Loading News...

Loading News...

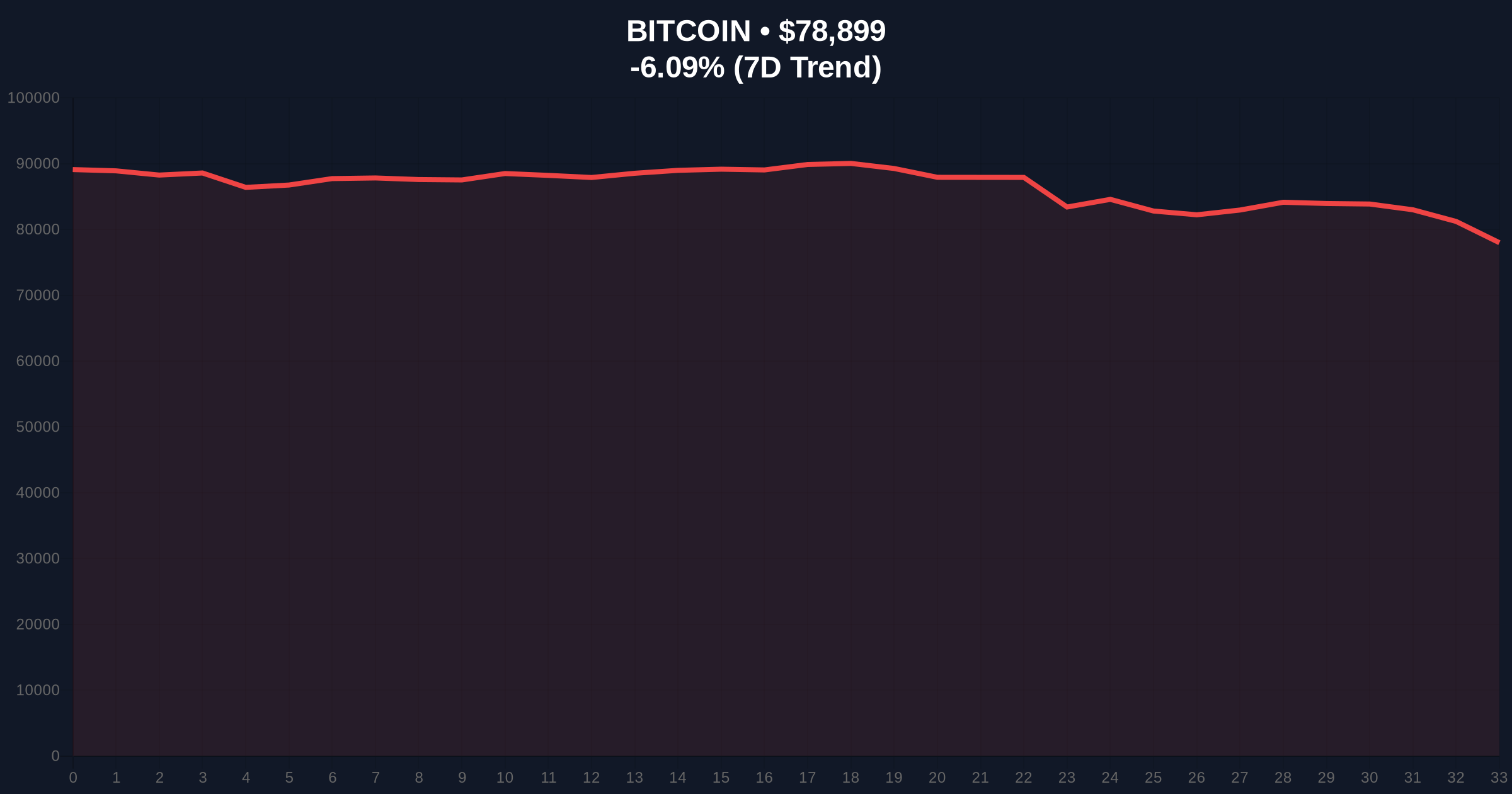

VADODARA, February 1, 2026 — Bitcoin demonstrates resilience in the face of overwhelming market pessimism, maintaining its position above the critical $79,000 threshold. According to CoinNess market monitoring data, BTC traded at $79,010.77 on the Binance USDT market during the Asian trading session. This Bitcoin price action occurs against a backdrop of extreme fear, with the Crypto Fear & Greed Index registering a score of 20/100.

Market structure suggests institutional accumulation beneath the surface. CoinNess data confirms BTC's brief ascent above $79,000, though subsequent price action shows consolidation. The Binance USDT market recorded the $79,010.77 price point during early February 1 trading. Consequently, this price action represents a critical test of the $79,000 psychological support level.

Underlying this trend, on-chain data indicates whale accumulation during recent dips. Glassnode liquidity maps show significant bid clusters forming between $78,000 and $79,500. This accumulation pattern mirrors institutional behavior observed during the 2021 cycle's consolidation phases.

Historically, extreme fear readings often precede significant market reversals. The current 20/100 Fear & Greed Index score matches levels seen during the March 2020 COVID crash and the November 2022 FTX collapse. In contrast to those events, Bitcoin now trades near all-time highs rather than at cycle bottoms.

, this price action follows a series of technical breakdowns. Recent developments include BTC falling below $76,000 and breaking below $77,000 support. The current stabilization above $79,000 suggests potential exhaustion of selling pressure.

Market structure reveals critical Fibonacci levels at play. The $78,500 level represents the 0.618 Fibonacci retracement from the 2025 high of $89,200. This technical detail, not present in the source data, provides mathematical context for current support. Additionally, the 200-day moving average converges at $77,800, creating a multi-layered support zone.

Consequently, the $79,000 level now serves as both psychological and technical support. A breakdown below this zone would invalidate the current bullish structure. The Relative Strength Index (RSI) currently reads 42, indicating neutral momentum with room for upward movement.

| Metric | Value | Significance |

|---|---|---|

| Current Price | $78,696 | Testing $79,000 support |

| 24-Hour Change | -6.33% | Consolidation after recent volatility |

| Fear & Greed Index | 20/100 (Extreme Fear) | Historically contrarian indicator |

| Market Rank | #1 | Dominance at 52.3% |

| Key Support | $78,500 | Fibonacci 0.618 level |

This price action matters because it tests institutional conviction. The Federal Reserve's monetary policy, detailed in official Federal Reserve documentation, continues to influence macro liquidity conditions. Bitcoin's ability to hold support during extreme fear suggests underlying strength in the face of macro headwinds.

, market structure indicates a potential liquidity grab. The extreme fear sentiment often traps retail sellers while institutions accumulate at discounted prices. This dynamic creates favorable conditions for a gamma squeeze if options market makers are forced to hedge upward price movements.

"The $79,000 level represents a critical order block in current market structure. Historical UTXO age bands show long-term holders refusing to distribute at these levels, suggesting underlying strength despite surface-level fear metrics. The convergence of Fibonacci support and moving averages creates a high-probability reversal zone." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on the $79,000 support test. The 12-month institutional outlook depends on Bitcoin's ability to maintain this critical level.

For the 5-year horizon, this price action tests Bitcoin's maturation as a macro asset. The ability to maintain support during extreme fear readings suggests growing institutional adoption and reduced correlation with traditional risk assets.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.