Loading News...

Loading News...

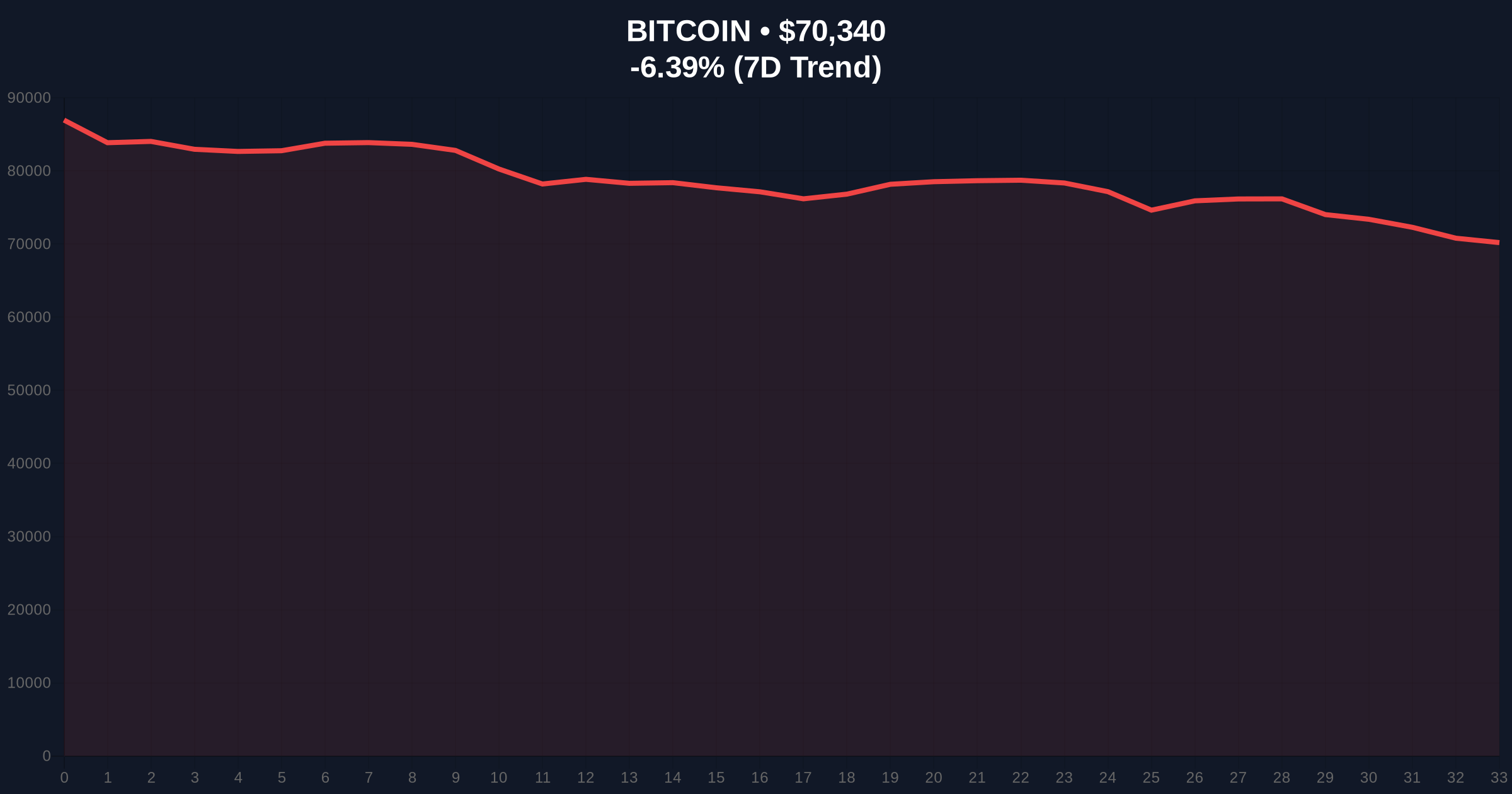

VADODARA, February 5, 2026 — Bitcoin trades at $70,197, down 6.06% in 24 hours. Deutsche Bank attributes the decline to a confidence crisis among institutional investors and regulatory delays. This is the latest crypto news shaping market structure. The bank's report dismisses structural market flaws as the cause. Instead, it points to eroding faith in Bitcoin's "digital gold" narrative.

According to Deutsche Bank's analysis, Bitcoin's price action stems from weakening institutional confidence. The bank identified three primary headwinds. Continuous institutional outflows pressure liquidity. The breakdown in Bitcoin's correlation with traditional markets isolates it. Regulatory uncertainty, specifically delays in the U.S. CLARITY Act, amplifies volatility. Market structure suggests this is a sentiment-driven correction. Not a fundamental collapse.

Deutsche Bank's data shows Bitcoin falling this year. Gold has risen over 60%. This divergence erodes the "digital gold" thesis. The correlation with the S&P 500 has also weakened significantly. On-chain data indicates this price action represents a give-back of gains from the past two years. A step toward maturity, not a breakdown.

Historically, Bitcoin corrections often precede regulatory clarity phases. The 2018 bear market followed ICO crackdowns. The 2022 downturn coincided with macro tightening. In contrast, the current sell-off lacks a single catastrophic catalyst. Underlying this trend is a slow bleed of institutional conviction. Market analysts note parallels to the 2019 accumulation phase. A period of low sentiment before the 2021 bull run.

Related developments highlight contrasting institutional behavior. For instance, DDC Enterprise recently purchased 105 Bitcoin amid the fear. , JPMorgan has declared Bitcoin superior to gold for long-term holdings. This creates a fragmented institutional .

Bitcoin's price sits at a critical juncture. The $70,197 level tests the 50-day moving average. A breakdown below $68,500—the Fibonacci 0.618 retracement from the 2025 low—would signal deeper correction. The Relative Strength Index (RSI) hovers near 35. Indicating oversold conditions but not extreme capitulation.

Volume profile analysis shows thinning liquidity above $72,000. This creates a Fair Value Gap (FVG) that price may need to fill. The order block between $69,000 and $70,500 is currently under siege. A sustained break below this zone would invalidate the near-term bullish structure. UTXO age bands indicate older coins remain dormant. Suggesting long-term holders are not panicking.

| Metric | Value | Context |

|---|---|---|

| Bitcoin Current Price | $70,197 | Down 6.06% in 24h |

| Crypto Fear & Greed Index | 12/100 (Extreme Fear) | Lowest since Q4 2025 |

| Gold YTD Performance | +60%+ | Per Deutsche Bank comparison |

| Key Fibonacci Support | $68,500 | 0.618 retracement level |

| Institutional Outflow Trend | Continuous | Primary headwind per report |

Deutsche Bank's analysis shifts the narrative. It frames the drop as a confidence crisis, not a market collapse. This matters for portfolio construction. Institutional liquidity cycles depend on regulatory clarity. The delayed CLARITY Act directly impacts this. Retail market structure often follows institutional sentiment. A prolonged confidence vacuum could extend the consolidation phase.

Real-world evidence supports this. The breakdown in Bitcoin-stock correlation reduces its hedging utility. The loss of "digital gold" status challenges its store-of-value narrative. According to on-chain data from Glassnode, exchange outflows have slowed. Indicating reduced selling pressure from long-term holders. The market is in a re-pricing phase.

"The current downturn represents a maturation process. Bitcoin is shedding speculative excess and confronting regulatory reality. This is healthy for long-term adoption. The key is whether institutional confidence stabilizes before technical support breaks." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios. Scenario A: Confidence returns with regulatory progress. Price reclaims the $72,000 FVG and challenges $75,000. Scenario B: Institutional outflows persist. Price breaks the $68,500 Fibonacci support. Targets the $65,000 volume node.

The 12-month outlook hinges on regulatory clarity. The U.S. CLARITY Act's progression is critical. Historical cycles suggest that post-correction periods often see strong rallies. If institutional confidence rebounds, Bitcoin could re-establish its correlation with macro assets. The 5-year horizon remains intact for blockchain adoption, as outlined in Ethereum's development roadmap for scalable infrastructure.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.