Loading News...

Loading News...

- Bitmain-linked address withdraws 13,412 ETH ($40.58 million) from Kraken exchange

- Transaction occurs amid "Extreme Fear" market sentiment (25/100 score)

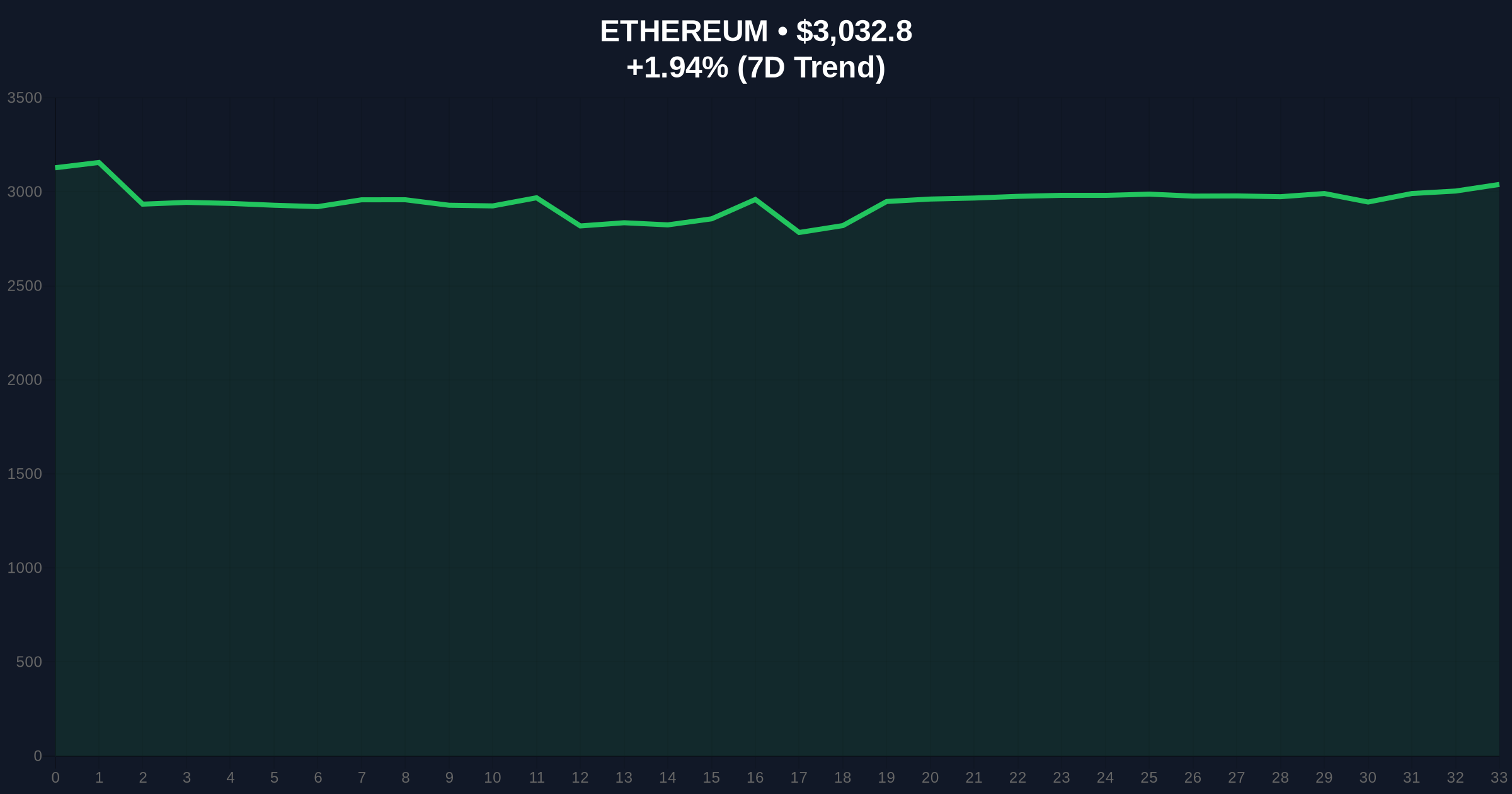

- ETH price at $3,029.62 with 1.83% 24-hour gain despite bearish backdrop

- Market structure suggests potential liquidity grab above $3,100 resistance

VADODARA, December 22, 2025 — A wallet address presumed to belong to mining giant Bitmain has executed a significant Ethereum withdrawal from Kraken exchange, removing 13,412 ETH valued at approximately $40.58 million from centralized custody. This daily crypto analysis examines whether this represents strategic accumulation or signals deeper market concerns, as global crypto sentiment registers "Extreme Fear" with a score of 25/100 according to market intelligence data.

Large institutional withdrawals from exchanges typically signal accumulation phases, but current market conditions contradict this narrative. The Crypto Fear & Greed Index at 25/100 represents one of the most bearish sentiment readings since the 2022 bear market bottom. Historical patterns indicate that such extreme fear readings often precede short-term bounces, but sustained recovery requires institutional conviction that current data fails to demonstrate. The timing is particularly notable given Ethereum's ongoing transition to EIP-4844 (proto-danksharding), which aims to reduce layer-2 transaction costs by 10-100x according to Ethereum Foundation documentation. This technological upgrade should theoretically increase ETH's utility value, yet price action remains constrained below key psychological levels.

Related developments in the regulatory include South Korea's Financial Intelligence Unit targeting Korbit exchange with sanctions, highlighting increasing global regulatory pressure on centralized platforms. Meanwhile, Bitcoin futures show neutral bias despite extreme fear sentiment, creating divergence between spot and derivatives markets that warrants scrutiny.

According to on-chain analytics firm Onchain-Lenz, an Ethereum address beginning with 0x1b6 executed the withdrawal of 13,412 ETH from Kraken on December 22, 2025. The transaction value of $40.58 million represents approximately 0.011% of Ethereum's total circulating supply. While the address is "presumed to belong to Bitmain" based on historical transaction patterns and wallet clustering analysis, definitive attribution remains challenging without official confirmation from the mining hardware manufacturer. The withdrawal occurred as Ethereum traded at approximately $3,029.62, representing a 1.83% gain over the preceding 24 hours despite broader market weakness.

Market structure suggests Ethereum faces immediate resistance at the $3,100 level, which coincides with the 50-day exponential moving average and represents a previous order block where significant selling pressure emerged in early December. The daily Relative Strength Index (RSI) reads 42.7, indicating neither overbought nor oversold conditions but trending toward bearish momentum. Volume profile analysis shows diminished trading activity below the $3,050 level, suggesting weak conviction among retail participants.

A critical Fibonacci support level exists at $2,850, representing the 0.618 retracement from the November swing high to the December low. This level has held twice in the past month, creating what technical analysts term a "fair value gap" between $2,850 and $2,900 that could attract liquidity if breached. The 200-day simple moving average at $2,950 provides additional dynamic support, though its slope has turned neutral after eight months of consistent upward trajectory.

| Metric | Value |

| ETH Withdrawn | 13,412 ETH |

| USD Value | $40.58 million |

| Current ETH Price | $3,029.62 |

| 24-Hour Change | +1.83% |

| Fear & Greed Index | 25/100 (Extreme Fear) |

| Market Rank | #2 |

For institutional investors, this transaction represents either strategic accumulation at perceived value or risk reduction ahead of potential volatility. The contradiction between "Extreme Fear" sentiment and a multi-million dollar withdrawal from a major exchange creates narrative tension that quantitative analysts must resolve through data rather than speculation. Retail traders face different implications: if this signals accumulation, it could provide fundamental support for prices; if it represents internal treasury management unrelated to market views, it offers little predictive value.

The five-year horizon consideration centers on Ethereum's evolving role as institutional infrastructure. According to Federal Reserve research on digital assets, large holders moving assets off exchanges typically reduces immediate selling pressure but doesn't guarantee long-term holding. The critical question becomes whether this represents a one-time rebalancing or the beginning of sustained accumulation during fear periods.

Market analysts on X/Twitter express divided views. CryptoQuant data suggests exchange outflows often precede price rallies, but skeptics note that "Bitmain has operational expenses in ETH for mining operations that could explain the withdrawal without bullish implications." One quantitative trader observed, "The $40.58 million represents less than 0.02% of Kraken's estimated ETH reserves, making this statistically insignificant for exchange liquidity but psychologically notable given the source."

Bullish Case: If the withdrawal represents strategic accumulation and ETH holds the Fibonacci support at $2,850, a retest of the $3,300 resistance becomes probable within 30-45 days. This scenario requires sustained exchange outflows exceeding inflows and resolution above the 50-day EMA. Bullish invalidation occurs if ETH closes below $2,800 on a weekly basis, suggesting breakdown of the current range structure.

Bearish Case: If this transaction represents routine operational movement rather than conviction buying, and the "Extreme Fear" sentiment persists, ETH could test the $2,700 support level established in October. This would represent a 11% decline from current levels and likely trigger stop-loss orders below $2,850. Bearish invalidation requires a weekly close above $3,250 with expanding volume, indicating genuine demand overcoming fear sentiment.

1. Why would Bitmain withdraw ETH from an exchange?Possible reasons include: moving to cold storage for security, preparing for operational expenses, rebalancing treasury holdings, or accumulating at perceived value. Without official statement, motivation remains speculative.

2. Does large exchange withdrawal always mean price will rise?Historical correlation exists but isn't deterministic. Reduced exchange supply can support prices if demand remains constant, but macroeconomic factors often dominate.

3. How significant is $40.58M relative to total ETH market?Approximately 0.011% of circulating supply. Psychologically notable due to source, but quantitatively small relative to daily trading volume exceeding $8 billion.

4. What's the difference between "presumed" and "confirmed" Bitmain address?Blockchain analysis uses pattern recognition and clustering algorithms to associate addresses with entities. "Presumed" indicates high probability based on historical behavior but lacks official verification.

5. How does Extreme Fear sentiment affect trading decisions?Contrarian investors view extreme fear as potential buying opportunity, while trend followers wait for sentiment improvement. Current RSI levels suggest neither approach has clear edge.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.