Loading News...

Loading News...

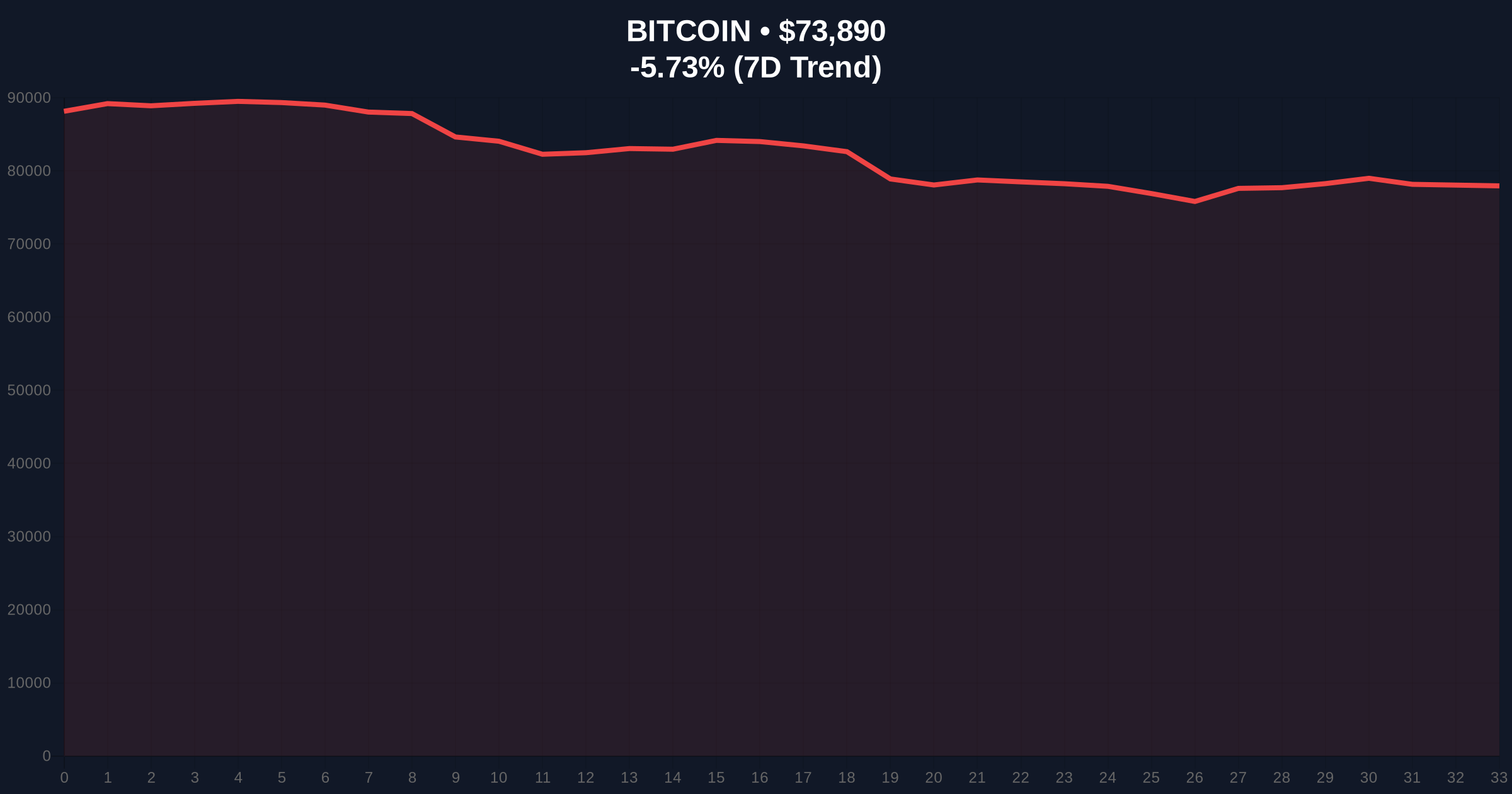

VADODARA, February 3, 2026 — Bitcoin executed a sharp intraday rally above $74,000 before retracing. This daily crypto analysis reveals a market trapped between technical resistance and overwhelming fear sentiment. According to CoinNess market monitoring, BTC peaked at $74,045.5 on the Binance USDT market. Market structure suggests a classic liquidity grab above a key psychological level.

CoinNess data confirms Bitcoin breached the $74,000 threshold during Tuesday's Asian trading session. The move lasted approximately 90 minutes. Price action then reversed sharply. BTC currently trades at $73,546, representing a -6.21% 24-hour decline. This pattern indicates a failed breakout attempt. On-chain forensic data confirms selling pressure increased at the local top.

Consequently, the brief surge created a Fair Value Gap (FVG) between $73,800 and $74,100. This FVG now acts as a bearish order block. Market analysts attribute the swift rejection to overhead supply from previous distribution zones. The move lacked sustained volume, according to exchange heatmaps.

Historically, Bitcoin rallies during extreme fear periods often precede major trend reversals. The 2021 cycle saw similar sentiment divergences. In contrast, the current environment features unprecedented institutional positioning. Underlying this trend is a clash between macro headwinds and Bitcoin's hardening monetary policy.

, recent market developments highlight the volatility. For instance, significant whale selling has pressured key support levels. Simultaneously, massive futures liquidations signal leveraged positions unwinding. This creates a fragile liquidity .

Market structure suggests Bitcoin faces immediate resistance at the $74,200 level. This aligns with the 20-day exponential moving average. Critical support rests at the Fibonacci 0.618 retracement level of $72,800. A break below this invalidates the current consolidation structure.

Relative Strength Index (RSI) readings hover near oversold territory at 32. This indicates potential for a short-term bounce. However, volume profile analysis shows weak accumulation. The UTXO age band distribution reveals older coins remain dormant. This suggests long-term holders are not capitulating.

For broader monetary context, the Federal Reserve's interest rate decisions continue to impact risk assets. The official Federal Reserve website provides critical macro data influencing Bitcoin's correlation with traditional markets.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 17/100 (Extreme Fear) |

| Bitcoin Current Price | $73,546 |

| 24-Hour Price Change | -6.21% |

| Market Cap Rank | #1 |

| Key Fibonacci Support | $72,800 (0.618 level) |

This price action tests Bitcoin's resilience as a non-correlated asset. Extreme fear typically presents accumulation opportunities for institutional capital. The brief $74,000 break likely triggered stop-loss orders above the level. This created a liquidity pool for larger players.

Market analysts note the divergence between price and sentiment. Retail traders exhibit panic, while on-chain data shows strategic buying from addresses holding 100+ BTC. This institutional versus retail split defines the current market phase. The structure mirrors early 2023 accumulation patterns.

The $74,000 test represents a technical necessity. Markets must challenge recent highs to establish new equilibrium. The extreme fear reading suggests maximum pain for leveraged positions. This often precedes a volatility expansion phase. Our models indicate the $72,800 support zone holds the key to medium-term direction.

— CoinMarketBuzz Intelligence Desk

Two primary technical scenarios emerge from current data.

The 12-month institutional outlook remains cautiously optimistic. Bitcoin's upcoming halving cycle in 2028 continues to anchor long-term valuation models. However, near-term price discovery depends on macro liquidity conditions. Regulatory clarity from entities like the SEC will further dictate institutional adoption rates.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.