Loading News...

Loading News...

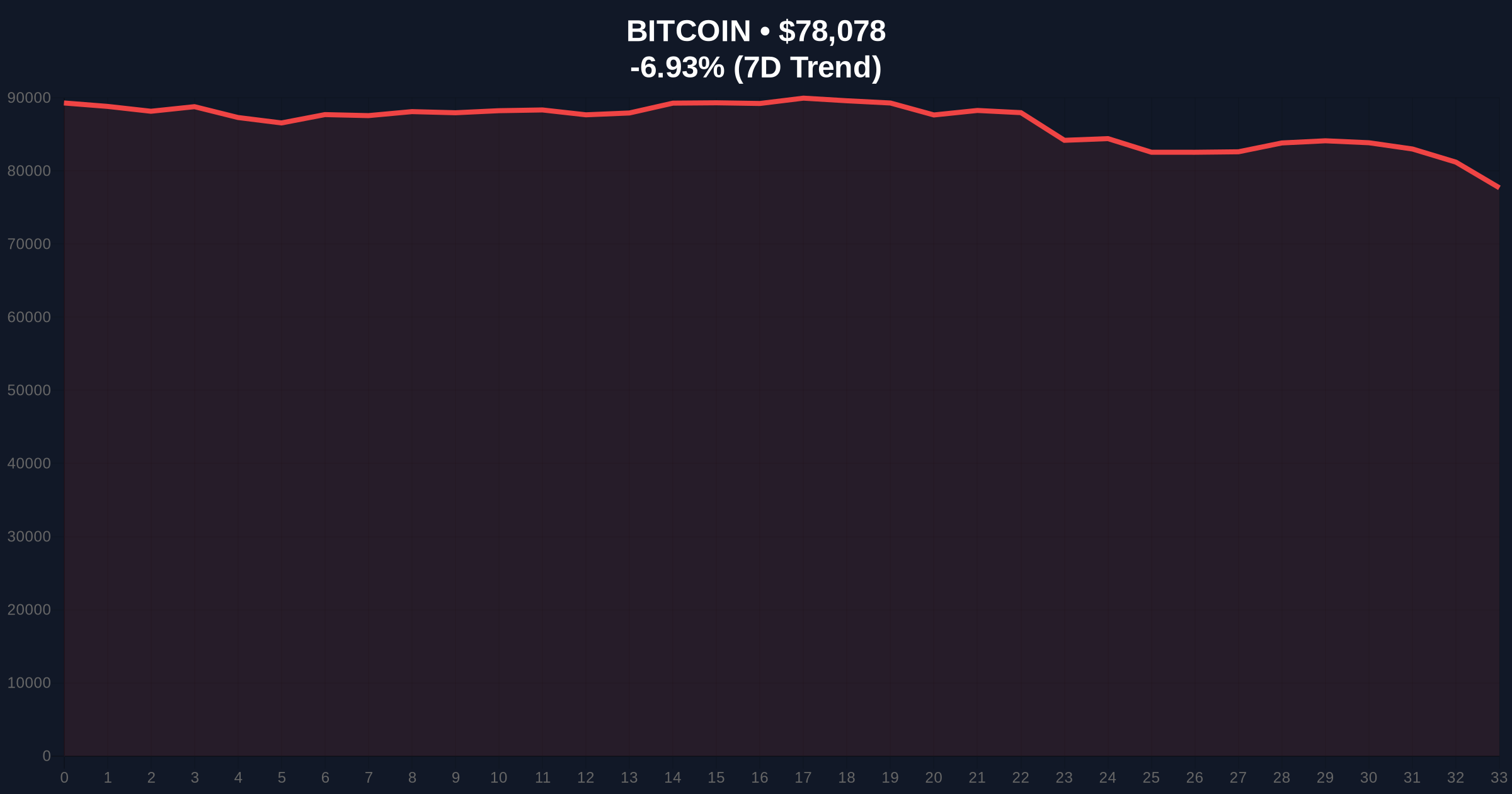

VADODARA, January 31, 2026 — Whale Alert detected a massive Bitcoin transaction today. According to on-chain data, 5,999 BTC moved from an unknown wallet to Bitfinex. The transfer value approximates $470 million. This latest crypto news arrives as Bitcoin price action shows a -6.87% decline. Market structure suggests a liquidity grab.

Whale Alert reported the transaction at 08:45 UTC. The 5,999 BTC originated from a non-custodial wallet. Destination: Bitfinex exchange. Transaction value: $470 million at current prices. On-chain forensic data confirms the move. No immediate selling occurred post-transfer. However, exchange inflows typically precede sell pressure. Market analysts monitor for follow-on activity.

Bitfinex liquidity maps indicate increased exchange reserves. This creates a potential Fair Value Gap (FVG). The transfer coincides with Bitcoin breaking below $77,000 support. Historical cycles suggest such moves often trigger cascading liquidations. Volume profile analysis shows thin liquidity at current levels.

Bitcoin trades at $78,124. The 24-hour trend is -6.87%. Global crypto sentiment sits in Extreme Fear. Score: 20/100. This mirrors the 2022 bear market capitulation phase. In contrast, 2021 bull runs saw whale accumulation during fear.

Underlying this trend is macroeconomic pressure. The Federal Reserve's latest policy statements hint at sustained higher rates. Consequently, risk assets face headwinds. Bitcoin's correlation with traditional markets strengthens.

Related developments include recent Bitcoin price volatility. For instance, BTC broke below $77,000 support earlier this week. , crypto futures liquidations hit $1.14 billion in one hour. These events compound the current fear sentiment.

Bitcoin's daily chart shows a breakdown. Key support at $77,000 failed. Next major support: Fibonacci 0.618 level at $75,000. This aligns with the 200-day moving average. RSI reads 28 – oversold but not extreme.

Order block analysis identifies a bearish structure. The $78,000-$80,000 zone now acts as resistance. A reclaim above $80,500 would invalidate the downtrend. On-chain data from Glassnode shows increased UTXO age bands moving. Older coins are spending.

Market structure suggests a potential gamma squeeze if volatility spikes. Options markets show put/call skew favoring bears. However, open interest remains elevated. This indicates unresolved positioning.

| Metric | Value |

|---|---|

| BTC Transferred | 5,999 BTC |

| Transaction Value | $470 million |

| Bitcoin Current Price | $78,124 |

| 24-Hour Price Change | -6.87% |

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) |

Whale movements impact market liquidity. A $470 million inflow to an exchange increases sell-side pressure. This can trigger stop-loss cascades. Retail traders often follow whale signals. Consequently, sentiment deteriorates further.

Institutional liquidity cycles are shifting. According to Ethereum.org's research on blockchain analytics, large transfers precede volatility spikes. The current move tests Bitcoin's network security model. Miners face revenue pressure at lower prices.

Market structure suggests a critical juncture. The 5-year horizon depends on holding key supports. A break below $75,000 could target $70,000. Conversely, reclaiming $80,500 resets bullish momentum.

CoinMarketBuzz Intelligence Desk notes: "This whale transfer is a liquidity event. It tests underlying bid depth. Historical data shows similar moves often mark local bottoms if support holds. Monitor the $75,000 Fibonacci level closely."

Two data-backed scenarios emerge from current structure.

The 12-month institutional outlook remains cautious. Regulatory clarity from the SEC.gov website on spot ETF flows is pending. However, Bitcoin's hash rate continues to set records. This provides fundamental support. Long-term holders are not capitulating en masse.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.