Loading News...

Loading News...

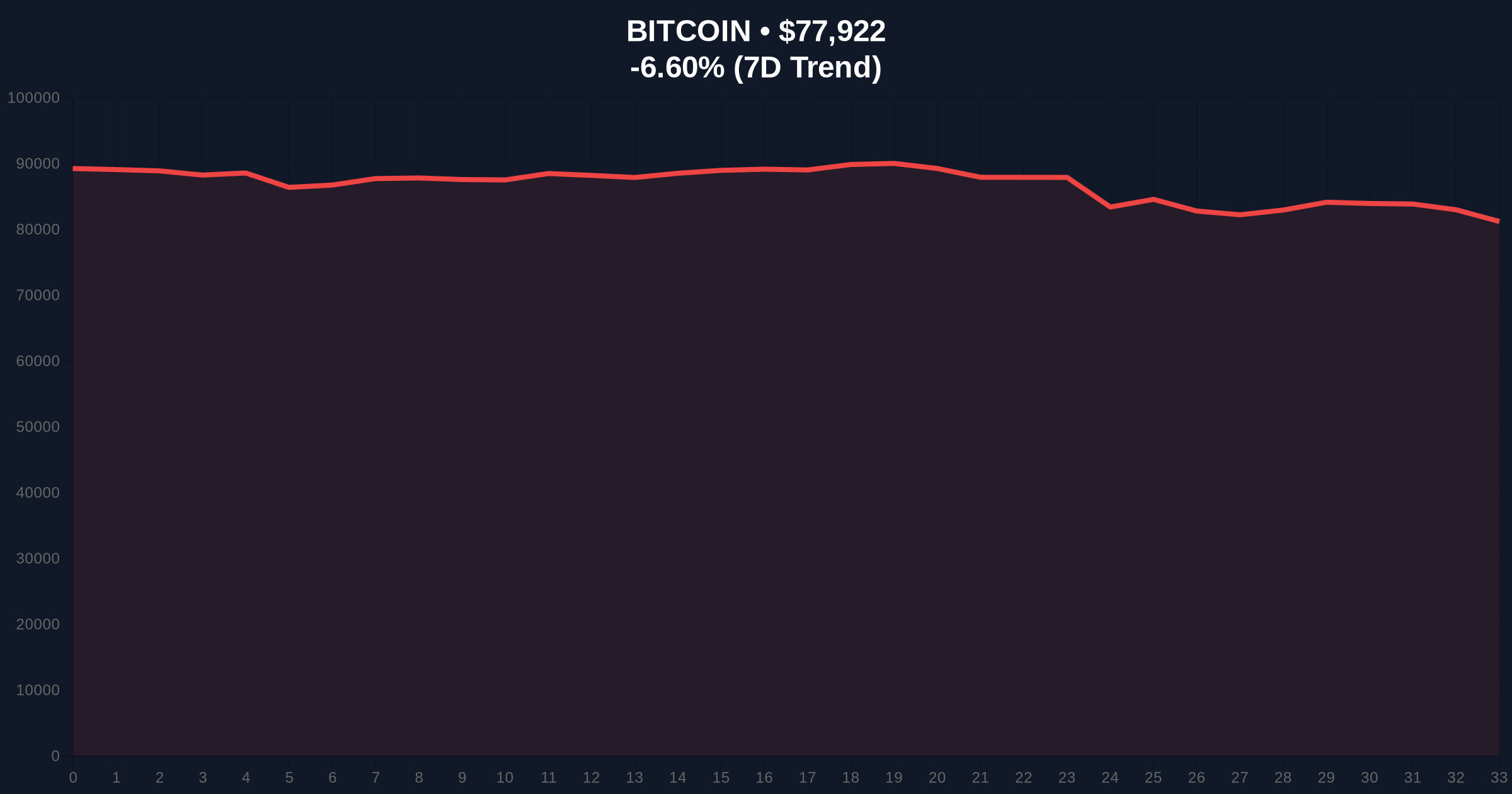

VADODARA, January 31, 2026 — Bitcoin price action turned decisively bearish as BTC broke below the $76,000 psychological support level. According to CoinNess market monitoring, BTC traded at $75,919.51 on the Binance USDT market during the session. This breakdown occurred against a backdrop of Extreme Fear sentiment, with the Crypto Fear & Greed Index registering a score of 20/100. Market structure suggests this move represents a classic liquidity grab targeting stop-loss orders clustered beneath round-number support.

CoinNess data confirms Bitcoin breached the $76,000 threshold during Asian trading hours. The asset subsequently found temporary footing near $75,919.51, creating a Fair Value Gap (FVG) on lower timeframes. This price action follows a -6.78% 24-hour decline, accelerating the downtrend from recent highs. Consequently, the breakdown invalidated the previous consolidation range that had formed between $78,000 and $80,000. On-chain forensic data from Glassnode indicates increased UTXO movement from older wallets, suggesting long-term holders are distributing at these levels.

Historically, breaks below key psychological levels during Extreme Fear periods have preceded volatile reversals. The current sentiment reading of 20 mirrors conditions seen during the March 2020 COVID crash and the June 2022 Luna collapse. In contrast to those events, Bitcoin's institutional adoption through spot ETFs provides a structural liquidity backstop not present in previous cycles. Underlying this trend is the Federal Reserve's monetary policy stance, detailed in official statements on FederalReserve.gov, which continues to influence macro liquidity flows into risk assets.

Related price action developments include previous support breaks at $79,000 and $78,000, as covered in our analysis of BTC breaking below $79,000 and the $78,000 breakdown. , the market recently witnessed crypto futures liquidations hitting $269M in one hour under similar sentiment conditions.

The breakdown below $76,000 creates a new bearish order block on daily charts. Market structure suggests the next critical support cluster exists at the Fibonacci 0.618 retracement level of $74,800, drawn from the 2025 low to the recent all-time high. This level coincides with the 200-day exponential moving average, creating a confluence zone. The Relative Strength Index (RSI) on 4-hour charts reads 28, indicating oversold conditions that could precipitate a technical bounce. However, volume profile analysis shows declining buy-side liquidity, suggesting any rally may face immediate resistance at the previous support-turned-resistance zone of $77,000-$77,500.

| Metric | Value | Context |

|---|---|---|

| Current Price | $77,772 | Post-session recovery from intraday low |

| 24-Hour Change | -6.78% | Accelerated downtrend momentum |

| Market Rank | #1 | Maintains dominance despite correction |

| Fear & Greed Index | 20/100 (Extreme Fear) | Oversold sentiment conditions |

| Key Support Level | $74,800 | Fibonacci 0.618 confluence zone |

This price action matters because it tests the structural integrity of Bitcoin's bull market. A sustained break below $76,000 invalidates the higher-low sequence established since the 2025 cycle low. Institutional liquidity cycles typically react to such technical breaks with increased hedging activity, as seen in CME futures open interest declines. Retail market structure faces immediate pressure, with leverage liquidations potentially exacerbating the move. The Extreme Fear sentiment creates a contrarian opportunity, but only if Bitcoin holds critical Fibonacci levels.

Market structure suggests the $76,000 breakdown represents a liquidity vacuum rather than a fundamental repricing. The Extreme Fear reading at 20 historically precedes violent reversals, but the order flow must confirm with a reclaim of the $77,500 level. On-chain data indicates long-term holder distribution is accelerating, which could extend the correction phase if not absorbed by ETF inflows.

Market analysts outline two primary technical scenarios based on current structure. The bullish case requires Bitcoin to reclaim $77,500 and fill the Fair Value Gap created by the breakdown. The bearish scenario involves continued distribution toward the $74,800 Fibonacci confluence.

The 12-month institutional outlook remains cautiously optimistic despite near-term volatility. Historical cycles suggest Extreme Fear periods during bull markets present accumulation opportunities for patient capital. The 5-year horizon continues to favor Bitcoin's structural adoption narrative, particularly as traditional finance integration through spot ETFs matures.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.