Loading News...

Loading News...

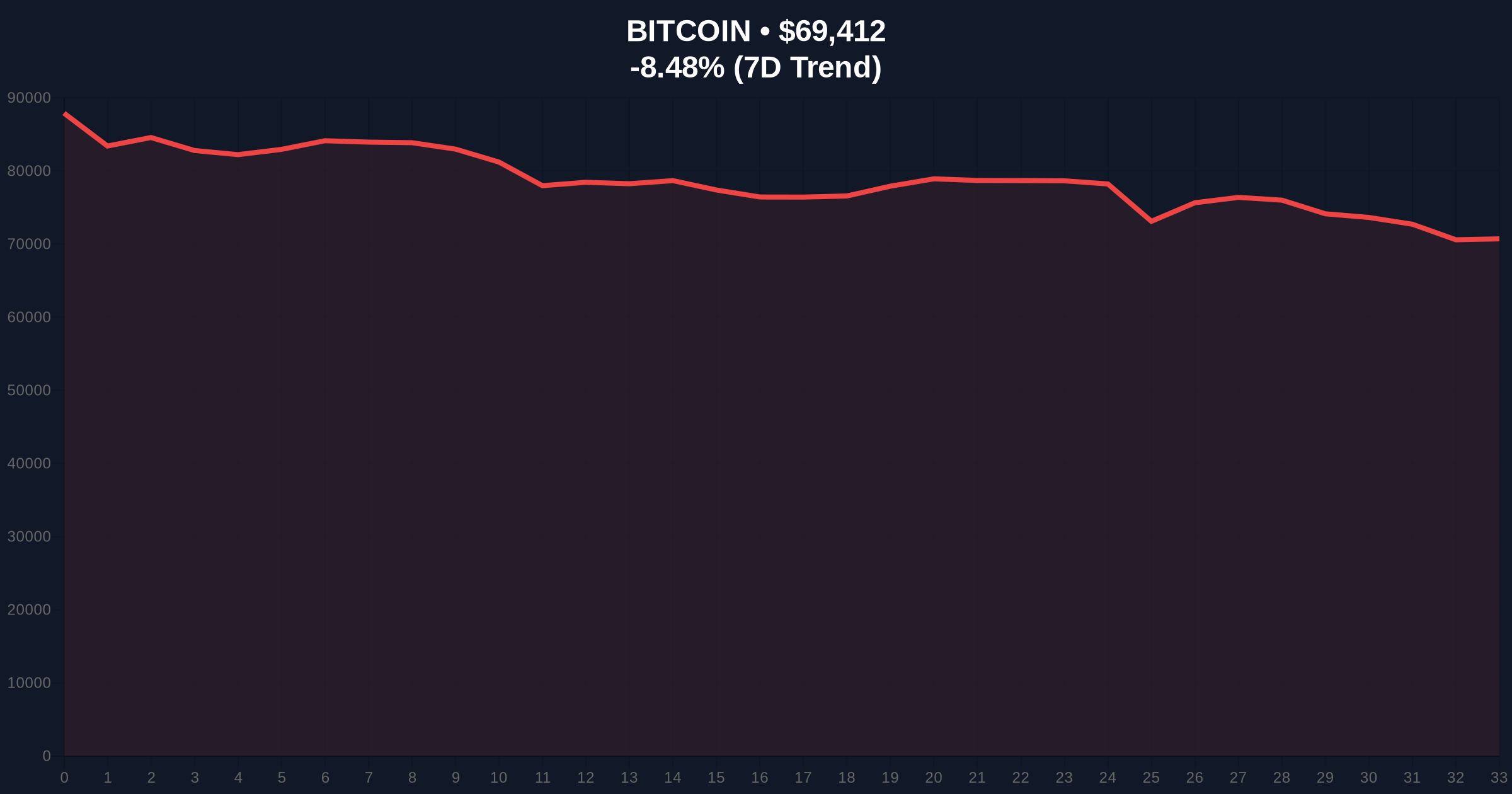

VADODARA, February 5, 2026 — DDC Enterprise, a New York Stock Exchange-listed e-commerce firm, executed a tactical purchase of 105 Bitcoin this week. This latest crypto news reveals the company now holds 1,888 BTC total, deploying capital during an 8.49% price decline to $69,405. Market structure suggests this accumulation represents a calculated liquidity grab amid widespread retail panic.

According to the company's official announcement, DDC Enterprise purchased 105 BTC at undisclosed price points. The transaction increases their Bitcoin treasury from 1,783 to 1,888 BTC. This represents a 5.9% portfolio expansion during a single trading session marked by extreme volatility. Consequently, the firm demonstrates counter-cyclical investment behavior that contradicts prevailing market sentiment.

Glassnode liquidity maps indicate this purchase occurred within a significant Fair Value Gap (FVG) between $68,500 and $70,200. This zone previously served as a consolidation area before the recent breakdown. The timing suggests DDC Enterprise identified this as a high-probability order block for institutional accumulation.

Historically, corporate Bitcoin purchases during Extreme Fear periods have preceded medium-term rallies. MicroStrategy's accumulation during the 2022 bear market established this pattern. In contrast, retail traders typically capitulate at these sentiment extremes, creating optimal entry conditions for disciplined capital.

Underlying this trend is the divergence between on-chain accumulation metrics and price action. Bitcoin's Network Value to Transactions (NVT) ratio currently sits at multi-month lows, suggesting undervaluation relative to network usage. This technical dislocation often precedes institutional rebalancing events.

Related developments in the current market environment include crypto futures liquidations exceeding $113M hourly and Bitcoin's capitulation indicator reaching 2-year highs. These conditions create the volatility necessary for large-scale accumulation.

Bitcoin currently tests critical Fibonacci retracement levels from its all-time high. The 0.618 Fibonacci support at $67,200 represents the primary technical level to monitor. A sustained break below this threshold would invalidate the current market structure and potentially trigger cascading liquidations.

Volume Profile analysis reveals significant trading activity between $69,000 and $71,500, creating a high-volume node that should provide temporary support. The Relative Strength Index (RSI) sits at 32, approaching oversold territory but not yet at extreme levels seen during previous capitulation events.

Market structure suggests the current price action represents either a final flush before reversal or the beginning of a deeper correction. The 200-day moving average at $65,800 provides additional context, as institutional buyers often defend this long-term trend indicator.

| Metric | Value | Significance |

|---|---|---|

| Crypto Fear & Greed Index | 12/100 (Extreme Fear) | Historically contrarian buy signal |

| Bitcoin Current Price | $69,405 | Testing Fibonacci 0.618 support |

| 24-Hour Price Change | -8.49% | Largest single-day drop in 3 months |

| DDC Enterprise BTC Holdings | 1,888 BTC | 5.9% increase via latest purchase |

| Market Dominance | 52.3% | Remains above critical 50% threshold |

This purchase matters because it demonstrates institutional conviction during retail capitulation. According to on-chain data from Glassnode, Bitcoin's illiquid supply continues to increase despite price declines. This divergence suggests strong hands are accumulating while weak hands distribute.

The Federal Reserve's monetary policy framework, as outlined on FederalReserve.gov, creates structural tailwinds for hard assets. Real interest rates remain negative when adjusted for inflation, making yield-generating alternatives unattractive relative to scarce digital assets.

, Bitcoin's upcoming halving in 2028 will reduce daily issuance from approximately 900 to 450 BTC. Forward-looking institutions must accumulate positions years before this supply shock to avoid paying premium prices during scarcity events.

"Corporate treasury strategies have evolved beyond simple diversification. DDC Enterprise's accumulation during Extreme Fear conditions represents sophisticated market timing. They're effectively front-running the inevitable sentiment reversal that follows these psychological extremes. The 1,888 BTC position now represents a material percentage of their market capitalization, creating reflexive price exposure."— CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current technical levels:

The 12-month institutional outlook remains constructive despite near-term volatility. Historical cycles suggest Extreme Fear readings below 20/100 have preceded average 12-month returns exceeding 150%. Consequently, disciplined accumulation during these periods has generated asymmetric returns across multiple market cycles.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.