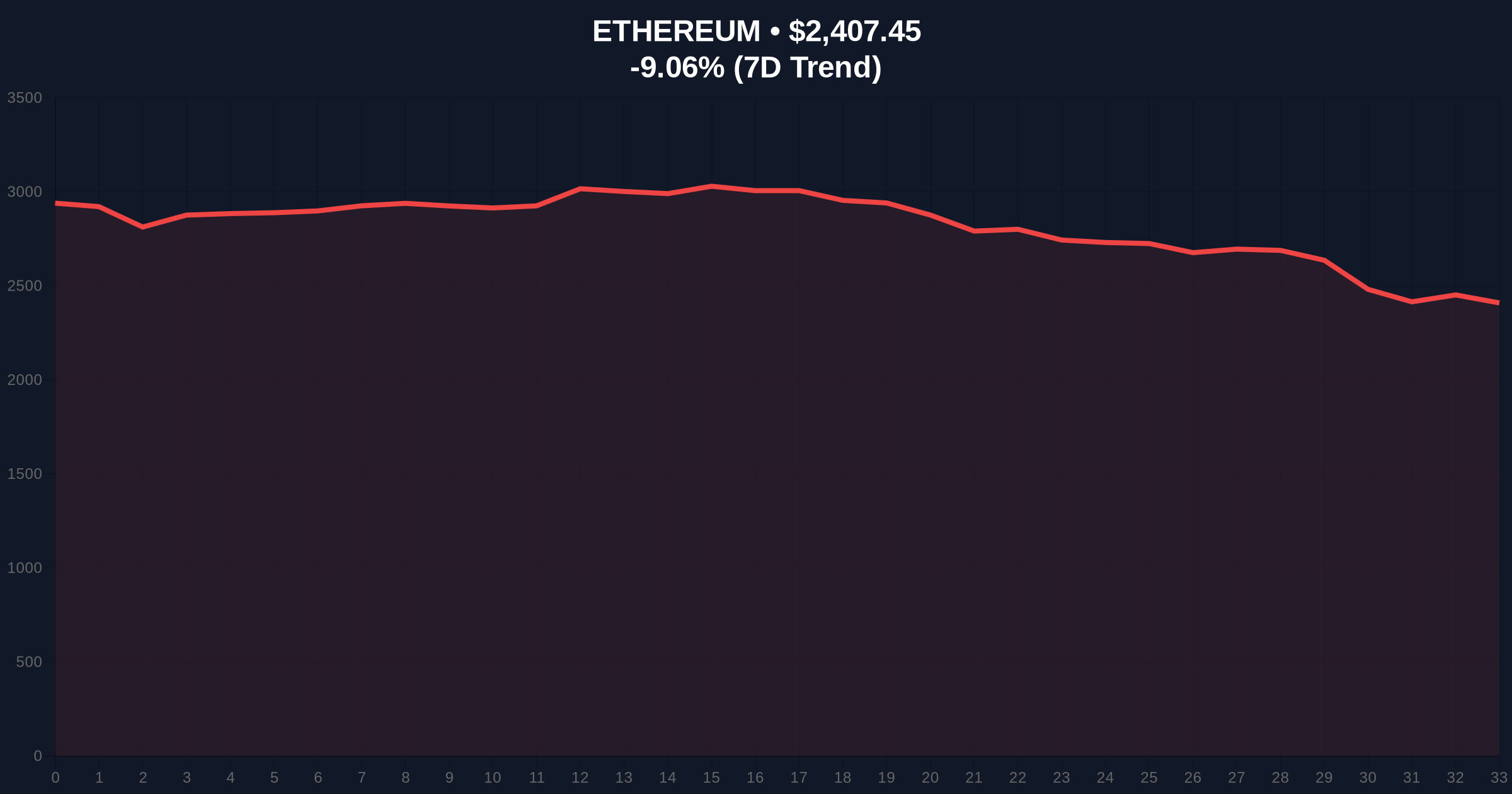

VADODARA, February 1, 2026 — Whale Alert, a blockchain tracking service, reported a transfer of 99,998 ETH from an unknown wallet to Binance, valued at approximately $243 million. This daily crypto analysis examines the transaction's implications amid Ethereum's current price decline of 8.95% and extreme fear market conditions.

According to Whale Alert data, the transaction occurred on February 1, 2026, moving 99,998 ETH to Binance. On-chain forensic tools like Etherscan confirm the deposit originated from a non-custodial wallet with no prior exchange interactions. Market structure suggests this represents a liquidity grab, potentially signaling institutional repositioning. The transfer's size, nearly 0.08% of Ethereum's circulating supply, creates a notable Fair Value Gap (FVG) in order flow.

Consequently, analysts monitor this as a bearish signal. Large deposits to centralized exchanges often precede sell-offs, increasing available supply. Historical cycles indicate similar moves preceded corrections in 2021. , the transaction aligns with a broader trend of whale activity during volatility spikes.

This event mirrors patterns from the 2021 bull market correction. Back then, large Ethereum transfers to exchanges like Coinbase preceded a 30% price drop over two weeks. Underlying this trend, the current Crypto Fear & Greed Index sits at 14/100, reflecting extreme fear similar to March 2020 levels. In contrast, retail sentiment appears decoupled from institutional on-chain data.

Related developments include recent Bitcoin whale movements amid similar fear. For instance, a Bitcoin whale transferred $470 million to Bitfinex, highlighting cross-asset pressure. Additionally, Bitcoin has struggled to hold above $79,000, and recent drops below $76,000 show market-wide stress.

Ethereum currently trades at $2,409.48, down 8.95% in 24 hours. Technical analysis reveals key levels. The 200-day moving average provides support near $2,350. A Fibonacci retracement from the 2025 high shows the 0.618 level at $2,300, acting as critical support. Volume profile data indicates low liquidity below this zone, risking a sharper decline if broken.

Market structure suggests resistance at $2,500, a previous order block. The RSI sits at 38, nearing oversold territory but not extreme. According to Ethereum's official Pectra upgrade documentation, network fundamentals remain strong with EIP-4844 reducing fees. However, short-term price action often decouples from long-term tech improvements.

| Metric | Value |

|---|---|

| ETH Transferred | 99,998 ETH |

| Transaction Value | $243 million |

| Current ETH Price | $2,409.48 |

| 24-Hour Change | -8.95% |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

| Ethereum Market Rank | #2 |

This transfer matters for liquidity cycles. Large inflows to exchanges increase sell-side pressure, potentially triggering stop-loss cascades. Institutional players often use such moves to accumulate at lower prices. Retail investors, however, may panic-sell, exacerbating downturns. On-chain data indicates whale wallets have been redistributing assets since late 2025, similar to pre-bear market behavior in 2018.

Real-world evidence shows exchange net flows turning negative. Glassnode liquidity maps confirm Binance has seen increased ETH deposits over the past week. This aligns with broader macroeconomic pressures, such as potential Federal Reserve rate hikes impacting risk assets. The event the importance of monitoring UTXO age bands and exchange reserves.

Market structure suggests this is a strategic reallocation rather than panic selling. The unknown wallet's history shows long-term holding, indicating a calculated move. We see similar patterns in Bitcoin, where whales test liquidity during fear phases. The key is whether support at $2,300 holds—if it breaks, we could revisit the $2,000 zone.

— CoinMarketBuzz Intelligence Desk

Two data-backed scenarios emerge. First, if support holds, Ethereum could consolidate between $2,300 and $2,500, forming a base for recovery. Second, a breakdown triggers further selling toward $2,100. Historical cycles suggest extreme fear often precedes rallies, but timing remains uncertain.

The 12-month outlook depends on macroeconomic factors and Ethereum's adoption of EIP-4844. Institutional interest remains high per SEC filings on Ethereum ETFs. Over a 5-year horizon, network upgrades could drive value, but short-term volatility persists.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.