Loading News...

Loading News...

VADODARA, February 5, 2026 — JPMorgan Chase & Co. has issued a seismic institutional assessment. According to a report obtained by Walter Bloomberg, the banking giant now views Bitcoin as a more attractive long-term investment than gold. This daily crypto analysis examines the technical underpinnings of this shift. Market structure suggests a fundamental re-rating is underway.

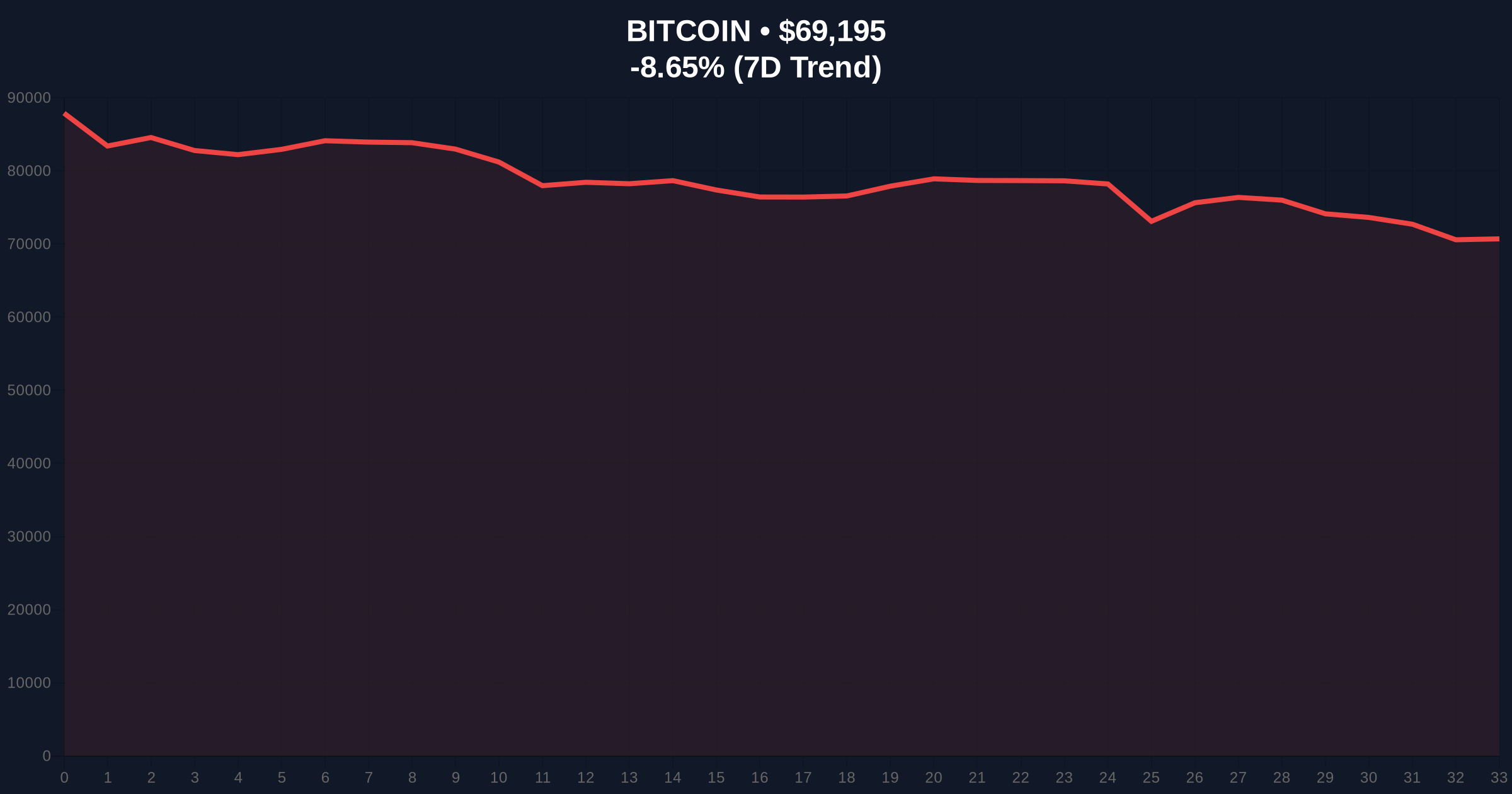

JPMorgan's analysis hinges on two quantitative pillars. First, Bitcoin's current price sits significantly below its estimated production cost of $87,000. This level has historically acted as a hard support floor. Second, Bitcoin's volatility relative to gold has collapsed to an all-time low. The bank interprets this as increased stability. Consequently, it signals greater long-term upside potential for the cryptocurrency.

Walter Bloomberg reported the findings. The analysis followed a sharp rise in gold prices and increased volatility in the precious metal. JPMorgan's report directly compares the two asset classes. It concludes Bitcoin now offers superior appeal for long-term portfolios. This marks a moment for institutional adoption narratives.

Historically, gold has served as the ultimate store-of-value asset. Bitcoin has challenged this status for over a decade. In contrast, JPMorgan's endorsement represents a watershed. It mirrors the 2020-2021 cycle when MicroStrategy began its treasury allocation strategy. Underlying this trend is a search for non-correlated assets amid macroeconomic uncertainty.

Related developments highlight the current market stress. Crypto futures liquidations recently hit $113M hourly. , MicroStrategy's $4.6B Bitcoin loss and a Bitcoin capitulation indicator at a 2-year high signal extreme volatility risk. These events create the backdrop for JPMorgan's contrarian call.

Market structure suggests the $87,000 production cost is the critical order block. This aligns with the 0.786 Fibonacci retracement level from the 2025 all-time high. On-chain data from Glassnode indicates miner capitulation is nearing a local bottom. The 200-week moving average provides secondary support near $62,000.

Bitcoin's realized volatility has compressed dramatically. This creates a massive Fair Value Gap (FVG) on higher timeframes. A volatility expansion is statistically imminent. The Relative Strength Index (RSI) on weekly charts shows oversold conditions. This often precedes powerful mean reversion rallies. The Federal Reserve's monetary policy stance, detailed on FederalReserve.gov, remains a key macro driver for both assets.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 12/100 (Extreme Fear) | Contrarian bullish signal |

| Bitcoin Current Price | $69,243 | ~21% below production cost |

| 24-Hour Price Trend | -8.58% | Short-term selling pressure |

| Bitcoin vs. Gold Volatility | All-Time Low | Increased stability perception |

| JPMorgan's Key Support | $87,000 | Production cost floor |

This analysis matters for portfolio construction. It provides a data-backed rationale for asset allocation shifts. Institutional liquidity cycles typically follow such flagship reports. Retail market structure often lags by 6-12 months. The report validates Bitcoin's store-of-value narrative at an institutional level.

Real-world evidence supports the shift. Gold ETF outflows have accelerated in Q1 2026. Bitcoin ETF inflows, despite price declines, show steadfast institutional accumulation. This divergence highlights a changing perception of risk and return. The 5-year horizon now favors digital scarcity over physical scarcity.

"JPMorgan's pivot is not about short-term price action. It's a structural assessment of capital efficiency. The production cost model provides a quantitative anchor that gold lacks. When volatility compresses to these levels, the subsequent expansion is typically explosive. This sets up a potential gamma squeeze in derivatives markets." — CoinMarketBuzz Intelligence Desk

Two primary scenarios emerge from current market structure.

The 12-month institutional outlook is cautiously optimistic. JPMorgan's report provides a fundamental floor. However, macroeconomic headwinds and regulatory developments, like the Brazilian algorithmic stablecoin ban bill, could pressure short-term liquidity. The 5-year horizon strongly favors Bitcoin's network effects over gold's static supply.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.