Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

- Metaplanet approves dividend-paying preferred stock targeting overseas institutional investors seeking Bitcoin exposure

- Market structure suggests this represents a liquidity grab during extreme fear sentiment (25/100)

- Technical analysis shows Bitcoin at $89,651 with critical Fibonacci support at $82,000

- Structural contradictions emerge between growth-focused Bitcoin strategy and traditional income securities

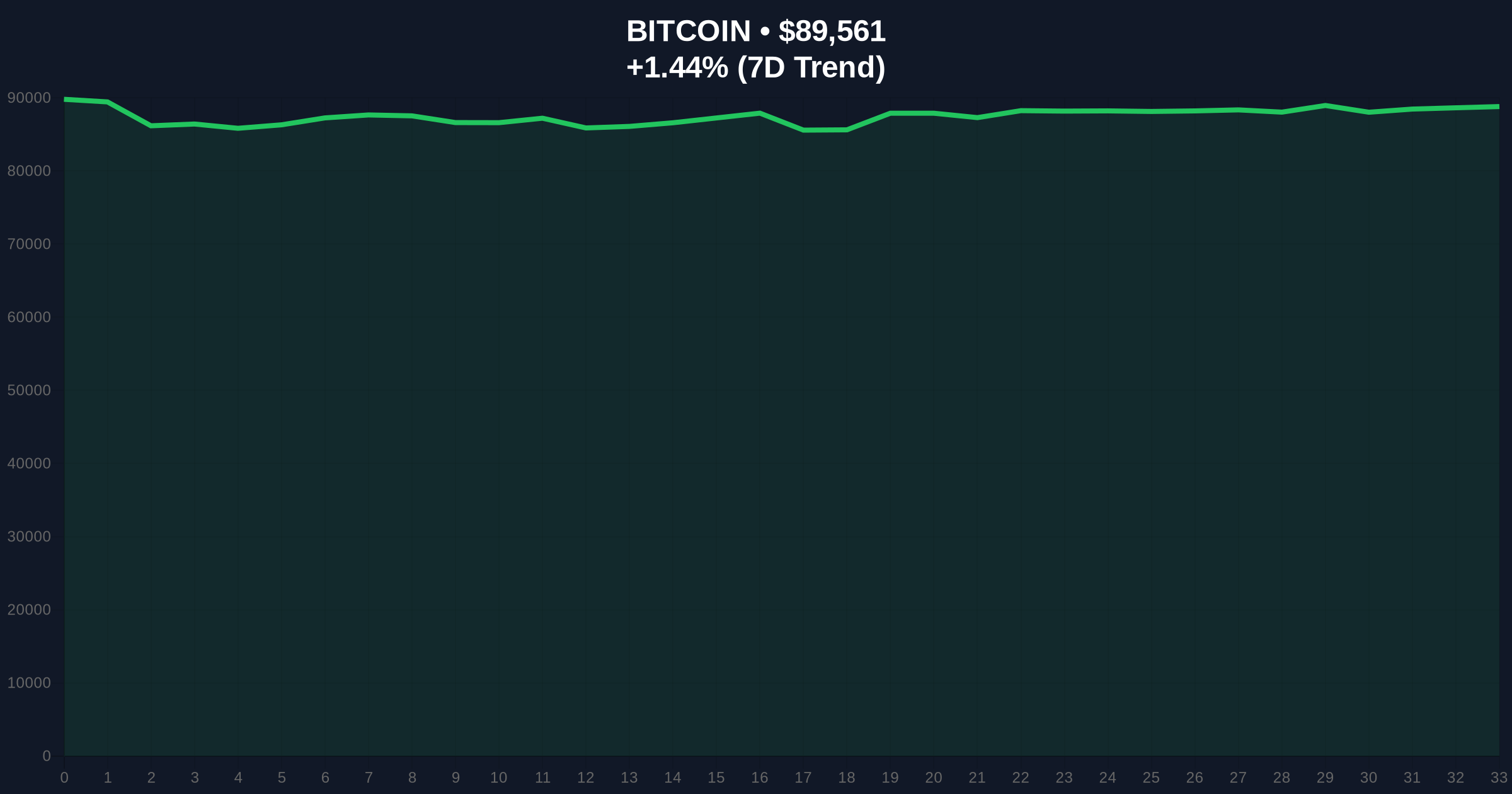

VADODARA, December 22, 2025 — In a move that represents a significant pivot in corporate Bitcoin strategy, Japanese publicly listed company Metaplanet has approved the issuance of dividend-paying preferred stock specifically targeting foreign institutional investors. This daily crypto analysis examines whether this represents genuine innovation or a structural contradiction that exposes deeper market vulnerabilities. Market structure suggests this announcement arrives during extreme fear sentiment with Bitcoin trading at $89,651, creating potential for a liquidity grab rather than sustainable institutional adoption.

Metaplanet's announcement occurs against a backdrop of increasing corporate Bitcoin adoption but persistent regulatory uncertainty. The company's previous strategy mirrored MicroStrategy's aggressive accumulation approach, positioning Bitcoin as a primary treasury reserve asset. However, the shift to dividend-paying securities represents a fundamental departure from this growth-focused model. Market structure suggests this mirrors patterns observed during previous market contractions where corporations pivot to income-generating strategies to attract capital during periods of volatility. The timing is particularly notable given current global crypto sentiment registering "Extreme Fear" at 25/100, indicating potential capitulation phases that often precede institutional accumulation.

Related developments in corporate Bitcoin strategy include recent analysis of UK corporate Bitcoin holdings facing significant unrealized losses and Bitmain's substantial ETH withdrawals sparking market skepticism. These patterns suggest broader corporate reassessment of cryptocurrency exposure strategies amid market stress.

According to reporting from Cointelegraph, Metaplanet's board has approved the issuance of dividend-paying preferred stock with specific provisions for overseas institutional investors. The company can now reclassify capital reserves to fund preferred stock dividends and share buybacks, with issuance limits for Class A and B preferred shares doubled. Class B shares have been explicitly approved for foreign institutional distribution. This structure reportedly aims to provide Bitcoin exposure to global institutions reluctant to hold BTC directly or invest in volatile common stock. The announcement follows Metaplanet's recent trading debut on the U.S. OTC market and establishment of a Miami subsidiary, positioning the company to attract global capital while operating within Japan's regulatory framework.

Bitcoin currently trades at $89,651 with a 24-hour trend of +1.54%. Volume profile analysis shows declining participation during recent price consolidation, suggesting institutional hesitation despite the Metaplanet announcement. The weekly chart reveals a critical Fibonacci support level at $82,000 (61.8% retracement from recent highs), which represents a key invalidation level for bullish continuation. RSI readings at 42 indicate neutral momentum with bearish divergence on higher timeframes. Market structure suggests the current price action represents a fair value gap (FVG) between $87,500 and $91,200 that requires filling before sustainable directional movement.

Bullish invalidation occurs below $82,000, which would signal breakdown of the current consolidation structure. Bearish invalidation occurs above $94,500, representing the upper boundary of the current order block and previous resistance zone. The 200-day moving average at $85,200 provides intermediate support, though recent price action has shown weak defense of this level during selloffs.

| Metric | Value |

| Bitcoin Current Price | $89,651 |

| 24-Hour Trend | +1.54% |

| Market Sentiment Score | 25/100 (Extreme Fear) |

| Critical Fibonacci Support | $82,000 |

| 200-Day Moving Average | $85,200 |

For institutional investors, Metaplanet's structure potentially offers Bitcoin exposure without direct custody challenges or regulatory complications associated with spot holdings. However, market structure suggests this creates a derivative exposure layer that introduces counterparty risk and dilutes the fundamental value proposition of Bitcoin as a sovereign asset. The dividend mechanism represents a traditional capital market approach that contradicts Bitcoin's deflationary monetary policy, creating structural tension between the asset's inherent properties and the financial engineering attempting to package it.

For retail investors, this development signals increasing financialization of Bitcoin exposure through traditional securities, potentially creating more accessible entry points but also introducing complex risk layers. The regulatory implications are significant, as this structure may fall under traditional securities oversight rather than cryptocurrency-specific frameworks, creating potential jurisdictional arbitrage opportunities.

Market analysts express skepticism about the structural coherence of dividend-paying Bitcoin securities. "Creating income-generating instruments from a deflationary asset represents a fundamental contradiction," noted one quantitative researcher on X. Bulls argue this represents innovative financial engineering that bridges traditional and crypto markets, while bears point to the dilution of Bitcoin's core value proposition through financial intermediation. The consensus among technical analysts suggests this announcement has generated minimal price impact, with Bitcoin remaining range-bound despite the purported institutional appeal.

Bullish Case: If Metaplanet successfully attracts substantial institutional capital through this structure, it could establish a new template for corporate Bitcoin exposure. Successful adoption might drive Bitcoin above the $94,500 resistance level, targeting previous highs near $98,000. Market structure suggests this would require sustained volume expansion and closing above the current FVG.

Bearish Case: If institutions remain skeptical of the derivative structure or regulatory challenges emerge, this could represent another failed attempt at financializing Bitcoin. Failure to hold the $82,000 support level would signal broader market weakness, potentially targeting the $78,000 region where significant liquidity pools exist. The extreme fear sentiment suggests continued downside pressure unless clear institutional accumulation patterns emerge.

What is Metaplanet's new Bitcoin strategy?Metaplanet has approved dividend-paying preferred stock specifically for foreign institutional investors, creating a derivative Bitcoin exposure vehicle.

How does this differ from MicroStrategy's approach?MicroStrategy accumulates Bitcoin directly as a treasury asset, while Metaplanet creates income-generating securities backed by Bitcoin exposure, representing a more traditional capital markets approach.

What are the risks of this structure?Counterparty risk, regulatory uncertainty, dilution of Bitcoin's fundamental properties, and potential misalignment between dividend obligations and Bitcoin's volatile price action.

How does this affect Bitcoin's price?Minimal immediate impact observed, with Bitcoin trading at $89,651. Sustained institutional adoption through this structure could provide price support, but structural contradictions may limit long-term effectiveness.

What technical levels are critical for Bitcoin?$82,000 represents key Fibonacci support (bullish invalidation), while $94,500 represents resistance (bearish invalidation). The 200-day MA at $85,200 provides intermediate support.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.